Subscribe to get our FREE

GOLD IRA GUIDE

Silver IRA Investments: A Comprehensive Guide

Investing in a Silver IRA can be a smart move for diversifying your retirement portfolio. With the stability and growth potential of silver, this type of investment offers a good alternative to traditional investments, and it can help you to delve all the uncertainties of traditional paper assets.

While gold often gets most of the attention, silver offers unique benefits that make it an attractive option for savvy investors.

However, not all silver products qualify for inclusion in an IRA, so it’s crucial to understand what is considered IRA-approved silver and why it might be a valuable addition to your retirement strategy.

What is IRA-Approved Silver?

IRA-approved silver refers to specific types of silver bullion that meet the strict requirements set by the IRS for inclusion in a self-directed IRA. These requirements ensure that the silver held in your IRA maintains a high level of purity and quality.

Specifically, IRA-approved silver must have a minimum fineness of 0.999, meaning it is 99.9% pure. Additionally, the silver must be in the form of coins or bars that are produced by a government mint or an accredited refiner, assayer, or manufacturer.

Let's take a look at all the common Ira-approved Silver products you can include in your portfolio:

Common IRA-Approved Silver Products

There are several popular silver products that meet the IRS requirements and are commonly included in precious metal IRAs:

American Silver Eagle Coins

Issued by the U.S. Mint, these coins are one of the most popular choices for IRA investors. They contain one troy ounce of 99.9% pure silver and are widely recognized and trusted.

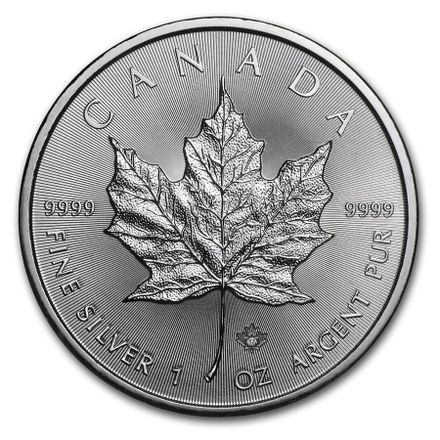

Canadian Silver Maple Leaf Coins

Produced by the Royal Canadian Mint, these coins also boast a purity of 99.99% and are highly regarded for their security features and craftsmanship.

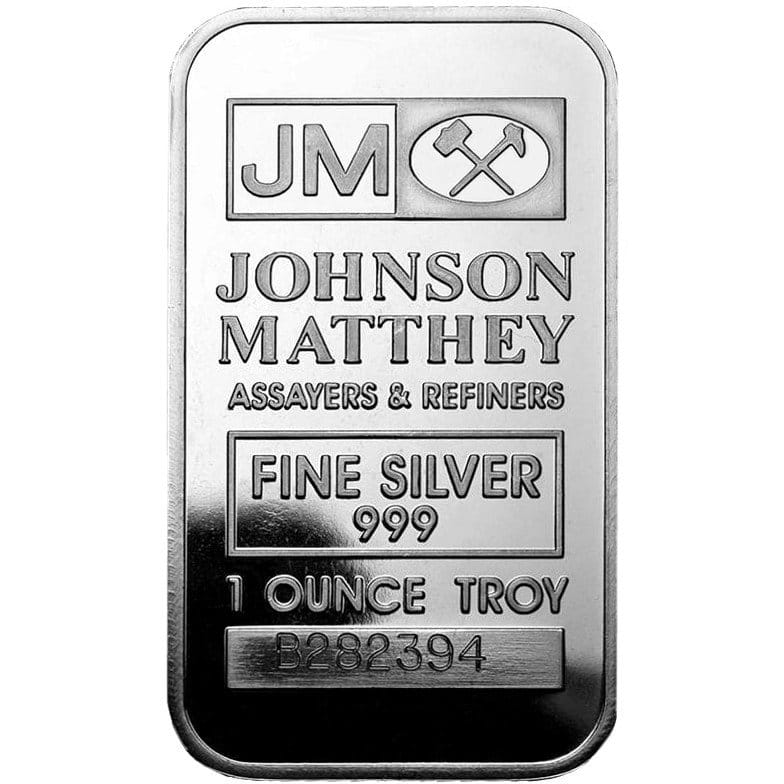

Silver Bars

Various private mints and refineries produce silver bars that meet IRA standards. These bars come in various sizes, typically ranging from 1 ounce to 100 ounces, and offer a cost-effective way to invest in silver due to their lower premiums compared to coins.

Why Choose a Silver IRA for Your Retirement?

Adding silver to your IRA can provide several key benefits that enhance your overall retirement strategy:

Diversification:

Silver offers an opportunity to diversify your portfolio beyond traditional assets like stocks and bonds. By holding a mix of different asset classes, you can reduce risk and increase the potential for long-term growth.

Hedge Against Inflation:

Silver, like other precious metals, is often seen as a hedge against inflation. When the purchasing power of fiat currencies declines, the value of silver typically rises, preserving your wealth.

Potential for Growth:

Silver has industrial applications in addition to being a store of value. Its demand in industries like electronics, solar energy, and healthcare contributes to its potential for price appreciation over time.

Liquidity:

IRA-approved silver products are generally easy to buy and sell, making them a liquid investment. This liquidity can be especially beneficial during retirement when you may need to access your funds.

Top Silver IRA Companies for 2024

Augusta Precious Metals

Augusta Precious Metals is known for its low costs and transparency. Customers have a clear understanding of the fees they are paying and the services they are receiving. This clarity in pricing is why Augusta is ranked as the best gold IRA company for transparent pricing.

Noble Gold

Noble Gold is our top pick for smaller investors, thanks to its low minimum investment requirement and comprehensive educational resources.

Your Step-by-Step Guide to Investing in a Silver IRA: Building a Strong Financial Future

Grasping the Concept of a Silver IRA

Think of a Silver IRA as your safety net against uncertain economic times. Unlike traditional IRAs that focus on stocks and bonds, this account lets you hold real, tangible silver. Why is this important? Because silver has intrinsic value that often rises when the economy dips, acting as a hedge against inflation.

Pro Tip: Silver doesn’t just retain value; it often appreciates over time, especially during economic downturns.

Finding the Right Silver IRA Custodian – Your Financial Partner

Choosing a custodian is like picking a teammate in a game – you want someone trustworthy, experienced, and capable. A good custodian manages all the nitty-gritty details, from account setup to IRS compliance. You’ll find options ranging from specialized firms that focus on precious metals to larger financial institutions.

Questions to Ask Your Custodian:

- How long have you been handling Silver IRAs?

- What are the fees involved?

- How do you store and secure the silver?

Remember, this is your financial future, so don’t hesitate to ask for clear answers.

Opening Your Self-Directed IRA Account

This step might seem intimidating, but it’s straightforward. Your custodian will guide you through filling out the paperwork. Think of it like opening a new bank account but with the potential for higher growth and security.

Why "Self-Directed"? It means you have the freedom to choose where your money goes – in this case, silver – rather than relying solely on traditional investments.

Funding Your Silver IRA – Fuelling Your Investment

Funding your Silver IRA is a flexible process. Here are your main options:

- Direct Transfer: Move funds directly from an existing IRA. This is tax-free and straightforward.

- Rollover: A great option if you have an old 401(k) from a previous job. Just ensure you complete the rollover within 60 days to avoid penalties.

- New Contributions: Perfect if you’re starting fresh or want to maximize yearly contributions.

Tip: Plan ahead and consult a financial advisor to ensure your funding strategy aligns with your retirement goals.

Selecting Your Silver Investments – Making It Personal

This is where things get exciting! You can choose to invest in:

- Physical Silver Coins: Popular options include American Silver Eagles or Austrian Philharmonics. They’re not only valuable but also beautiful.

- Silver Bars: Ideal for those who want to invest in larger quantities. Bars range in size, so you can pick what fits your budget.

Consider This: Physical silver is tangible – you can actually hold it in your hand, which offers a sense of security that paper investments can’t provide.

Completing the Purchase – Taking the Plunge

After you’ve chosen your silver, instruct your custodian to make the purchase. They’ll handle the transaction, ensuring it’s done according to IRS guidelines. Your silver will then be stored in an approved depository, which is like a highly secure vault, safeguarding your investment.

Think of your Silver IRA like a garden – it needs occasional attention. Track the silver market trends, stay updated on economic factors, and consult your custodian for insights. This way, you can make informed decisions about whether to hold, buy more, or make adjustments.

Did You Know? The IRS has strict regulations about where your silver must be stored. It can't be kept at home, even if you have a safe.

Important Considerations about Silver IRA

While investing in silver through an IRA offers many advantages, there are also important factors to consider:

- Storage Requirements: Silver held in an IRA must be stored in an IRS-approved depository. You cannot take physical possession of the silver without incurring penalties and taxes, making it essential to choose a reliable custodian who provides secure storage.

- Market Volatility: Like all investments, the price of silver can fluctuate. It’s important to be aware of the potential for short-term volatility and to have a long-term investment horizon.

- Fees: Be mindful of the fees associated with a precious metals IRA, including setup fees, storage fees, and annual maintenance costs. These can vary depending on the custodian and the amount of silver you hold.

Final Thoughts

Silver is a versatile and valuable addition to any retirement portfolio, offering benefits such as diversification, inflation protection, and potential for growth.

By understanding the requirements for IRA-approved silver and carefully selecting the right products, you can enhance your long-term financial security and build a robust retirement plan.

For more information, you can take a look at the IRS website concerning this matter.

FAQ

A Silver IRA is a self-directed individual retirement account that allows you to invest in physical silver, rather than just traditional assets like stocks and bonds. Unlike a traditional IRA, which typically limits you to paper assets, a Silver IRA gives you the ability to diversify your portfolio with tangible silver, which can act as a hedge against inflation and economic instability.

In a Silver IRA, you can typically hold silver coins, bars, and rounds that meet the IRS's purity requirements. The silver must be at least 99.9% pure. Popular examples include American Silver Eagles, Canadian Silver Maple Leafs, and silver bars from accredited refiners.

To set up a Silver IRA, you'll need to open a self-directed IRA with a custodian that specializes in precious metals. Once your account is set up, you can fund it by rolling over funds from an existing retirement account or making a direct contribution. Your custodian will then help you purchase and store the silver in an approved depository.

Investing in a Silver IRA offers several benefits, including diversification of your retirement portfolio, protection against inflation, and the potential for growth as the demand for silver increases. Additionally, silver is a tangible asset that you own directly, which can provide a sense of security in times of economic uncertainty.

Yes, like all investments, Silver IRAs come with risks. The price of silver can be volatile, and while it can protect against inflation, it can also lose value. Additionally, there are costs associated with storage, insurance, and custodial fees that need to be considered. It's important to consult with a financial advisor to ensure a Silver IRA aligns with your overall investment strategy.

No, you cannot take physical possession of the silver while it is held within the IRA without incurring penalties and taxes. The silver must be stored in an IRS-approved depository. However, once you reach the age of 59½, you can take distributions in the form of either cash or physical silver, depending on your preference and the rules of your IRA custodian.

Articles on all your favorite subjects

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.