Understanding Gold IRA Fees: How to Maximize Your Investments

In this article, we will break down for you the fees associated with Gold IRAs, as we want to help you to make informed decisions to protect your financial portfolio while proceeding with this type of investment.

We always stress about the fact that understanding how fees associated with investing in precious metals impact your returns is crucial to achieving your wealth-building goals.

In fact, investing in precious metals for your IRA after choosing a provider, might involve hidden costs, like custodian fees, storage costs and much more.

For this reason, we will carefully dissect each aspect, so that you can have a better understanding on how to minimize expenses and optimize your profits. It's not always obvious and easy to navigate all this information, and it's easy to get confused, especially if we consider the quantity of offers in the market.

Therefore, we wanted to create a guide that will help you to take control of your investments and evaluating which would be the best options for you In the long run.

As previously mentioned in all our articles, we have the opinion that it is important to approach this investment carefully, especially concerning the choice of the best Gold IRA provider (see our choice below).

As you will have to choose a third party custodian to complete this investment, the choice of the provider is the most important step to take.

We also strongly suggest taking a look at the IRS Guidelines, as it’s crucially important to have a consultation as a primary information source.

Key Takeaways:

- Types of Fees: Investors should be aware of setup fees, annual custodial fees, storage fees, and transaction costs, which can vary depending on the provider.

- How to Minimize Costs: Comparing different custodians, choosing cost-effective storage options, and understanding fee structures can help investors reduce unnecessary expenses.

- Evaluating Custodians: Not all custodians charge the same fees—researching and selecting a reputable provider with transparent pricing is essential.

- Long-Term Investment Strategy: While fees are an important consideration, focusing on the long-term benefits of gold as a hedge against inflation and economic uncertainty is key.

Importance of Understanding Gold IRA Fees

Understanding Gold IRA fees is crucial for anyone looking to invest in precious metals as part of their retirement strategy.

In fact, The fees associated with these accounts can significantly impact the overall returns on your investment, which makes it essential to have a clear grasp of what to expect.

As we said, choosing a third-party provider will have an impact on the hidden costs if you won’t take full control of the entire process in the correct way.

With many investors focusing solely on the potential gains from gold, overlooking the associated costs can be a huge mistake: it can lead to reduced profits and unexpected financial burdens and overall stress.

Instead, the full comprehension of these fees, will help you to make more informed decisions that align with your long-term financial goals.

Moreover, being aware of the different types of fees can help you better negotiate with custodians and service providers. They have the tendency to do not being 100% transparent in providing information sometimes.

Therefore, we can’t stress more about the fact that Knowledge is power in the investment world.

In fact, educating yourself about the various fees and asking the right questions, will help you to avoid pitfalls that many novice investors encounter.

Furthermore, this conscience can lead to better management of your investment portfolio, ensuring you are not only growing your assets but also protecting them from unnecessary costs that could erode your wealth over time.

Finally, understanding Gold IRA fees equips you with the ability to compare different custodians and service providers effectively. Each company may have a unique fee structure, and knowing what to look for can save you money in the long run.

Types of Gold IRA Fees

Gold IRA fees can be categorized into several distinct types, each of which plays a role in the overall cost of maintaining your investment account.

The most common fees include custodian fees, storage fees, and transaction fees.

Let’s start with the first one. Custodian fees are charged by the financial institution that manages your Gold IRA.

These fees can vary widely depending on the custodian and may be charged annually or as a percentage of the total assets in your account.

Secondly, Storage fees are another cost to take into important consideration.

Since physical gold must be securely stored, custodians typically charge a fee for the storage of your precious metals.

This fee can be assessed on an annual basis and may vary based on the amount of gold you own and the type of storage facility used.

Some custodians offer segregated storage, where your gold is stored separately from other clients' assets, while others provide commingled storage, where multiple investors' metals are kept together.

Third, Transaction fees are incurred whenever you buy or sell gold through your IRA. These fees can include commissions charged by brokers and any additional charges related to processing the transaction.

It's important to factor these costs into your overall investment strategy, as frequent buying and selling can quickly accumulate expenses that diminish your returns.

Gold IRA FEES

1.

Custodian Fees: Charged by the financial institution managing your Gold IRA. These can be annual or a percentage of your assets, varying by provider.

2.

Storage Fees: Since gold must be securely stored, custodians charge an annual fee based on the amount of gold and storage type (segregated vs. commingled).

3.

Transaction Fees: Costs incurred when buying or selling gold, including broker commissions and processing fees. Frequent transactions can impact returns.

Factors Affecting Gold IRA Fees

Several factors can impact the fees associated with Gold IRAs, making it essential for investors to be aware of these variables.

First and foremost, the choice of custodian plays a significant role in determining fees. Different custodians have varying fee structures, which can include different charges for account setup, annual maintenance, and transaction costs.

Some custodians may offer lower fees but provide fewer services, while others may charge higher fees for a more comprehensive service package.

For this reason, we recommend you to make your research to help you identify the best fit for your investment needs.

Another factor influencing Gold IRA fees is the type of gold you choose to invest in. The IRS has specific guidelines regarding the types of gold that can be held in a Gold IRA, which can include gold bullion, coins, or bars.

The purity and weight of the gold can also affect its price and, consequently, the fees associated with buying and selling these assets.

Higher-quality gold may carry a premium, impacting transaction fees and overall costs.

Market conditions can also play a role in the fees related to Gold IRAs. During times of high demand or volatility, transaction fees may increase as brokers and custodians adjust their pricing to reflect the market environment.

Additionally, changes in regulations or economic conditions can affect the availability of services and the associated costs.

As a result, staying informed and taking information about market trends and economic indicators will help you anticipate fee changes and adjust your investment strategy accordingly. We recommend you anyway to take a look at our blog articles to stay updated with further information.

Strategies to Minimize Gold IRA Fees

Minimizing fees associated with Gold IRAs is essential for maximizing your investment returns.

One first effective strategy is to shop around for custodians and compare their fee structures. Take the time to get quotes from multiple providers, considering not only the fees, but also the services included.

We highly recommend you to do not be afraid of asking in-depth questions and make comparisons.

Some custodians may offer lower annual fees but charge higher transaction fees, while others may provide comprehensive services at a reasonable cost.

In all this mess, your duty is finding the right balance between fees and services can help you to reduce overall costs while ensuring your investment is well-managed.

Another tactic to minimize fees is to limit the frequency of transactions. Each time you buy or sell gold within your IRA, you incur transaction fees that can add up quickly.

Therefore, if you adopt a long-term investment strategy and avoiding frequent trading, you can significantly reduce these costs.

Consider establishing a buy-and-hold approach where you focus on acquiring gold with the intention of holding it for an extended period.

This strategy not only minimizes transaction fees but also allows you to benefit from potential price appreciation over time.

Additionally, consider consolidating your assets to reduce fees. If you have multiple Gold IRAs with different custodians, you may be paying multiple sets of fees.

By consolidating your investments into a single account, you can streamline your fees and simplify your investment management.

Evaluate your existing accounts to determine if a consolidation is feasible and beneficial, ensuring you still maintain a diversified portfolio while minimizing costs.

Comparison of Gold IRA Custodians and Their Fee Structures

When choosing a Gold IRA custodian, it’s crucial to compare their fee structures to ensure you select the best option for your investment strategy.

First, we want to let you know that each custodian will have different fees related to account setup, annual maintenance, transaction costs, and storage fees.

For example, Some custodians may offer flat-rate fees, while others may charge fees based on the value of your gold holdings. For this reason, we suggest taking a look at this page to have more information.

As we already said, information is key, so we strongly suggest you to ask them information in details.

Understanding these differences can help you make an informed decision based on your investment size and frequency of transactions.

Moreover, custodians may vary in the types of services they offer, which can also influence their fee structures.

In fact, some custodians may provide additional services such as market analysis, investment advice, or educational resources, which could justify higher fees.

Generally speaking, the most serious companies in the market like Augusta precious metals are mostly focused on providing educational resources to their clients.

This is a sign of trust that you should take into consideration.

On the other hand, if you are a knowledgeable investor who prefers a more hands-on approach, you may opt for a custodian with lower fees and fewer additional services.

Evaluating the trade-offs between cost and service can help you align your choice of custodian that will align with your investment goals.

This choice is crucial, therefore it will require all your attention.

Another important aspect to consider is the custodian's reputation and level of customer service. While fees are a critical factor, the quality of service can also have a significant impact on your overall experience.

For this reason, we advise you to look for custodians with positive reviews and ratings, as well as those that provide responsive customer support.

We suggest you to take a look at websites like Trustpilot and check for the type of answers they provide to their clients Together with the response time.

A custodian that is easy to communicate with and offers personalized assistance can make your investment journey smoother and more successful.

In conclusion, balancing costs against service quality can help you find a custodian that best meets your needs.

Tax Implications of Gold IRA Fees

Understanding the tax implications of Gold IRA fees is an essential aspect of managing your investment.

Generally, the fees associated with managing a Gold IRA are tax-deductible, meaning you can deduct these costs from your taxable income.

However, it's crucial to document all expenses accurately and ensure they meet IRS guidelines. We strongly suggest you to keep track of all your expenses and ask for further help to a consultant.

This will help you to minimise the impact of taxes during the process, so that you can avoid to be stressed further.

Another tax consideration is the Impact of fees on your account's performance. While fees can be deducted, they still reduce the overall value of your investment, which can have tax implications upon distribution.

When you eventually withdraw funds from your Gold IRA, the amount you pay in fees over time can affect the taxable portion of your distribution.

Generally speaking, you can’t withdraw from your Gold IRA without avoiding costs, you can have more information about this subject on this page.

In any case, if you will understand how fees influence your net gains and tax liabilities, you will be able to make more informed decisions about your investment strategy.

Additionally, it's important to be aware of the potential for changes in tax legislation that could impact the deductibility of fees.

Tax laws are subject to change, and staying informed about any updates will help you strategize effectively.

Consulting with a tax professional who specializes in retirement accounts can provide invaluable guidance on how to navigate the complexities of Gold IRA fees and their tax implications, ensuring you remain compliant and maximize your investment potential.

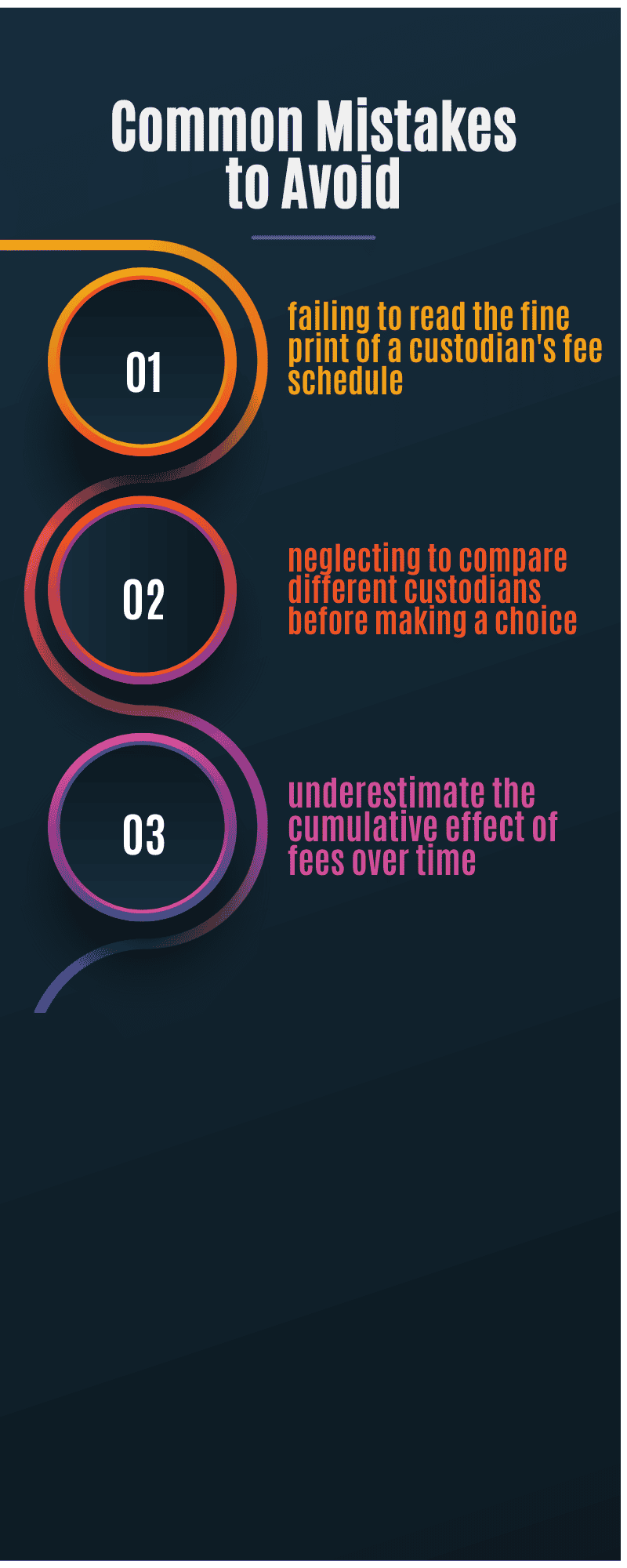

Common Mistakes to Avoid When Dealing with Gold IRA Fees

Navigating the world of Gold IRA fees can be challenging, and there are several common mistakes that investors should be wary of.

One major pitfall is failing to read the fine print of a custodian's fee schedule. Many investors might overlook specific fees or charges that can significantly impact their returns.

As we already said, It's essential to thoroughly review all fee structures and ask questions if anything is unclear. Being proactive in understanding fees can prevent unpleasant surprises in the future.

Another common mistake is neglecting to compare different custodians before making a choice. Some investors may settle for the first custodian they come across without researching alternatives.

We strongly recommend dedicating adequate time to make the necessary comparisons before taking this choice.

This can lead to missed opportunities for lower fees or better services. Taking the time to compare multiple custodians can help ensure you select one that aligns with your investment goals while minimizing costs.

Always remember that not all custodians are created equal, and diligent research can pay off in the long run.

Lastly, many investors underestimate the cumulative effect of fees over time. Even seemingly small fees can compound and significantly reduce your overall investment returns.

It’s important to consider the long-term implications of fees when evaluating your Gold IRA strategy, as gold IRA investments are structured to pay off in the long run.

Tools and Resources for Calculating Gold IRA Fees

To effectively manage and minimize Gold IRA fees, various tools and resources can assist investors in calculating and understanding their costs.

Online calculators are widely available, allowing you to input your investment details and estimate potential fees associated with different custodians.

These tools can provide a clear picture of how fees will impact your overall returns, helping you to make informed decisions about which provider to choose.

Additionally, many financial websites, like Investopedia, offer comparison charts that break down the fee structures of various Gold IRA custodians.

These resources can save you time and effort by allowing you to quickly see how different custodians stack up against one another in terms of fees and services.

Finally, educational resources such as webinars, articles, and forums can provide valuable insights into managing Gold IRA fees.

Many financial experts share their experiences and tips, which can help you navigate the complexities of fees associated with precious metals investments.

We strongly suggest you taking a look at Augusta precious metals blog and YouTube channel as they are careful in providing the necessary education to their clients.

Conclusion and Maximizing Your Gold IRA Investments

In conclusion, we think that investing in a Gold IRA is a particular type of investment that has its pros and cons, and it must be seen mostly as a way to protect your savings in the long run.

By navigating all the available online information, you must be aware that knowledge is your best ally.

By arming yourself with information and leveraging the right strategies, you can maximize your investments and pave the way for a prosperous financial future.

With the right approach, you can surely take out the best from it, but the condition is that you will need a guide together to the most transparent level of information before proceeding. We recommend taking a look at this page on Investopedia for further information.

FAQ

Gold IRA fees typically include custodian fees, storage fees, and transaction fees. Custodian fees cover account management, storage fees to ensure secure gold storage, and transaction fees apply when buying or selling gold.

To reduce costs, compare different custodians, choose cost-effective storage options (e.g., commingled vs. segregated), and limit unnecessary transactions that incur extra fees.

Segregated storage keeps your gold separate from other investors’ assets, while commingled storage stores multiple clients’ metals together. Segregated storage is typically more expensive but provides individual asset protection.

In most cases, Gold IRA fees are not tax-deductible, but it’s always best to consult a tax professional to understand how they apply to your specific financial situation.