Subscribe to get our FREE

GOLD IRA GUIDE

Gold vs Crypto Investment: Which Is the Better Choice?

When it comes to choosing between a gold vs crypto investment, many investors wonder which offers the best balance of security and growth potential. Both assets have unique advantages.

The debate between gold and cryptocurrency as investment vehicles has gained significant traction in recent years. With the rise of digital assets, many investors are contemplating the benefits of cryptocurrencies like Bitcoin compared to the traditional safe-haven asset, gold.

The federal regulators approved In January 2024 the first wave of spot Bitcoin ETFs and as a consequence, investors can now easily buy “shares” in the cryptocurrency without taking custody of the coin itself.

Not to mention, the recent endorsement on cryptocurrencies given by Donald Trump has validated cryptocurrencies as an official, valuable resource for investors.

As a result, many investors see now bitcoin as a valid asset that allow to invest and build wealth while avoiding capital gains taxes. As a consequence, bitcoin surpassed the super-high price of $69200 per token, with a raise of +50% appreciation in only one month.

Many millennials see now cryptocurrency as an asset to invest on for their retirement accounts and more in general, cryptocurrencies are now facing a raise in trust and they are going through a phase we can call “high growth institutional adoption phase”.

This combination of convenience and tax benefit are contributing to the raise of bitcoin investments, and many companies like My Digital Money and BitcoinIRA are now offering crypto to IRA services.

On the other hand, the demands for gold (and precious metals) vs cryptocurrencies are very diverse.

Gold is considered as a safe-haven good to invest on, as it is tangible and investors tend to buy it when economies go down. Gold is a key part of electronics devices, so that when economies go up, the demand for electronic goods rises together with the investments in jewelry.

Cryptocurrencies are seen more like a speculative high-risk high-return form of investment, and being computational data, they are not tangible.

Despite the steps forward, cryptocurrencies are still not considerable as a substitute for gold.

In fact, as gold has multiple uses, its price can be more resilient despite it might however fluctuate overtime.

Cryptos on the contrary can be very unstable, and for this reason they can be considered as less relatable than gold.

This article delves into the fundamental differences between these two assets (Gold and Crypto), exploring their historical significance, investment vehicles, volatility, risk factors, and future prospects.

By the end of this comprehensive guide, you'll have a clearer understanding of how to navigate the investments landscape, whether you're inclined toward the tangible allure of gold or the digital revolution of cryptocurrency.

In fact, both gold and crypto offer unique advantages, but also drawbacks. As we always say, it is important to have a clear, complete vision before proceeding with any investment, and with this article we want to make you aware of all the details before taking the further steps.

The Nature of Gold and Cryptocurrency

Gold: A Tangible Asset

Gold has been revered for centuries, not just for its beauty and its shiny yellow color, but also for its intrinsic value. It's not only a rare precious metal, but it also contains characteristics that make it unique among precious metals themselves.

As a tangible asset, gold is something you can hold in your hand, something you can touch. This feeling, brings a sense of security that digital assets cannot match, being linked to the mere use of informatics.

Historically, gold has been used during the last 5000 years as a form of currency, together with other uses, for example jewelry. Today, gold is also a key component in many industrial applications.

Its scarcity and durability make it an enduring store of value, particularly in times of economic uncertainty like the ones we are living right now.

Gold's role as a safe-haven asset is well-documented. When financial markets are turbulent, investors often flock to gold to protect their wealth and repair it from the storm.

Unlike fiat currencies, which can be devalued by inflation or poor economic policy, gold has a long history of retaining its value over time.

In fact, it does not respond to the same laws of inflation as fiat currencies, but it maintains his inner value. This attribute has made it a cornerstone of portfolios for investors who aim for stability and risk management.

Cryptocurrency: A Digital Revolution

Cryptocurrency, on the other hand, represents a radical shift in how we think about money and value. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous entity known as Satoshi Nakamoto.

The idea behind Bitcoin was to create a decentralized form of digital money that operates independently of any government or financial institution.

Bitcoin's value proposition lies in its scarcity (with a capped supply of 21 million coins) and the security provided by the famous blockchain technology. Blockchain is a decentralized ledger that records all transactions across a network of computers, making it nearly impossible to alter past transactions without the consensus of the network.

Blockchain makes cryptocurrencies transactions safe and fast with no intermediaries or controls.

Unlike gold, cryptocurrency is purely digital and has no physical form. Its value is purely given by the value market. It can offer high earnings opportunities, but also losses are frequent.

Therefore, these characteristics bring both advantages and disadvantages.

On one hand, it allows for seamless global transactions without the need for intermediaries. On the other hand, the lack of tangibility can be a deterrent for those who prefer the security of physical assets.

The Pros and Cons of Gold vs Crypto Investment

Physical Gold

This includes gold bars, coins, and more goods like jewelry. Owning physical precious metals provides the benefit of holding a tangible asset, which can be particularly reassuring in times of storms. The downside is that physical gold requires secure storage, and it may involve additional costs such as insurances to protect from risks.

Gold ETFs

Exchange-traded funds (ETFs) allow investors to gain exposure to gold without the need to own the physical asset. Gold ETFs are traded on stock exchanges and typically track the price of gold. They offer liquidity and convenience but come with management fees.

Gold Mining Stocks

Investing in companies that mine gold is another way to gain exposure to the metal. The performance of gold mining stocks is not solely tied to the price of gold; it also depends on the operational efficiency and profitability of the mining companies. Mine gold can be another important opportunity for investors.

digital assets

Why Choose Gold Over Crypto for Long-Term Security?

3.

Blockchain Stocks: Another way to invest in the cryptocurrency space is by buying shares in companies that are heavily involved in blockchain technology. This includes firms that develop blockchain platforms or those that mine cryptocurrencies.

1.

Direct Purchase: Investors can buy cryptocurrencies directly through exchanges such as Coinbase, Binance, or Kraken. This method involves creating a digital wallet where the purchased coins are stored. The process is straightforward but requires a good understanding of how to secure digital assets as they can be stolen. The security is always a crucial point.

2.

Cryptocurrency ETFs and Funds: Like gold ETFs, cryptocurrency ETFs provide exposure to digital assets without the need to own the actual coins. These funds are relatively new and may offer exposure to a basket of cryptocurrencies or focus solely on Bitcoin.

Gold vs Bitcoin: A Comparative Analysis

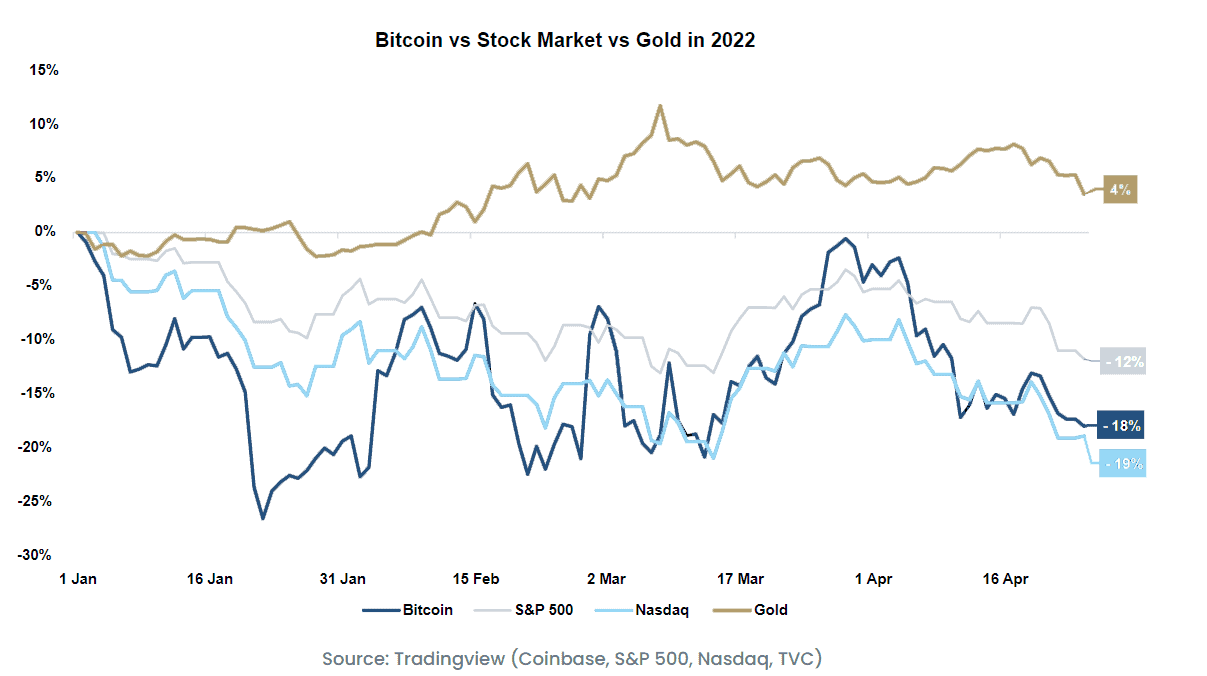

One of the most significant differences between gold and cryptocurrency is their volatility and associated risks involved in owning one of the two. As we said above, they respond to different laws, and they are regulated by two different markets, with gold being generally less fluctuant and unstable.

Gold's Stability

Gold is known for its stability, especially compared to cryptocurrencies. While the price of gold can fluctuate due to factors such as interest rates, inflation, and geopolitical events, these movements are generally more predictable and less extreme than those seen in cryptocurrency markets. Gold is generally a safe asset as its price can fluctuate slightly, but not at the same level of unpredictability as cryptocurrencies.

Historically, gold has acted as a hedge against inflation and currency devaluation for many years. It was used (and still is) in the past as a guaranty and a form of payment among kings and before the end of the gold standard, it was considered as a safe guaranty for nation's economies. During periods of high inflation, gold often retains its value or even appreciates, providing a safeguard for investors' wealth. When economies go down, generally the price of gold increases. This stability makes gold an attractive option for conservative investors looking to preserve capital.

Cryptocurrency's Volatility

Cryptocurrency, particularly Bitcoin, is notorious for its extreme price swings. Since its inception, Bitcoin has experienced several boom-and-bust cycles, with prices soaring to new heights before crashing down. This volatility can be attributed to several factors, including market sentiment, regulatory news, technological developments, and macroeconomic trends. It is difficult to predict, but with its risks are associated also high returns if managed wisely. Problem is, it requires a high level of comprehension, as well as a good dose of luck.

For example, during the 2017 bull run, Bitcoin's price skyrocketed from around $1,000 to nearly $20,000, only to plummet to around $3,000 by the end of 2018. Similar patterns have been observed in subsequent years, making cryptocurrency a high-risk, high-reward investment. It's all about timing and knowledge, and as a consequence, it's a type of investment that is not made for everyone.

While some investors are drawn to the potential for outsized returns, others are wary of the significant risks involved. Cryptocurrencies are still relatively new, and their future is uncertain, even if they are the more and more accepted with time passing by. Regulatory crackdowns, technological vulnerabilities, and competition from other digital assets could all impact the value of cryptocurrencies, making them highly unpredictable.

Gold vs. Bitcoin: the edge against inflation

The ability to hedge against inflation is a critical factor for many investors when choosing between gold and cryptocurrency.

Gold as an Inflation Hedge

Source: Yahoo Finance

Gold has a well-established reputation as an inflation hedge. Throughout history, gold has maintained its purchasing power during periods of high inflation, and still maintains its levels. The graphic above, for example, shows how gold raises its price during the Covid-19 crisis.

As we see, in times of calamities, investors migrate towards tangible goods. This is because gold's value is not tied to any specific currency or government policy. When inflation erodes the value of paper money, gold tends to appreciate as investors seek a more stable store of value.

The relationship between gold and inflation is well-documented. For instance, during the 1970s, a period marked by high inflation, gold prices soared as investors flocked to the metal to protect their wealth. More recently, during times of economic uncertainty, gold has continued to perform well, reinforcing its status as a reliable inflation hedge.

Bitcoin as a Potential Inflation Hedge

Bitcoin is often compared to gold in terms of its potential to hedge against inflation. Proponents argue that Bitcoin's fixed supply of 21 million coins makes it a deflationary asset, as opposed to fiat currencies that can be printed at will by central banks. This scarcity, combined with growing adoption, could position Bitcoin as a digital alternative to gold.

However, there are caveats. Unlike gold, Bitcoin does not have a long track record, and its ability to act as a reliable inflation hedge is still unproven.

Simply, bitcoins are not around since so much time, and this creates a lack of data. While some investors see Bitcoin as a hedge against the devaluation of fiat currencies, others view it as a speculative asset with high volatility, which could undermine its effectiveness as an inflation hedge.

In the short term, Bitcoin has shown some correlation with traditional assets like tech stocks, which questions its role as a safe haven. For instance, during the COVID-19 pandemic, Bitcoin's price initially dropped alongside equities before rebounding later in the year.

This behavior contrasts with gold, which quickly regained value as a safe-haven asset during the same period.

For more information, we advise you to take a look in the World Gold Council website.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.