A Comprehensive Guide for Transferring IRA to Gold

Key Takeaways:

- Understanding Gold IRAs: Learn what a Gold Individual Retirement Account (IRA) is and how it differs from traditional IRAs.

- Benefits of Transferring to a Gold IRA: Explore the advantages, including diversification, inflation protection, and potential tax benefits.

- Step-by-Step Transfer Process: Detailed instructions on how to move your existing retirement funds into a Gold IRA.

- Choosing the Right Custodian: Guidance on selecting a reputable custodian to manage your Gold IRA.

- IRS Regulations and Compliance: Important rules and guidelines to ensure your Gold IRA meets all legal requirements.

If you are you considering diversifying your retirement portfolio, transferring your IRA to gold could be an important opportunity for your personal wealth in order to safeguard your savings.

In our articles, we often talk about the importance of considering the economic environment when it comes to make your investment.

If we take a look at the uncertainties of nowadays’ world economy, the impact of new technologies like AI and the potential new conflicts on several fronts (Europe, Taiwan and others…), it’s becoming crucially important to safely invest a part of your portfolio in concrete and tangible assets.

Therefore, this strategy will help you to protect yourself from any sort of economic uncertainty that might occur during the upcoming years.

This is the reason why we wrote this comprehensive guide, in which we will delve into the advantages of navigating the process of transferring your IRA to gold.

We will explain you in details the process and the mindset you will need to adopt and the details you have to take care of.

At the end of this article, you will discover both the benefits and potential pitfalls of transferring your IRA to gold: from hedging against economic uncertainties to understanding the tax implications involved, everything will be more clear.

We will also give you concrete examples and case studies to add more information to your learning process.

Furthermore, we always advise to you to take a look at the IRS rules. We also strongly recommend checking for a professional financial consultation before proceeding with any investment process.

Comparison of gold IRA companies

When considering a transfer of your IRA to gold, it's essential to compare various gold IRA companies to find the best fit for your investment needs. Start by evaluating their reputations and how long they have been in the industry.

Established companies with a solid track record often provide a level of reliability and expertise that newer entrants may not possess.

Furthermore, look for customer reviews, ratings from independent organizations, and any industry awards that can provide insight into a company's credibility.

Next, examine the fees associated with each gold IRA company. Costs can vary significantly between providers, so it's crucial to understand what you're paying for.

Common fees include account setup, maintenance, storage, and transaction fees. Some companies may offer lower initial fees but charge higher ongoing costs, while others may have a more transparent fee structure.

Lastly, consider the range of products and services offered by each gold IRA company. Some companies may specialize in precious metals, while others might offer a broader range of investment options.

Ensure that the company you choose provides access to high-quality gold products and solid customer support. A company that offers educational resources and guidance can be invaluable as you navigate the complexities of investing in a gold IRA.

Understanding IRA and its investment options

Let’s start with definitions: an Individual Retirement Account (IRA) is a popular investment vehicle designed to provide individuals with Tax advantages for retirement savings.

There are several types of IRAs, including Traditional IRAs, Roth IRAs, and SEP IRAs. Each type has its own set of rules regarding contributions, withdrawals, and tax implications.

To delve into this topic, we also advise you to take a look at this page too: we analyzed in details the various types, so you can have a better view of the different types of IRAs.

However, generally speaking IRAs allow you to invest in a variety of assets, including stocks, bonds, mutual funds, and real estate, enabling individuals to build a diversified portfolio over time.

In fact, the flexibility of IRAs makes them appealing at a first glance, but it's essential for you to understand how each investment option might work at your advantage in the long run.

For instance, while stocks and bonds can provide significant growth potential, they often come with inherent risks tied to market volatility.

They are influenced by market trends, so it all depends on how much risk you would like to accept.

In contrast, tangible assets like gold, silver, platinum or palladium can serve as a hedge against inflation and economic downturns because they are immune to stock market fluctuations.

Moreover, many investors may not be aware that they can include precious metals within their IRAs, specifically through a gold IRA.

As we already said, this specialized account allows individuals to invest in physical gold and other approved precious metals, adding a layer of security and stability to their retirement savings.

As you consider transferring your IRA to gold, it's imperative to grasp the fundamental aspects of IRAs and the various investment options available to take full advantage of this transition.

Benefits of transferring IRA to gold

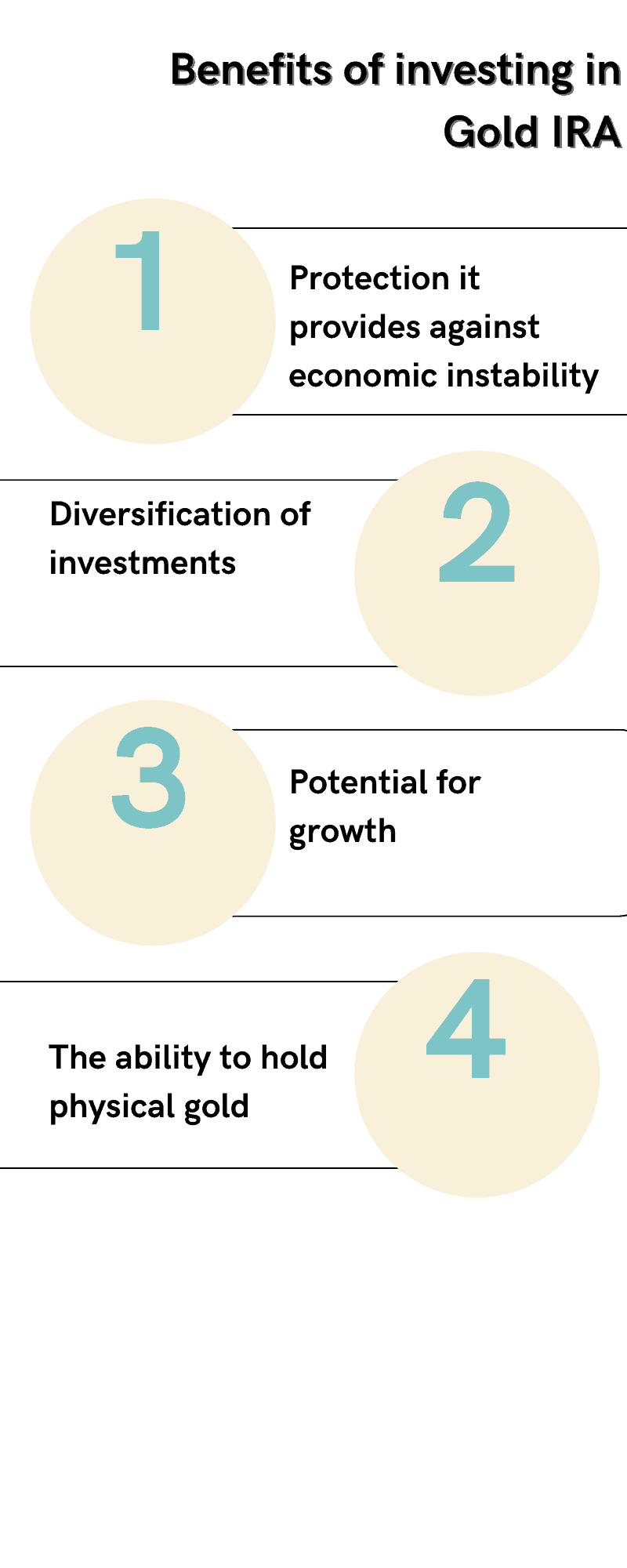

But which are concretely the benefits for you when it comes to Transfer gold (or other precious metals) into your IRA?

Transferring your IRA to gold can offer numerous advantages that may enhance your retirement portfolio. The first one is the protection against inflation.

In fact, Gold has historically maintained its value over time, often appreciating during periods of economic uncertainty.

If you decide to invest in gold, you can insulate your retirement savings from the eroding effects of inflation, ensuring that your purchasing power remains intact as you approach retirement age.

In addition to inflation protection, gold and other precious metals are often viewed as a safe haven during market turbulence. When stock markets experience volatility, investors frequently flock to gold as a means of preserving wealth.

This shift can provide stability to your investment portfolio, making gold a valuable asset in times of financial distress. Its value is proven by centuries of human history, and it will never change. Or at least, it will never change drastically.

By transferring your IRA to gold, you can potentially reduce overall portfolio risk, creating a more resilient financial foundation for your retirement.

A portion of your portfolio invested in Gold can reduce risks and give you the guaranty of a stable asset you can always count on.

Another notable benefit of a gold IRA is the opportunity for diversification. Diversifying your investment portfolio is a key strategy for minimizing risk and enhancing returns.

In fact, Gold and other precious metals typically have a low correlation with traditional asset classes, such as stocks and bonds. The result for you is that by integrating gold into your retirement portfolio, you can achieve a greater level of diversification, which can ultimately lead to improved performance over the long term.

These combined benefits of inflation protection, market stability, and diversification make transferring your IRA to gold an interesting option for many investors.

Risks associated with investing in gold through an IRA

While we have been talking about the numerous benefits to transferring your IRA to gold, it's also essential to acknowledge the risks associated with such an investment.

One significant risk is the potential for price volatility. Although gold is often considered a stable asset, its price can still fluctuate based on various factors, including geopolitical events, changes in interest rates, and shifts in supply and demand.

Investors must be prepared for these fluctuations, as they can impact the value of their gold holdings and, subsequently, their overall retirement portfolio.

Another risk to consider is the lack of income generation. Unlike stocks or bonds that may provide dividends or interest payments, gold does not generate dividends in the short or medium term. It is simply a stable asset, but not a guarantee of dividends.

This concretely means for you that the only way to realize gains from gold investments is through price appreciation. As a result, relying solely on gold for your retirement savings may not be the most effective strategy for generating the income needed in retirement.

It's crucial to strike a balance between gold and other income-generating assets to ensure a sustainable income stream during your retirement years.

This is the reason why we advised you to check for an expert to advise you about which portion of your assets should be precious metals, and which would be the good alternatives to pair these metals with.

Furthermore, in this article, we also talked about the importance of silver as a good option. In this other article, you will find specific insights about the precious metals allowed into an IRA.

Lastly, investing in a gold IRA involves specific regulations and guidelines that must be adhered to, which can present additional challenges.

For example, not all gold products are eligible for inclusion in an IRA, and there are strict rules governing the storage and handling of physical gold (Source: Investopedia).

Moreover, we have to stress about the fact that failing to comply with these regulations can result in penalties and tax consequences.

Thus, it's vital to fully understand these requirements and work with reputable custodians to navigate the complexities of a gold IRA investment effectively.

Steps to transfer your IRA to gold

List of Steps

Step 1

The first step is to assess your current IRA and determine whether it qualifies for a transfer to a gold IRA.

Step 2

Select a reputable gold IRA custodian

Step 3

Fill out the necessary paperwork to initiate the transfer

Transferring your IRA to gold involves a series of steps that require careful planning and execution. The first step is to assess your current IRA and determine whether it qualifies for a transfer to a gold IRA.

Most traditional and Roth IRAs can be converted, but it’s essential to confirm this with your financial advisor or custodian.

As a result, understanding the specifics of your existing IRA will help you to make the best possible choice.

Once you've established that your IRA can be transferred, the next step is to select a reputable gold IRA custodian. This custodian will facilitate the transfer process and ensure compliance with IRS regulations.

Conduct thorough research to find a custodian with a solid reputation, transparent fee structure, and excellent customer service.

As we already said in other articles, we advise you to read carefully reviews and consult with other investors to determine which custodians are the most trustworthy and reliable.

After selecting a custodian, you will need to fill out the necessary paperwork to initiate the transfer. This typically involves completing a transfer request form and providing any required documentation.

Your new custodian will then coordinate with your current IRA provider to facilitate the transfer of funds. Once the funds are transferred, you can begin selecting the gold and other precious metals to include in your new IRA.

Throughout this process, maintaining open communication with your custodian and staying informed about the timeline and requirements will help ensure a smooth transition to your gold IRA.

Choosing a reputable gold IRA custodian

Selecting a reputable gold IRA custodian is one of the most critical steps in the process of transferring your IRA to gold. A custodian acts as the intermediary between you and your investment, managing the buying, selling, and storage of your gold assets.

Therefore, it’s essential to choose a custodian with a proven track record and a strong commitment to client satisfaction. Start by researching various custodians and comparing their services, fees, and reputation within the industry.

When evaluating potential custodians, consider their level of experience and expertise in handling gold IRAs specifically.

Look for custodians who specialize in precious metals and have a deep understanding of the regulations governing these types of accounts.

Additionally, check if they have a solid customer service team that can assist you throughout the process and answer any questions you may have about your investment. Remember that they have to be oriented to the well-being of the client, not theirs. This means that they have a long-therm vision, which guarantees their trustworthiness.

A custodian with a responsive and knowledgeable team can make a significant difference in your overall experience.

Lastly, transparency in fees is crucial when choosing a custodian. Custodians may charge various fees for account setup, storage, transaction, and management services.

Ensure that you fully understand the fee structure before committing to a custodian. Look for custodians who provide clear, upfront information about their fees and avoid those with hidden charges.

We strongly advice you to do not skip this process for any reason, as the choice of the right provider and custodian will be the key to have peace of mind, knowing that your investment is in good hands.

Factors to consider when selecting gold for your IRA

When it comes to selecting gold for your IRA, there are several key factors to consider, ensuring that your investment aligns with your retirement goals.

First and foremost, it’s essential to understand the IRS regulations regarding the types of gold that are eligible for inclusion in an IRA.

The IRS allows specific forms of gold, including bullion coins and bars that meet certain purity standards (typically .9999 or higher). Familiarizing yourself with these standards will help you make informed decisions when selecting gold for your retirement account.

Another important factor to consider is the form of gold you wish to invest in. Investors can choose between gold bullion, coins, and other forms of precious metals.

Bullion bars are typically more cost-effective due to lower premiums over spot price, while coins may offer additional collectible value but can come with higher premiums.

Finally, consider the liquidity of the gold you choose to invest in. Liquidity refers to how easily an asset can be converted into cash without significantly affecting its price.

Generally, larger and more recognized bullion coins and bars tend to be more liquid than lesser-known varieties. Ensuring that your gold investment has a good degree of liquidity can provide you with greater flexibility in the future, should you need to access your funds or make adjustments to your portfolio.

Tax implications of transferring IRA to gold

Understanding the tax implications of transferring your IRA to gold is crucial for making informed investment decisions. Generally, transferring funds from one IRA to another, such as moving from a traditional IRA to a gold IRA, is considered a tax-free event as long as the transfer is executed correctly.

This means that you can shift your assets without incurring immediate tax liabilities, preserving your retirement savings for future growth.

However, it's essential to distinguish between a Direct transfer and a rollover. In a direct transfer, the funds move directly from one custodian to another without you ever taking possession.

This method is straightforward and avoids any tax consequences. On the other hand, a rollover involves you receiving the funds before depositing them into a new IRA, which must be completed within 60 days to avoid taxes and penalties.

Understanding these distinctions will help you navigate the transfer process and minimize potential tax implications.

Furthermore, once your gold IRA is established, it's important to be aware of the tax treatment of distributions. When you withdraw funds from your gold IRA in retirement, those distributions are generally subject to income tax at your ordinary tax rate.

If you withdraw before the age of 59½, you may also incur an additional 10% early withdrawal penalty. Keeping these tax implications in mind as you plan your retirement strategy will help you optimize your financial outcomes and avoid unexpected tax liabilities.

Conclusion and key takeaways

In conclusion, we can say that transferring your IRA to gold should be approached with careful consideration and planning, as it’s an investment you do with your future, knowing that it is quite different from investing in stock market products.

This is the reason why we advise to you to take a look at this Investopedia article to know more. Always keep an eye on the IRS regulations and their updates as you proceed with your choice.