Understanding IRA-Approved Gold: Your Guide to Secure Investments

Investing in gold through an Individual Retirement Account (IRA) is a strategic and increasingly popular method to protect your savings with a physical asset that holds intrinsic value.

As we repeated in the most part of our articles, during uncertain economic times, IRA gold investments offer a hedge against inflation, market volatility, and currency devaluation.

Therefore, before you allocate your retirement funds into precious metals, it’s essential to understand which gold products qualify and how the process works, so you stay compliant with IRS rules and make smart, informed decisions.

What Is IRA-Approved Gold?

Not all gold is eligible for inclusion in a self-directed IRA. IRA-approved gold refers to specific bullion coins and bars that meet the IRS’s stringent purity and production requirements. To qualify, gold must be at least 99.5% pure and produced by an accredited manufacturer, typically one approved by NYMEX, COMEX, or the LBMA (London Bullion Market Association).

In other words, your typical gold jewelry, collectible coins, or lower-purity gold bars won’t meet the criteria. The IRS wants to ensure that only standardized, high-quality, easily valued precious metals are used for retirement investing.

Eligible Gold Products for IRA Gold Investments

If you’re considering adding physical gold to your retirement portfolio, here are some of the most commonly accepted options under IRS guidelines:

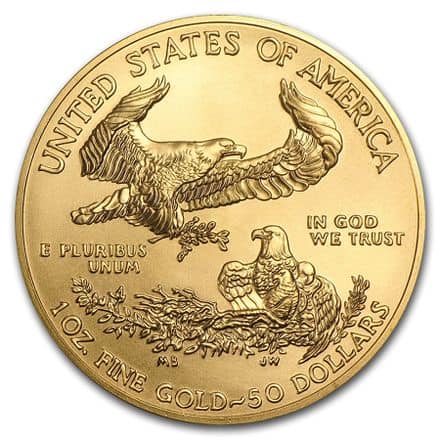

- American Gold Eagle coins (exception: these are 91.67% pure but still IRS-approved due to special exemption)

- Canadian Gold Maple Leaf coins

- Australian Kangaroo/Nugget coins

- Austrian Philharmonic gold coins

- Gold bars produced by approved refiners, with a minimum fineness of 0.995 (99.5%), and properly assayed

These products are widely recognized, liquid, and standardized, making them ideal for long-term investment within an IRA framework.

Eligible Gold Products for Your IRA

When it comes to selecting gold for your IRA, the IRS has a clear list of eligible products. Here are some of the most commonly approved gold options:

American Gold Eagle Coins

These coins are unique as they are one of the few exceptions allowed by the IRS despite being less than 99.5% pure. Their popularity and liquidity make them a strong choice.

Canadian Gold Maple Leaf Coins

Known for their 99.99% purity, these coins are highly sought after for their quality and recognition worldwide.

Austrian Gold Philharmonic Coins

With a 99.99% purity, these coins are appreciated not only for their gold content but also for their artistic design.

Gold Bars and Rounds

These must be produced by accredited manufacturers and meet the 99.5% purity requirement, offering a flexible option for investors looking to diversify their gold holdings.

process guide

How to Invest in Gold Through Your IRA

3.

Secure Storage:

The IRS mandates that the gold in your IRA must be stored in an approved depository. These facilities are highly secure, providing state-of-the-art protection and full insurance coverage for your assets.

1.

Set Up a Self-Directed IRA:

Unlike regular IRAs that limit you to stocks, bonds, and mutual funds, a self-directed IRA allows you to invest in physical assets like gold. Finding a reputable custodian experienced in handling gold IRAs is crucial.

2.

Choose your Gold and fund your account:

Work with a trusted precious metals' dealer to purchase IRS-approved gold.

You can fund your Gold IRA through contributions, rollovers, or transfers from existing retirement accounts. When rolling over funds, ensure you complete the process within 60 days to avoid taxes and penalties.

Benefits of Investing in IRA-Approved Gold

Investing in precious metals is more than just a trend, it’s a proven way to preserve and grow wealth across generations. Assets like gold, silver, and platinum don’t just sparkle; they serve as a powerful hedge against inflation, currency devaluation, and economic downturns.

Contrarily to paper assets that can lose value overnight, precious metals tend to retain purchasing power over time.

In fact, gold in particular has historically shown a strong inverse correlation to the stock market and fiat currencies, making it a vital component in any well-diversified portfolio.

For retirement savers, the appeal goes even further.

IRA gold investments allow you to place physical gold within a tax-advantaged retirement account, combining the security of tangible assets with the benefits of long-term wealth planning.

Why it's convenient investing in Gold and other precious metals ?

Diversification

Gold adds a layer of diversification to your retirement portfolio, reducing risk by spreading investments across different asset classes.

Hedge Against Inflation

Historically, gold has been a reliable hedge against inflation, maintaining its value even as the purchasing power of currency declines.

Long-Term Stability

Physical gold offers a tangible asset that isn’t subject to the same market fluctuations as stocks or bonds, providing a sense of security during economic uncertainties.

Key Considerations Before Investing in Precious Metals

While precious metals can add strength and stability to your portfolio, there are several important factors to consider before you dive in.

Understand Market Volatility

The price of gold, silver, and other metals can fluctuate based on global economic conditions, interest rates, and currency shifts. This isn’t necessarily a downside, because volatility can also create buying opportunities. However, it’s crucial to stay informed and take a long-term view.Diversification Is Non-Negotiable

Precious metals should complement, not dominate, your investment strategy. Think of gold and silver as insurance, valuable during periods of crisis, but not a substitute for stocks, bonds, or other growth-oriented assets. The strength of IRA gold investments lies in their role as a stabilizing force within a broader retirement plan.Choose Your Investment Vehicle Wisely

You can gain exposure to metals in several ways:Physical bullion (coins or bars)

Gold ETFs or mutual funds

Mining stocks

Self-directed IRAs holding physical gold

Each option has its own cost structure, liquidity profile, and risk level. For those focused on wealth preservation and retirement planning, IRA gold investments—particularly those involving physical gold stored in secure vaults—offer a unique balance of security and tax efficiency.

Think Long-Term, Not Speculative

Precious metals aren’t about timing the market or chasing quick gains. Their true value emerges over the long haul, especially in times of inflation or financial instability. That’s why many investors turn to gold IRAs: to anchor their portfolio with a timeless, reliable store of value.

Compliance: Always ensure your gold investments comply with IRS regulations to avoid penalties and preserve the tax-deferred status of your IRA.

Fees: Be aware of the fees associated with a Gold IRA, including setup, storage, and management fees. These can vary widely depending on your custodian and storage facility.

Market Volatility: While gold is generally stable, its price can still fluctuate. It’s important to consider your risk tolerance and investment strategy before committing a significant portion of your retirement savings to gold.

.

Additional Considerations for Your Gold IRA

When setting up IRA gold investments, one of the first decisions you’ll face is how to fund the account. In most cases, a direct transfer (also called a trustee-to-trustee transfer) is the preferred method. Unlike a rollover, it doesn’t trigger withholding taxes or early withdrawal penalties, and it keeps the process clean from an IRS perspective.

Another smart strategy? Diversify within your precious metals IRA. While gold remains the core holding for many investors, the IRS also allows other metals such as:

Silver (minimum purity: 99.9%)

Platinum and palladium (minimum purity: 99.95%)

Including a mix of these approved metals can enhance your portfolio’s resilience across different market cycles.

When it’s time to take distributions—typically after age 59½—you have two options:

Liquidate the metals and receive cash (the most common approach)

Take an in-kind distribution, meaning you receive the actual gold or silver coins/bars from the vault

Keep in mind: in-kind distributions are taxed based on the current fair market value of the metals, and may impact your overall tax liability. It's highly recommended to consult with a financial advisor or tax professional before deciding how to structure your withdrawals.

Rollover vs. Transfer

When moving funds from an existing retirement account to a Gold IRA, you have the choice between a rollover or a direct transfer. Direct transfers are often preferred due to their simplicity and lack of tax implications.

Diversification Within Precious Metals

While gold is a popular choice, you can also diversify within your IRA by including other precious metals like silver, platinum, and palladium, which are also IRS-approved.

In-Kind Distributions

When it's time to take distributions from your Gold IRA, you can either sell your gold for cash or opt for an in-kind distribution, where you take possession of the actual metals. Keep in mind that this could have tax implications.

Final Thoughts

Investing in a Gold IRA can be a strategic move for those looking to diversify their retirement portfolio and protect their wealth against economic uncertainty. Precious metals like gold offer a tangible, stable asset that has historically held its value over time, making them a wise choice for long-term financial security.

However, it's crucial to carefully consider your investment strategy, understand the associated costs, and work with reputable providers to ensure that your Gold IRA aligns with your overall financial goals.

By taking the time to educate yourself and make informed decisions, you can confidently navigate the complexities of Gold IRA investments and secure a more stable financial future.

For more information, we recommend you to take a look at the IRS website.

FAQ

Yes, you can transfer or roll over your existing IRA into a Gold IRA without incurring penalties, as long as the process is completed correctly. A direct transfer, where the funds move directly from one custodian to another, is typically the safest and most straightforward method to avoid any tax implications.

The IRS has specific requirements for the types of gold that can be included in a Gold IRA. Generally, you can hold gold coins and bars that meet a minimum fineness requirement of 99.5%. Popular options include American Gold Eagles, Canadian Gold Maple Leafs, and bars produced by approved refiners.

When you invest in a Gold IRA, your precious metals are stored in a secure, IRS-approved depository. These depositories provide high levels of security, including insurance coverage, to protect your assets. You cannot take physical possession of the gold while it is held within the IRA without triggering a distribution.

Yes, there are ongoing fees associated with maintaining a Gold IRA. These typically include storage fees for the physical gold, administrative fees from the custodian, and sometimes a setup fee. It’s important to understand these costs before opening a Gold IRA to ensure they align with your financial plan.

You can take physical possession of the gold in your Gold IRA, but it would be considered a distribution and subject to taxes and potential penalties if you're under the age of 59½. However, when you reach retirement age, you can choose to take in-kind distributions, meaning you receive the physical gold rather than selling it for cash.

Gold has historically been viewed as a safe-haven asset during times of economic uncertainty. While no investment is entirely risk-free, gold often retains or increases its value during market downturns, providing a hedge against inflation and currency devaluation. However, it’s important to diversify and not rely solely on gold for retirement security.

Before setting up a Gold IRA, consider factors such as the credibility of the custodian, the associated fees, the liquidity of gold compared to other assets, and how this investment fits into your broader retirement strategy. It’s also wise to consult with a financial advisor to ensure that a Gold IRA aligns with your financial goals.

Articles on all your favorite subjects

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.