Gold IRA vs. Traditional IRA: Which One is the Best for You?

Are you unsure about whether to choose a Gold IRA or a Traditional IRA for your retirement plan? Making the right decision could have a significant impact on your financial future. In fact, investing in precious metals to IRA is a type of investment the more and more Americans are looking for to protect their savings, especially with the uncertain economic conditions we are facing nowadays.

The levels of inflation are raising on a global scale, and even the USA are affected by it. When it comes to retirement, the choice might be choosing between a traditional IRA or a Gold IRA, means investing in your retirement account a percentage of precious metals to solidify a part of your patrimony. However, it has to be clear that investing in the one or the other one implies specific outcomes, costs, benefits and risks.

In this article, we'll break down the pros and cons of each option, helping you determine which one is best suited for your needs. We have to stress about the fact that there isn’t a perfect rule: it all depends on your needs as an investor and about how much you accept risks.

Is investing in a Gold IRA safer than investing in a traditional IRA ?

Generally speaking, investing in Gold (or other precious metals) for your IRA can be considered as a safe investment, but it requires particular attention to the costs involved.

As we have already mentioned in previous articles, A Gold IRA allows you to invest in physical gold or other precious metals as a way to secure your retirement savings. It can act as a hedge against inflation and market volatility, providing a tangible asset that holds value over time.

On the other hand, a Traditional IRA offers tax advantages, allowing you to deduct contributions from your income tax and potentially grow your savings tax-deferred until you start withdrawing the funds.

To make an informed decision, you need to consider factors such as your risk tolerance, investment goals, and time horizon, as already said.

We'll explore the advantages and drawbacks of each retirement plan, ensuring you have the necessary information to choose the option that aligns with your long-term financial objectives. Please, also consider taking a look at the IRS Guide concerning this type of investment, and we strongly advise you to seek for an excellent investment advisor before you make any move.

Key Takeaways:

- A Gold IRA allows you to invest in physical gold and other precious metals, providing a hedge against inflation.

- A Traditional IRA invests in stocks, bonds, and mutual funds, offering long-term tax-deferred growth.

- Gold IRAs require a custodian and have higher fees, whereas Traditional IRAs offer more liquidity and lower costs.

- Choosing between a Gold IRA vs Traditional IRA depends on your risk tolerance, financial goals, and retirement timeline.

- Gold IRAs provide stability during economic downturns, but Traditional IRAs tend to yield higher long-term returns.

What is a Gold IRA vs. Traditional IRA? (Definition & Basics)

A Gold IRA is a type of individual retirement account that allows investors to hold physical gold, silver, platinum, or palladium as part of their retirement portfolio. Unlike traditional IRAs that typically invest in stocks, bonds, or mutual funds, a Gold IRA provides the opportunity to own tangible assets.

As a result, this form of investment can appeal to those who are looking for a hedge against inflation and economic downturns, as precious metals have a long-standing history of retaining value, especially during times of financial uncertainty.

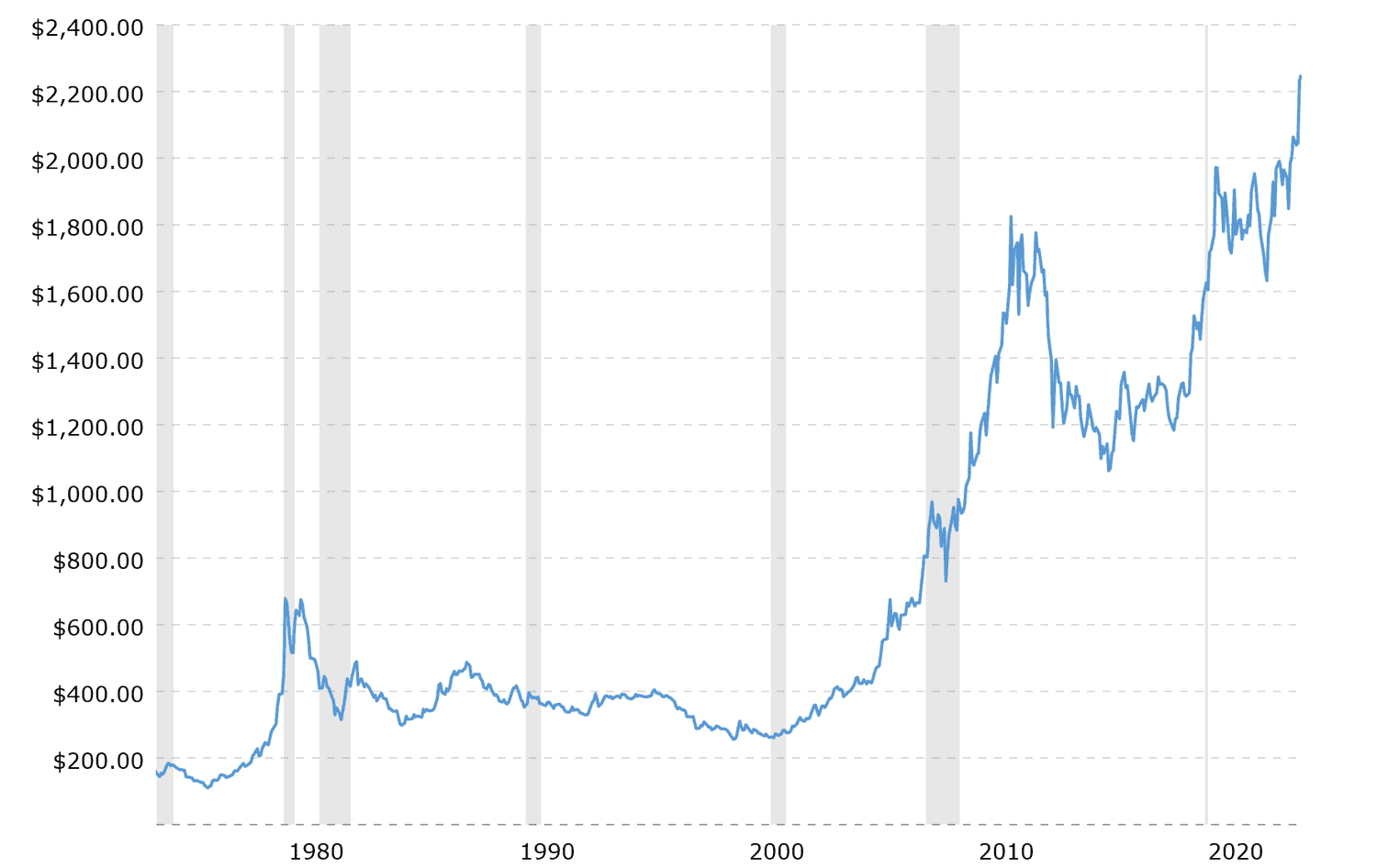

Gold Prices variation along the years. Source: Investopedia

To set up a Gold IRA, investors must work with a custodial service that specializes in precious metals.

In fact, these custodians manage the physical storage and security of the metals, ensuring compliance with IRS regulations. Consequently, investors can purchase gold coins, bullion, and bars, but it’s crucial to note that only specific types of gold and precious metals are allowed under IRS guidelines.

This means that not all gold purchases qualify, and investors must do their due diligence to ensure that their choices comply with the rules governing Gold IRAs.

Moreover, Gold IRAs provide an additional layer of diversification for retirement portfolios.

While traditional investments can fluctuate based on stock market volatility, precious metals often have a counter-cyclical nature, meaning they can sometimes increase in value when other investments decline.

Thus, this unique quality makes Gold IRAs an attractive option for those seeking to stabilize their retirement savings against market risks, thereby providing a sense of security for future financial needs.

What is a Traditional IRA?

A Traditional IRA, or Individual Retirement Account, is a popular retirement savings vehicle that provides individuals with tax advantages as they save for retirement.

It is slightly different compared to a Gold IRA, as contributions made to a Traditional IRA may be tax-deductible, depending on the individual's income level and participation in an employer-sponsored retirement plan.

This allows investors to reduce their taxable income in the year they contribute, potentially lowering their overall tax bill. The funds within a Traditional IRA grow tax-deferred, meaning that taxes on investment earnings are postponed until withdrawals begin, typically in retirement.

As an investor, you can choose from a wide array of investment options within a Traditional IRA, including stocks, bonds, mutual funds, and other securities.

Therefore, this flexibility allows individuals to tailor their portfolios according to their risk tolerance and investment goals.

Generally, the investment horizon for a Traditional IRA is long-term, as the account is designed to help individuals save for retirement over several decades. As a result, many people find that a Traditional IRA supports their long-term financial strategy effectively.

However, you have to know that there are Rules governing withdrawals from a Traditional IRA.

process guide

Let’s take a look at these rules together:

3.

Anyhow, despite these rules a Traditional IRA remains a widely used retirement tool, as it allows individuals to benefit from tax advantages while investing for their future.

1.

First, individuals cannot take distributions before the age of 59½ without facing a penalty, which can be as high as 10% of the amount withdrawn.

2.

Second, once an account holder reaches the age of 72, they are required to take minimum distributions (RMDs) from their account, which can impact financial planning in retirement.

Gold IRA vs. Traditional IRA: Pros and Cons

Which are the Pros of a Gold IRA ? We have to say that one of the primary advantages of a Gold IRA is its potential to act as a hedge against inflation. Over the years, gold has demonstrated resilience during economic downturns and inflationary periods, often retaining or increasing its value when fiat currencies decline.

Therefore, this characteristic makes a Gold IRA particularly appealing for those concerned about the long-term stability of their retirement assets.

In fact, by investing in precious metals, individuals can protect their purchasing power and safeguard their savings from the erosive effects of inflation.

Which are other benefits of a Gold IRA ?

Another significant benefit of a Gold IRA is the tangible nature of the investment. Unlike paper assets, physical gold and other precious metals can be held and stored, offering a sense of security and ownership.

Some investors find comfort in knowing they possess a commodity that has intrinsic value and has been recognized as a store of wealth for centuries. This can provide peace of mind in times of financial uncertainty, as individuals can rely on their physical assets rather than solely on fluctuating market securities.

Furthermore, adding a Gold IRA to a retirement portfolio can enhance diversification. A well-rounded investment strategy often includes a mix of asset classes, and incorporating precious metals can reduce overall risk.

In fact, gold typically has a low correlation with stocks and bonds, meaning that when traditional investments are underperforming, gold may perform well.

This diversification can help stabilize a retirement portfolio and provide a buffer against market volatility, ultimately supporting an investor’s long-term financial goals.

Cons of a Gold IRA

Despite its advantages, a Gold IRA also comes with several drawbacks that you should consider as an investor. One of the most significant downsides we want you to pay attention to, is the higher fees associated with setting up and maintaining a Gold IRA compared to traditional retirement accounts.

In fact, investors may incur costs for account setup, storage, insurance, and custodial services, which can eat into overall returns.

As a result, these fees can be particularly burdensome for those with smaller investment amounts, making it essential to weigh the costs against the potential benefits before choosing this investment vehicle.

Another concern is the limited range of investment options you will have while investing on a Gold IRA. Unlike a Traditional IRA that allows for a diverse array of securities, a Gold IRA is primarily focused on precious metals and all the related products.

This limitation can restrict an investor’s ability to tailor their portfolio according to their risk tolerance and financial goals. Additionally, the market for precious metals can be volatile, and the value of gold can fluctuate based on market demand, economic conditions, and geopolitical factors.

Consequently, this unpredictability may not align with the investment strategies of individuals seeking more stable, consistent returns.

Lastly, the physical nature of gold comes with its own set of challenges, including storage and security concerns. Investors must ensure that their gold is stored in a secure location, which often involves using third-party storage facilities.

These facilities may also charge additional fees for the secure storage of precious metals. Moreover, having a physical asset means that liquidity can sometimes be an issue. While gold can be sold, converting physical assets into cash may take time and effort, potentially delaying access to funds when needed.

Pros of a Traditional IRA

One of the key advantages of a Traditional IRA is the immediate tax benefits it offers to investors. Contributions to a Traditional IRA can be tax-deductible, which means that individuals can lower their taxable income for the year in which they contribute.

This can result in significant tax savings, especially if you fall into the higher income brackets. Additionally, we must say that the investment earnings within a Traditional IRA grow tax-deferred, allowing individuals to accumulate wealth without the burden of annual taxes on gains and dividends until they begin withdrawing funds.

Another benefit of a Traditional IRA is the broad range of investment options available. Investors can choose from various assets, including stocks, bonds, mutual funds, and ETFs.

This flexibility allows individuals to create a diversified portfolio tailored to their risk tolerance and investment objectives. Such diversification is essential for managing risk and optimizing returns over the long term, making a Traditional IRA an attractive option for those seeking growth in their retirement savings.

Moreover, a Traditional IRA allows for larger contribution limits compared to some other retirement accounts, enabling individuals to save more for retirement.

As of 2023, individuals can contribute up to $6,500 annually, with an additional catch-up contribution of $1,000 for those aged 50 and older.

This higher contribution limit enables investors to accelerate their savings and take advantage of the tax-deferred growth potential, ultimately enhancing their retirement nest egg.

Cons of a Traditional IRA

While a Traditional IRA offers many benefits, we also must say that it comes with specific drawbacks that investors should be aware of.

One of the significant disadvantages is the penalties associated with early withdrawals.

In fact, individuals who take distributions before reaching the age of 59½ may incur a 10% penalty on the amount withdrawn, in addition to any applicable income taxes. As a result, this can discourage individuals from accessing their funds when needed, making it essential to plan for retirement carefully and ensure that other savings are available for emergencies.

Another limitation of a Traditional IRA is the requirement for minimum distributions (RMDs) after reaching the age of 72. Account holders must begin withdrawing a specified amount each year, which can impact their overall tax situation and financial planning in retirement.

For some individuals, RMDs may force them to withdraw funds and potentially push them into a higher tax bracket, negating some of the tax benefits enjoyed during their working years. This requirement can complicate retirement income planning and may not align with everyone’s financial strategy.

Additionally, contributions to a Traditional IRA may not be fully tax-deductible for individuals who are covered by an employer-sponsored retirement plan, such as a 401(k), and whose income exceeds certain limits.

This means that some individuals may not enjoy the full tax benefits of a Traditional IRA, leading them to explore alternative retirement savings options that offer more advantageous tax treatment.

As a result, it’s crucial for investors to understand their eligibility and potential tax implications when considering a Traditional IRA.

Gold IRA vs Traditional IRA: Key Differences

Feature | Traditional IRA | Gold IRA |

Investment Type | Stocks, bonds, mutual funds | Physical gold, silver, platinum, palladium |

Tax Benefits | Tax-deferred growth | Tax-deferred growth |

Risk Level | Market-dependent | Lower risk, but subject to gold price fluctuations |

Liquidity | High | Lower (gold must be sold through an approved custodian) |

Costs | Low | Higher (custodian, storage, and insurance fees) |

Potential Returns | Higher over time | Lower but more stable |

Best for | Growth investors | Inflation hedge investors |

Which One is Right for You?

In summary, why you should invest in Gold IRA ?

Factors to Consider When Choosing Between a Gold IRA and Traditional IRA

When deciding between a Gold IRA and a Traditional IRA, several factors should be taken into account to ensure that the chosen retirement plan aligns with personal financial goals.

First, one of the primary considerations is an individual’s risk tolerance. Those who are comfortable with traditional investments and seek growth through stocks and bonds may find a Traditional IRA to be more suitable.

Conversely, individuals who are more risk-averse and concerned about market volatility may prefer the stability that gold can offer, making a Gold IRA a more appealing option.

Second, another important factor is the investment horizon. If an individual is planning for retirement several decades away, they might prioritize growth over stability, leaning towards the diversified options available in a Traditional IRA.

However, if someone is closer to retirement and seeks to preserve wealth, they may opt for a Gold IRA to protect their savings from economic fluctuations.

Understanding your timeline for retirement and your need for liquidity can significantly influence the choice between these two retirement accounts.

Finally, it’s essential to evaluate the associated costs and fees of each option. A Gold IRA generally comes with higher fees for storage, insurance, and custodial services, which can impact long-term returns. In contrast, Traditional IRAs typically have lower fees and more accessible investment options.

Assessing how these costs align with your financial strategy and future goals can help you make a more informed decision about which retirement plan is best suited to your needs.

Conclusion: Which Retirement Plan is Best for You? Gold IRA or Traditional IRA ?

Which is the conclusion we can make after discussing these two options ? We have touched all the most important points concerning risks and benefits.

However, we have to say that the choice between a Gold IRA and a Traditional IRA ultimately depends on your individual financial goals, risk tolerance, and investment preferences. It's a very personal process, and it must be guided by professional advice, we always stress about this very important factor.

A Gold IRA can be an excellent option for those seeking a tangible asset that acts as a hedge against inflation and economic instability. However, it comes with higher fees and limited investment options, which may not suit everyone’s financial strategy.

And what about Traditional IRA ?

On the other hand, a Traditional IRA offers immediate tax benefits, a broad range of investment choices, and a more cost-effective approach to retirement savings.

While it has its own set of limitations, such as penalties for early withdrawal and required minimum distributions, many investors find that the flexibility and potential for growth make it a suitable choice for long-term retirement planning.

Ultimately, it is crucial for individuals to thoroughly evaluate their financial situation and retirement goals before making a decision. We always stress about the fact that consulting with a financial advisor can also provide valuable insights tailored to personal circumstances.

Whether you're leaning towards a Gold IRA or a Traditional IRA, understanding the pros and cons of each option will empower you to make informed choices that will significantly impact your financial future.

Resources for Further Information on Retirement Planning

To further explore your retirement planning options, several resources can provide valuable information and guidance. The Internal Revenue Service (IRS) website offers comprehensive details on various retirement accounts, including eligibility, contribution limits, and tax implications.

We also advise to you to take a look at this Investopedia article to have more information about the subject.

This official source is an essential starting point for understanding the rules governing both Gold IRAs and Traditional IRAs.

Additionally, financial advisory services can provide personalized assistance tailored to your unique financial situation. Many financial planners specialize in retirement planning and can help you navigate the complexities of choosing the right retirement account based on your goals and risk tolerance.

They can also offer insights on asset allocation and investment strategies that align with your overall financial plan.

Final Conclusions

Finally, consider reading books and articles on retirement planning and investment strategies. Numerous publications cover topics ranging from the basics of IRAs to advanced investment techniques.

These resources can enhance your understanding of retirement planning, helping you make informed decisions that secure your financial future.

We also wrote an e-book about this subject that you can envision HERE.

Whether you choose a Gold IRA or a Traditional IRA, the key is to remain proactive and informed as you work towards achieving your retirement goals.