Advantage Gold Review

Advantage Gold entered the precious metals IRA space in 2014 and is headquartered in Los Angeles, California.

From the beginning, the company positioned itself as both a precious metals dealer and a specialist in helping investors transition part of their retirement savings into physical assets like gold, silver, platinum, and palladium.

In short, they’re not just selling coins, but they're guiding people through a specific kind of retirement diversification strategy.

The firm was founded by Adam Baratta, Larry Levin, and Kirill Zagalsky. Each founder brought practical experience from the upper tiers of the industry, including positions at U.S. Mint–affiliated precious metals dealers and backgrounds in commodities trading.

This combination of regulatory familiarity, trading experience, and hands-on retail operations has shaped the company's approach to client education and compliance.

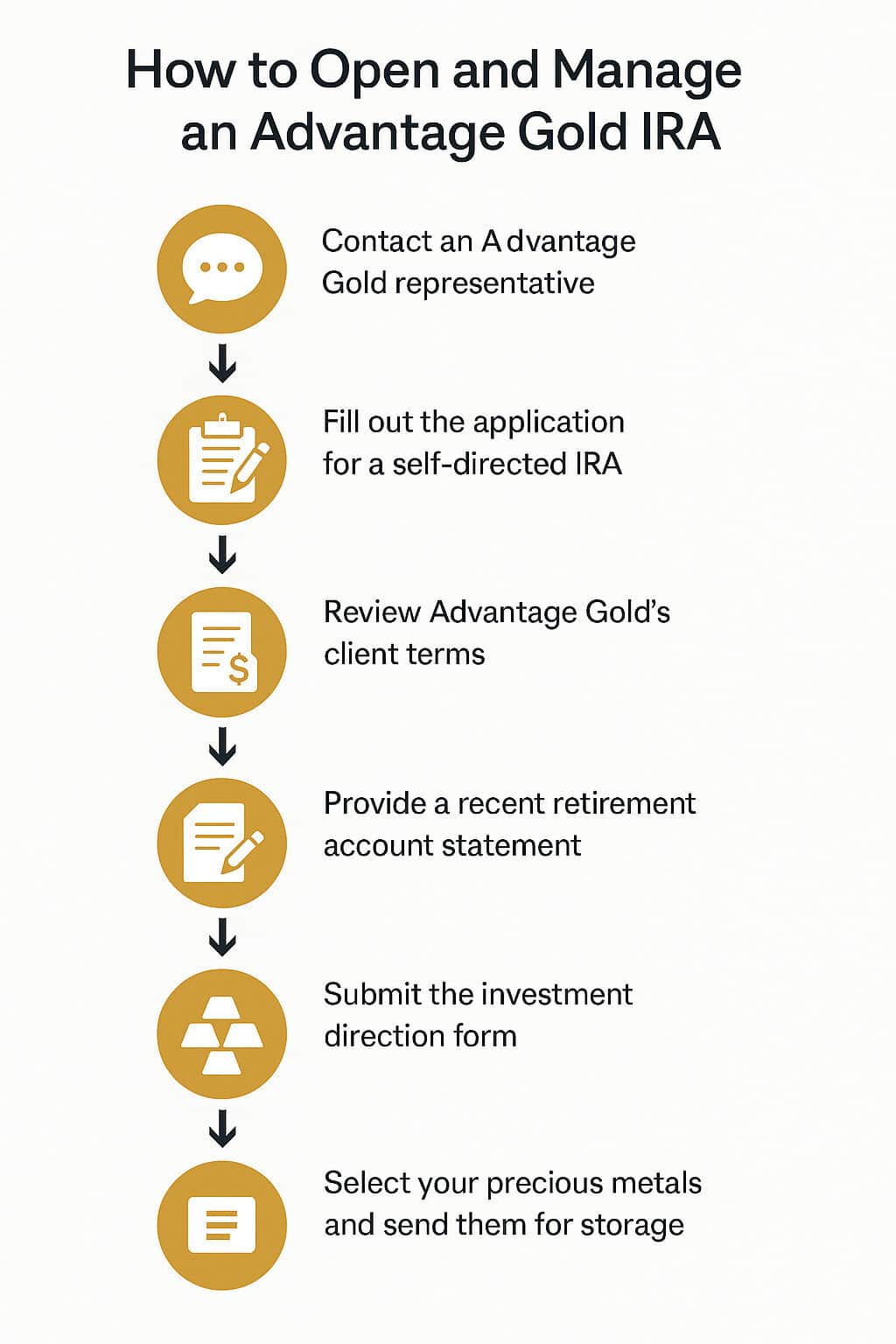

One of the reasons Advantage Gold has gained traction is its attention on clarity and support. In fact, setting up a precious metals IRA can be difficult and confusing for newcomers: IRS rules, rollover procedures, custodians, storage requirements, and many companies tend to gloss over the complexities.

Advantage Gold, on the other hand, is known for walking clients through the process step by step.

In fact, their team focuses on avoiding tax mistakes and helping investors move assets from 401(k)s or IRAs into a gold-backed account in a way that is compliant, smooth, and free from unnecessary penalties.

Overview of Our Evaluation

This review blends insights from verified customer experiences, official information provided by Advantage Gold, and our own analysis of the company’s products, services, and overall operational structure. We tried to give you a clear, balanced picture of how the company performs in practice.

Let's start by breaking down the strengths and weaknesses of Advantage Gold, by examining its fees and processes, and taking a closer look at its reputation within the broader gold IRA industry.

Pros and Cons

Pros

Cons

In short:

Advantage Gold performs very well in areas that matter like support, education, product authenticity, and overall customer satisfaction, while falling short in transparency and online convenience.

Company Background and Evolution

Advantage Gold operates from its main headquarters at 12100 Wilshire Boulevard in Los Angeles, California, with a secondary office in Austin, Texas. From the start, the company has been run by professionals who understand the precious metals market not just in theory, but through years of direct involvement in trading, analysis, and education.

One of the more visible figures behind the company is Adam Baratta, co-CEO and author of several bestselling books including The Great Devaluation and The End of Money. His work often focuses on the impact of inflation, monetary policy, and why physical gold has historically served as a defensive asset. Baratta is essentially the “educator-in-chief” of the firm, and his public profile reinforces the company’s emphasis on financial literacy.

Kirill Zagalsky, another co-founder, is frequently invited to share his views on national outlets such as NBC and Fox Business News. His role has always been more analytical, providing commentary on market trends and helping explain to a general audience why metals behave the way they do.

Larry Levin, meanwhile, brings decades of experience in stock and commodities trading. His background gives the company a practical understanding of market mechanics and investor behavior—knowledge that translates directly into their IRA strategies.

Together, this trio created a company that tries to bridge a gap many investors don’t even realize exists: physical precious metals can play a legitimate role in retirement planning, especially during periods of economic stress. Advantage Gold built its entire model around education first, transaction second.

Since its founding, the company has focused heavily on helping clients convert existing retirement plans—401(k)s, IRAs, TSPs into self-directed IRAs backed by bullion. They developed a dedicated team just for this purpose, and over time the business expanded to roughly 35 employees, many of whom specialize exclusively in Gold IRAs.

Advantage Gold sources its inventory from respected institutions, including NYMEX, COMEX, NYSE/Liffe, LPPM, LBMA, TOCOM, and other ISO-certified producers. This supply chain matters because it guarantees legitimacy and quality. As an authorized U.S. Mint dealer, the company handles only authentic coins and bars.

Its standing in the industry is reinforced through membership in both the Industry Council for Tangible Assets and the American Numismatic Association, which are two organizations that require adherence to strict professional standards.

Even though Advantage Gold is relatively new compared to some competitors with 30 or 40 years on the market, it has gained rapid traction. Part of this visibility has come through paid endorsements from conservative media personalities such as Mark Levin, Benny Johnson, Jason Hanson, and Ed Mylett. These partnerships have undeniably increased brand exposure among specific audiences.

However, the company’s growth isn’t just the result of marketing strategies. Investors appreciate its customer-focused model: fast and insured shipping, transparent storage options, regular market updates, and a reliable buyback program for those who want to liquidate their metals quickly and at fair prices. Its rise reflects a mix of strong branding, credible leadership, and genuine investor support.

Advantage Gold’s Products and Services

Advantage Gold’s core offering revolves around self-directed IRAs backed by physical precious metals, but the company also supports direct purchases of gold, silver, platinum, and palladium for investors who want to hold metals outside a retirement account. This dual structure makes the platform accessible both to long-term retirement savers and to individuals who simply want to diversify with tangible assets.

One of the reasons Advantage Gold stands out in the industry is the very low entry requirement.

In fact, to open a precious metals IRA, the minimum investment is $5,000, which is significantly below the usual thresholds seen elsewhere. Many competitors insist on $20,000, $25,000, or even $50,000 minimums, effectively shutting out smaller or first-time investors. Advantage Gold takes the opposite approach by lowering the barrier to entry and allowing more people to participate.

Every product offered by the company meets IRS standards for purity, weight, and eligibility, meaning that all gold, silver, platinum, and palladium items can be safely held inside an IRA without risking penalties or disqualification. For retirement-oriented investors, that compliance is absolutely essential.

Gold, Silver, Platinum, and Palladium Options

Advantage Gold is one of the few firms that provides a truly broad selection of precious metals, including IRS-approved palladium coins, which are much harder to find through other retailers. Availability varies depending on market demand, but the range of metals gives investors the ability to build a more nuanced and diversified portfolio, not just gold and silver.

Gold Products

The company offers a wide assortment of popular and IRA-eligible gold bullion, such as:

- 1 oz .9999 Gold Bars

- 1/10 oz Canadian Gold Maple Leafs

- 1 oz South African Gold Krugerrands

- 1 oz American Gold Eagles

- And several additional IRA-approved coins and bars

This lineup includes both globally recognized bullion coins and a variety of bar sizes, giving investors flexibility whether they want smaller denominations or larger allocations.

Silver Products

Advantage Gold’s silver catalog includes several highly liquid, globally trusted coins:

- 1 oz Canadian Silver Maple Leafs

- 1 oz American Silver Eagles

- Mexican Silver Libertads

- Australian Emperor Penguin coins

- And more

The selection blends standard IRA bullion with some pieces that appeal to collectors or investors who want a little more design variety.

Platinum Products

Platinum is less common in the IRA world, but Advantage Gold stocks several unique options, including:

- 1/3 oz Australian Whale Coins

- 1/3 oz Australian Leopard Seal Coins

- 1/3 oz Australian Sea Lion Coins

- Additional IRA-eligible platinum options

These fractional-weight platinum coins are unusual offerings, which can be attractive for investors who want exposure without buying full-ounce bars.

Palladium Products

Palladium is even more niche, and Advantage Gold is one of the few companies that actively carries it:

- 1 oz Palladium Bars

- Canadian Palladium Maple Leafs

- Other IRA-qualified palladium choices depending on availability

Copyrights image : Monex

For investors aiming for diversification beyond the standard gold-silver mix, these options provide a broader set of tools than most competitors offer.

Advantage Gold has built a product catalog that is far more diverse than what most gold IRA providers offer, both in terms of metals and in terms of the specific bullion items available.

This variety, combined with a very low minimum investment, makes the company especially appealing to investors who want flexibility and room to build a diversified precious metals strategy.

IRS Standards for IRA-Eligible Coins and Bars

When you invest in a precious metals IRA, the IRS imposes strict purity requirements to ensure that only high-quality, investment-grade metals are allowed into a retirement account. Gold must be at least 99.5% pure, silver must reach 99.9%, and both platinum and palladium must meet a standard of 99.95%.

Advantage Gold sources only products that satisfy these thresholds, drawing from reputable mints such as the U.S. Mint, the Royal Canadian Mint, and other globally recognized refiners.

These purity rules might sound technical, but they matter for one reason: they determine whether a coin or bar is allowed in an IRA. Buying metals that don’t meet IRS standards could create headaches down the line, including potential tax penalties. Advantage Gold tries to eliminate that risk by curating a catalog that is IRA-eligible from top to bottom.

In practice, most investors choose a mix of coins and bars. Each comes with different strengths:

- Coins often carry a slightly higher premium because of their design, rarity, or collectible appeal. Some coins can appreciate faster than gold’s spot price simply because they are popular with buyers.

- Bars generally trade closer to spot value and come with smaller markups, making them appealing for investors who want maximum metal weight for their money.

To make the distinctions clearer, here’s a more detailed look at common categories of coins and how they compare:

Coin Type | IRA Eligibility | Purity Requirement | Liquidity / Resale | Examples |

Bullion | Very High | Gold 99.5%+, Silver 99.9%+, etc. | High, trades near spot | American Eagle, Canadian Maple Leaf |

Premium / Semi-Numismatic | Depends on coin | Varies by mint | Medium; influenced by rarity and collector demand | Proof coins, limited editions |

Numismatic / Collectible | Generally not eligible | Varies widely | Low; resale depends on collectors | Rare historical coins |

For investors who don’t want an IRA, Advantage Gold also allows direct purchases of physical metals. The selection for non-IRA products may be narrower, and you are responsible for shipping, delivery, and insurance costs—something the company makes clear upfront.

It’s also worth noting that Advantage Gold does not mix physical metals with cryptocurrencies, nor does it offer digital or tokenized gold options. Their entire focus is on IRS-compliant, physical bullion—nothing synthetic or blockchain-based. This keeps their offering simple, transparent, and aligned with traditional retirement strategies.

Advantage Gold’s Buyback Program

One of the advantages of working with Advantage Gold is that the company offers a straightforward buyback program, giving investors an easy way to liquidate their metals when needed. Advantage Gold operates with a market-linked approach: clients can sell their metals back at rates tied to current market prices, with the spot price serving as the absolute minimum.

The process is deliberately simple. You contact the company for a live-market quote, ship your metals through insured channels, and, once the metals are verified, you typically receive your payment within 24 hours. For investors who want liquidity without stress or negotiation games, this matters a lot.

Another point in the company’s favor is its commitment to matching or beating competitor pricing on comparable bullion. This applies both when buying metals and when selling them back, giving customers additional confidence that they aren’t leaving money on the table.

Storage and Security

IRS regulations require that all metals held inside a self-directed IRA be stored in approved, third-party depositories. Advantage Gold partners with two of the most respected names in the industry to meet those standards:

- Delaware Depository (Wilmington, Delaware) — known for its long-standing reputation, competitive rates, and up to $1 billion in all-risk insurance coverage

- Brink’s Global Services — with high-security facilities in Los Angeles, California, and Salt Lake City, Utah

Both companies specialize in storing precious metals under rigorous physical and financial security protocols. Your holdings are protected against theft, natural disasters, fire, and even damage during transport. Insurance coverage is comprehensive and automatically included.

For investors who prefer additional privacy and control, Advantage Gold also offers segregated storage, where your metals are kept in a dedicated, individually labeled compartment, not pooled with other investors’ assets. Annual costs generally range from $100 to $150, depending on the storage partner and the specific arrangements made.

These depositories follow strict industry standards and are audited regularly. They also provide real-time inventory tracking, allowing clients to know exactly what they own and where it’s stored at all times. For retirement investors, this level of oversight and transparency creates an added layer of peace of mind.

Advantage Gold Fees and Costs

Advantage Gold is relatively transparent about how its fees work, although, like most companies in the precious metals industry, it does not publish real-time coin and bar prices on its website. Since precious metals pricing moves constantly, you’ll need to speak directly with a representative to get current quotes. This isn’t unusual, but it does mean you can’t compare prices online at a glance.

When it comes to IRA-related fees, the structure is straightforward and easy to understand:

- One-time IRA setup fee: $50

- Annual custodian administration:

- $95 with STRATA Trust

- Up to $225 with Equity Trust Company (depending on account type and size)

- Annual storage fees: $100–$150, depending on whether you choose shared or segregated storage

These are industry-standard costs, and in many cases lower than what competitors charge—particularly when using STRATA as the custodian.

chedules or hidden fees, this is a meaningful advantage.

Advantage Gold adds a modest markup on the metals themselves, typically in the 2%–7% range, depending on the product. This is competitive for the industry, especially when compared to firms that routinely push numismatics with much higher premiums. Additional fees may apply for:

- shipping,

- insurance,

- special handling,

- or direct purchase deliveries outside an IRA.

The company does offer some cost-saving perks. Accounts funded with $50,000 or more may have many of the first-year fees waived, and Advantage Gold frequently extends promotional pricing to new clients. Additionally, orders over $25,000 qualify for free shipping, which can reduce costs for larger purchases.

Overall, Advantage Gold’s fee structure is refreshingly predictable. There are no confusing tiered pricing systems, and the annual rates remain fixed regardless of how large your account becomes. For investors who prefer straightforward, fixed costs instead of sliding s

Advantage Gold Reviews, Complaints, and Ratings

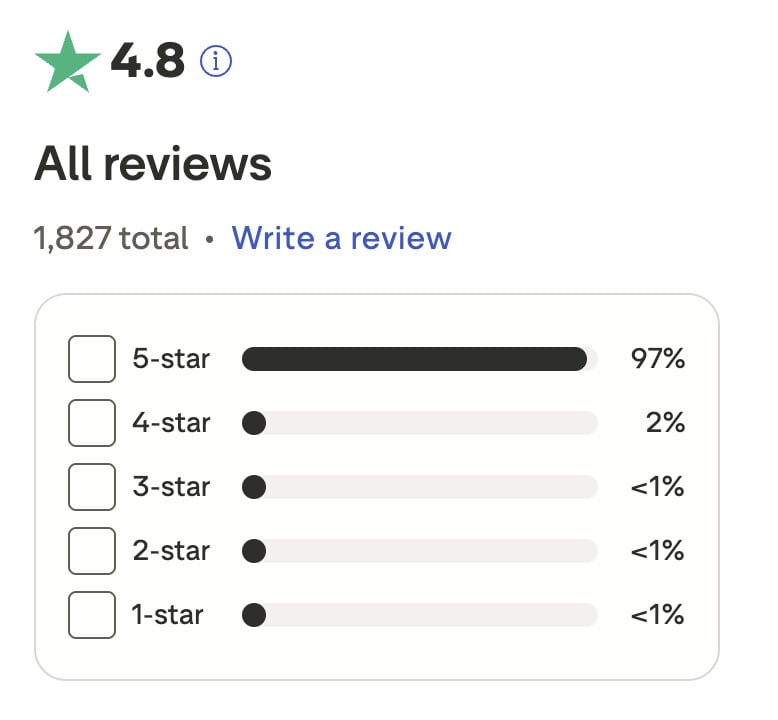

As of mid-2025, Advantage Gold continues to stand out as one of the highest-rated companies in the precious metals IRA space. Across virtually every major review platform, the sentiment is overwhelmingly positive, and the company has maintained this reputation consistently for years.

Advantage Gold holds an A+ rating with the Better Business Bureau and a AAA rating from the Business Consumer Alliance—two organizations that take customer protection and business ethics seriously. On Trustpilot, the company scores around 4.9 out of 5 stars, based on more than 1,800 customer reviews, which is an exceptional level of satisfaction for a financial services provider.

TrustLink, another respected platform in the precious metals industry, lists Advantage Gold at a full 5-star rating from nearly 500 reviews, and the company has held the #1 ranking for gold IRA providers for eight consecutive years. Consumer Affairs mirrors this trend with a 5-star rating based on over 440 customer submissions.

The bulk of these reviews highlight three recurring strengths:

- Consistent, high-quality customer service

- Thorough educational support (videos, guides, one-on-one calls)

- A smooth and transparent account setup process

Many reviewers mention that representatives walk them through each step patiently and clearly, something that matters a lot for investors who are new to self-directed IRAs. Names like Adam, Jose, Paul, and Richard are brought up frequently in reviews as examples of advisors who go above and beyond.

Repeat customers also note that the service remains reliable even during peak periods when gold demand surges, which is often when other dealers struggle with delays or communication issues.

Advantage Gold Complaints

No company in this sector is perfect, and Advantage Gold is not an exception. While complaints are relatively rare compared to the volume of positive feedback, some issues do appear on BBB and Trustpilot.

One BBB reviewer claimed that their stepmother was charged an extremely high premium, around 30% over spot, and that an advisor allegedly transferred her entire retirement balance into a gold IRA instead of the smaller portion she had intended. This is a serious accusation, and what’s more concerning is that Advantage Gold had not responded publicly to the complaint at the time of publication.

Other negative reviews mention:

- Unclear or unexpectedly high markups, which reduced expected returns

- Lower-than-anticipated buyback prices due to spreads and fees

- Occasional delays in shipping or communication, although these seem to be resolved fairly quickly

- Persistent follow-up calls

- The lack of an online checkout system, which forces every purchase through a phone representative

While the volume of complaints is small relative to the number of 5-star reviews, they do highlight areas where the company could improve—particularly in terms of transparency, responsiveness, and clearer communication about pricing.

Final Verdict

Advantage Gold is a legitimate and well-established gold IRA provider with strong ratings, respected industry memberships, and an impressive volume of positive customer feedback. For many investors, especially those who value hand-holding and detailed explanations, the company delivers a smooth, guided experience that simplifies what can otherwise be a confusing process.

That said, Advantage Gold is not without flaws. A handful of unresolved BBB complaints raise concerns about occasional communication gaps, unclear markups, or misunderstandings around transfers and buybacks. These cases are uncommon, but they’re worth noting, particularly for investors who prioritize total transparency on pricing.

If you’re considering Advantage Gold, it’s important to ask direct questions about fees, markups, and buyback spreads, and compare their answers with what other top-rated gold IRA companies are offering. A broader comparison will help you determine whether their model aligns with your expectations and whether the costs make sense for your situation.

Where Advantage Gold truly stands out is in its educational approach. The company invests heavily in helping clients understand precious metals, IRS rules, and the mechanics of a self-directed IRA. Their rollover process is streamlined, and the minimum entry cost is one of the lowest in the industry, making the service accessible to a wide range of investors.

Overall, Advantage Gold is a strong option for anyone, regardless of portfolio size, who wants to add physical precious metals to their retirement savings through a clear, structured, and fully guided process.

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.