Subscribe to get our FREE

GOLD IRA GUIDE

Platinum IRA: A Complete Guide to invest in Platinum for retirement

A Platinum IRA offers a unique way to diversify your retirement portfolio. By investing in platinum, you can protect your assets against market fluctuations and inflation.

Platinum is a rare and valuable precious metal, has gained prominence not only in industrial applications but also as a crucial component in investment portfolios.

Platinum's rarity and industrial demand make it an attractive option for diversification within a self-directed Individual Retirement Account (IRA). Including platinum in your retirement portfolio can provide a hedge against inflation, market volatility, and economic downturns.

Understanding IRA-Approved Platinum

To be included in an IRA, platinum must meet specific criteria set by the IRS. These criteria ensure that the platinum products are of high quality and suitable for long-term investment.

- Purity Requirements: Platinum must be at least 99.95% pure to qualify for inclusion in an IRA. This high purity standard ensures that the platinum you invest in maintains its value over time.

- Approved Forms: The IRS allows certain forms of platinum, including specific coins and bars, to be included in an IRA. Some of the most common IRA-approved platinum products include:

Top Platinum products admitted in an IRA

American Platinum Eagle coins

The American Platinum Eagle coin is the official platinum bullion coin of the United States, first introduced by the U.S. Mint in 1997. It is available in various denominations, with the one-ounce coin being the most popular and holding a face value of $100, making it the highest denomination of any U.S. coin.

These coins are composed of 99.95% pure platinum and are recognized for their intricate designs, which often feature Lady Liberty on the obverse side. The reverse designs vary annually, making them highly sought after by collectors. The American Platinum Eagle is not only a valuable investment in precious metals but also a collector's item, combining beauty with the stability of platinum.

Canadian Platinum Maple Leaf coins

The Canadian Platinum Maple Leaf coin is one of the most esteemed platinum bullion coins in the world, produced by the Royal Canadian Mint. First introduced in 1988, this coin is renowned for its purity, being composed of 99.95% pure platinum.

The coin's obverse side features a portrait of Queen Elizabeth II, while the reverse showcases the iconic maple leaf, symbolizing Canada.

The Canadian Platinum Maple Leaf is available in various denominations, but the one-ounce version, with a face value of 50 Canadian dollars, is the most popular among investors and collectors. Its high purity and the credibility of the Royal Canadian Mint make it a trusted choice for those looking to invest in platinum.

Australian Platinum Koala coins

The Australian Platinum Koala is a highly sought-after bullion coin produced by the Perth Mint, known for its purity, limited mintage, and detailed designs featuring Australia’s native koala. First introduced in 1988, each coin is struck in .9995 fine platinum and is legal tender under the Australian Currency Act.

The obverse displays a portrait of the reigning monarch, while the reverse features annually changing artistic renditions of the koala, making the series popular among both investors and collectors.

Australian Platinum Koalas are eligible for inclusion in IRS-approved Precious Metals IRAs and offer a combination of investment-grade metal content and collectible appeal.

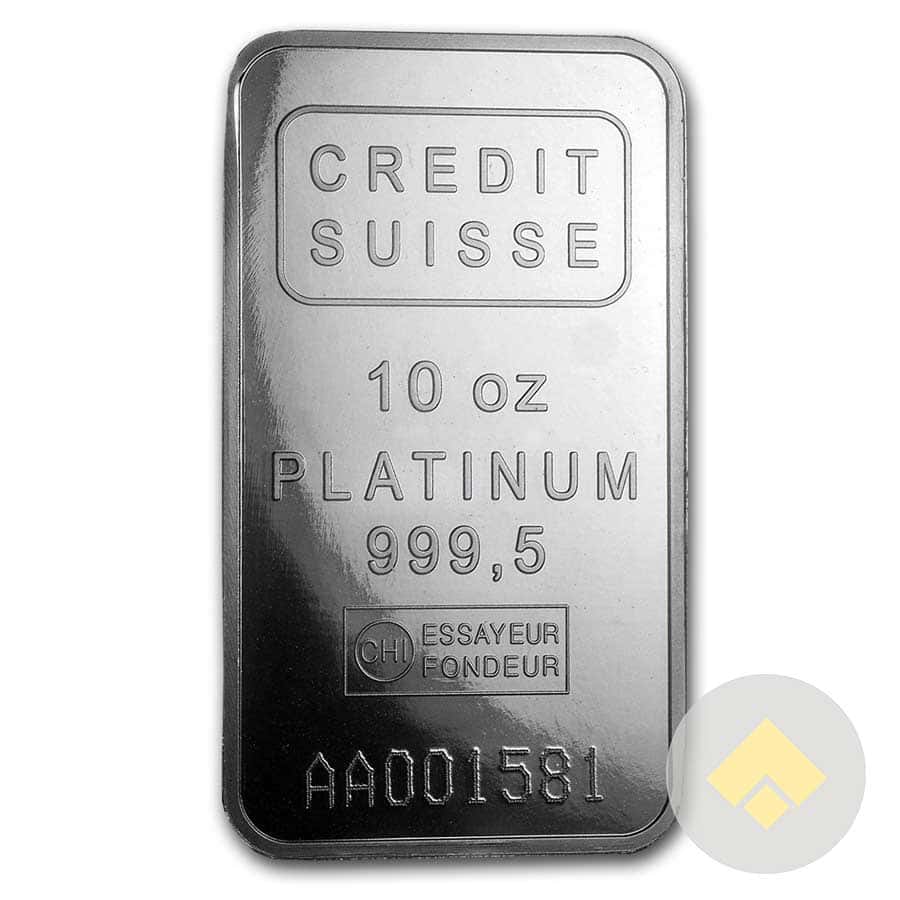

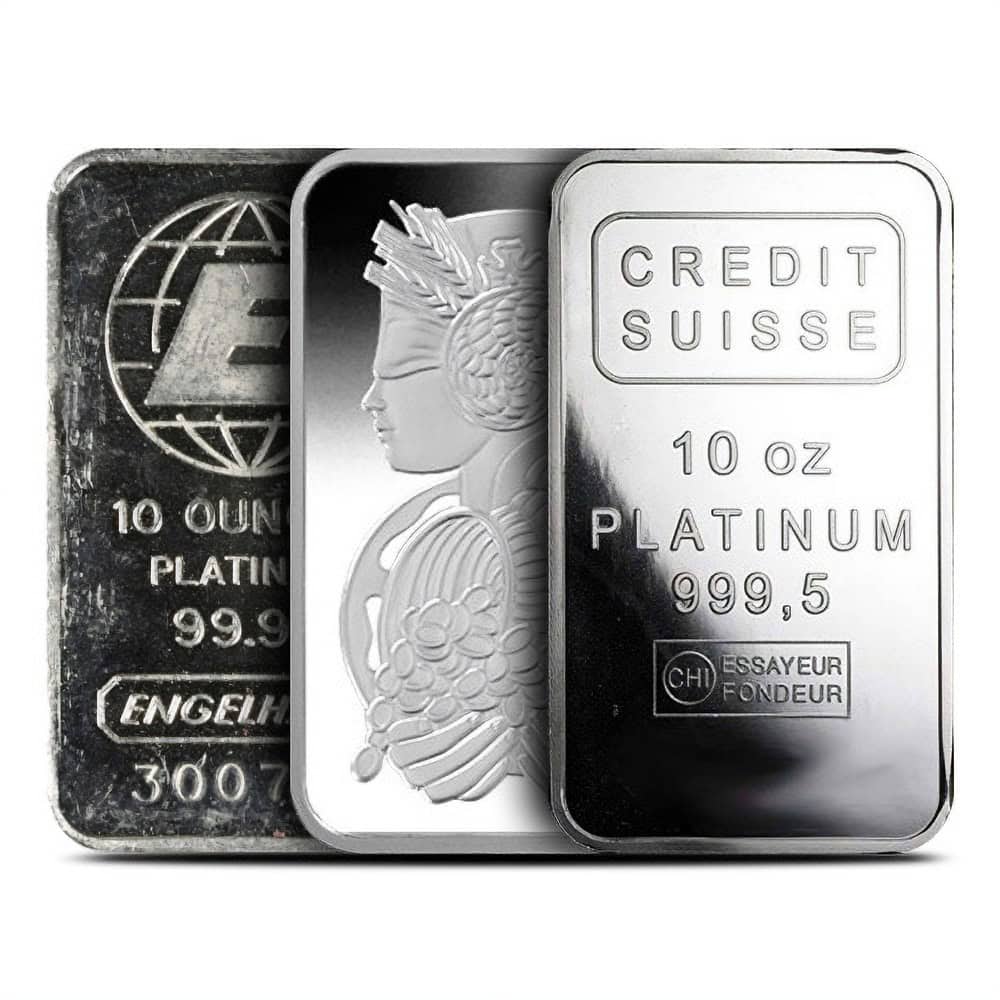

Platinum bars from accredited refiners

Platinum bars from accredited refiners are a popular choice for investors looking to add platinum to their portfolios. These bars are typically composed of 99.95% pure platinum and are available in various weights, ranging from 1 gram to 1 kilogram.

Accredited refiners, such as those recognized by the London Platinum and Palladium Market (LPPM), ensure that the bars meet strict standards for weight, purity, and quality. Each bar is usually stamped with a unique serial number, the logo of the refinery, the weight, and the purity level, which guarantees its authenticity. Investors favor platinum bars for their lower premiums compared to coins and their efficiency in storing significant value in a compact form.

The Benefits of Platinum IRA Investment

Investing in platinum through a self-directed IRA offers several advantages:

How to Invest in Platinum through an IRA

Setting up a platinum IRA involves several steps:

Risks and Considerations

While investing in platinum can provide diversification and protection against inflation, it's essential to be aware of the risks:

- Volatility: Platinum prices can be more volatile than those of other precious metals like gold and silver. This volatility can lead to significant price fluctuations in the short term.

- Market Factors: Platinum's value is influenced by various factors, including industrial demand, mining output, and geopolitical events. These factors can impact the supply and demand balance, affecting prices.

- Fees and Costs: Investing in platinum through an IRA involves fees, including custodian fees, storage fees, and transaction costs. It's essential to factor these into your investment strategy.

Final Thoughts

Investing in platinum through an IRA can be a strategic way to diversify your retirement portfolio, protect against inflation, and benefit from the metal's industrial demand.

However, as with any investment, it's crucial to weigh the benefits against the risks and consult with a financial advisor to ensure that platinum aligns with your long-term financial goals.

For more information, take a look at the IRS website.

FAQ

Platinum is rarer than gold and silver, which often makes it more valuable in periods of high demand. Additionally, its applications in the automotive and industrial sectors create potential for price appreciation, especially as demand for green technologies rises.

You can invest in platinum through physical platinum bars or coins, exchange-traded funds (ETFs) that track platinum prices, or stocks of companies involved in platinum mining and production. Each option offers different levels of risk and liquidity.

Like other precious metals, platinum can serve as a hedge against inflation, especially during periods of economic uncertainty. Its rarity and industrial use make it a potential store of value when traditional currencies lose purchasing power.

Platinum prices can be more volatile than gold or silver due to its industrial demand. Economic downturns or changes in automotive industry demand, which uses platinum in catalytic converters, can significantly impact prices.

Yes, platinum investments may be subject to capital gains tax when sold for a profit. The specific tax rate can vary depending on your country of residence and the form of platinum investment. It's recommended to consult with a tax advisor for detailed information.

The choice between platinum bars and coins depends on your investment goals. Coins often carry a higher premium over the spot price due to their collectability, while bars typically offer lower premiums and may be easier to store in larger quantities.