What You Need to Know About IRA Approved Silver Investments

If you're like most American investors, you've probably been wondering how to protect your money from all the uncertainty in today's financial landscape. Not everyone makes the right calls, sometimes it’s due to poor advice, other times it’s a simple miscalculation of risk.

Over the past five years, political instability in the U.S. has shaken investor confidence. That uncertainty often spills over into the markets, pushing people to look for safer, more tangible alternatives. In times like these, many investors turn to physical assets like silver to safeguard their savings.

Markets are volatile, the dollar continues to lose purchasing power, and planning for retirement feels increasingly complex, especially if you’re not fully aware of all the tools available.

That’s why more and more Americans are taking a closer look at silver, particularly when it’s IRA-approved. It’s a way to add both security and potential to a retirement plan.

Silver might not be as mainstream as gold, but that’s part of what makes it so interesting. As we’ve covered in past articles, it has huge potential and remains accessible to a wider range of investors.

But before diving in, it’s important to understand how silver fits into an IRA, what makes it “approved,” and why this kind of investment might make sense over the long term.

That’s exactly what we’ll unpack in this article.

Understanding the Basics of IRAs and Precious Metals

Individual Retirement Accounts (IRAs) are a smart way to grow your savings while taking advantage of tax benefits.

We’ve discussed this topic extensively on our blog, but here we want to focus on how silver fits into your retirement plan, how does it actually work?

As we’ve mentioned, most Americans are familiar with the typical assets you can hold in an IRA, like stocks, bonds, or mutual funds. What fewer people realize is that you can also use a specific type of account, called a Self-directed IRA, to invest in physical assets like silver, gold, platinum, or palladium.

Here’s the key difference: a Traditional or Roth IRA usually limits you to what your brokerage offers. A self-directed IRA, on the other hand, gives you access to a much broader range of investments.

If you're someone who wants more control, or you're worried about inflation, currency devaluation, or market volatility, owning something tangible like silver can be a smart move.

It offers not just diversification, but a sense of stability that many investors are looking for today.

Why is Silver so useful in an IRA ?

Silver, in particular, stands out. Why? Simple.

It’s more affordable than gold, has widespread industrial applications, and has a long track record of holding its value. That makes it especially attractive for investors looking to diversify their retirement savings with something tangible, something that isn’t just a number on a screen.

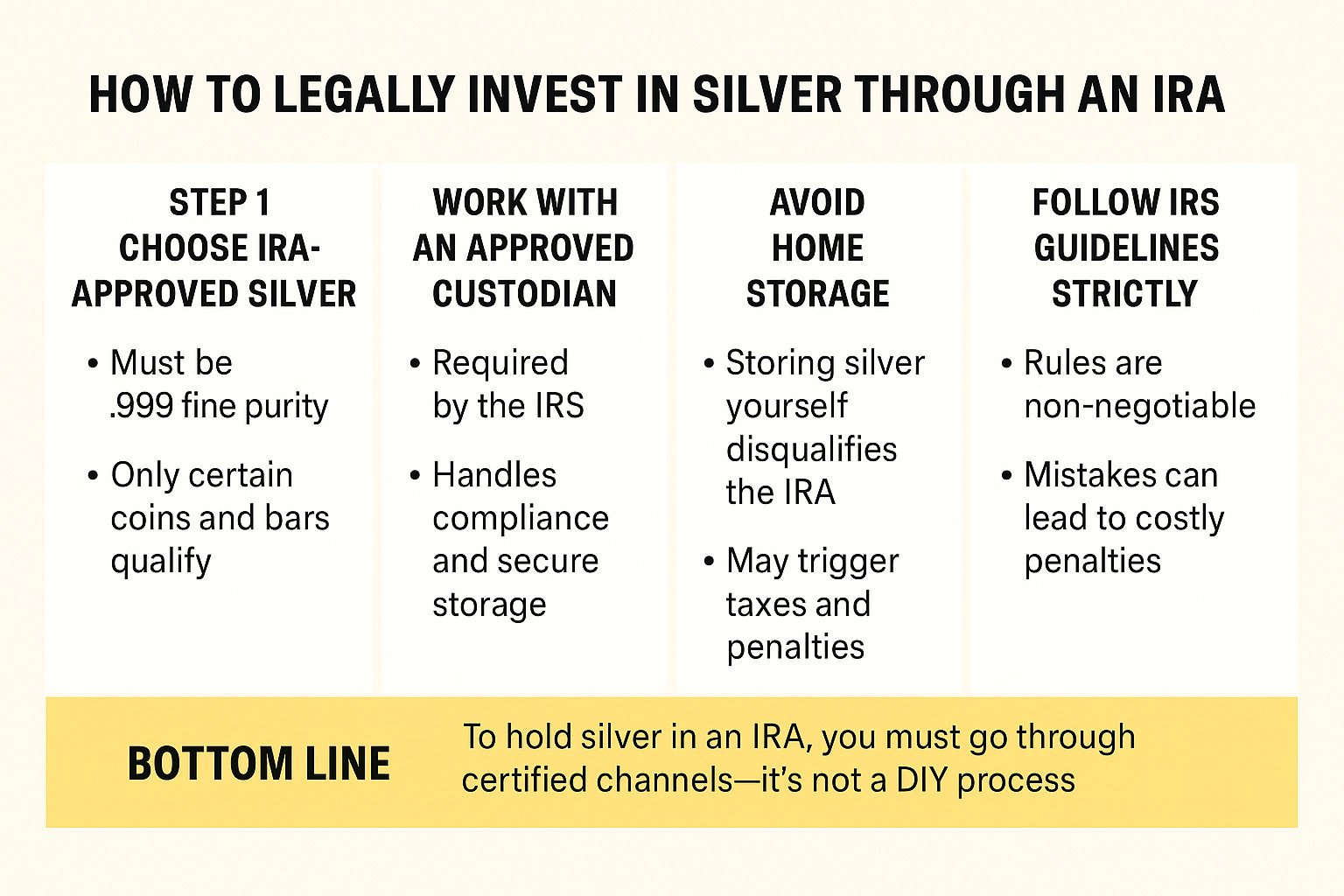

But, and this is important, investing in silver through an IRA isn’t as simple as it might seem. It’s not like walking into a coin shop and locking up a few bars at home. The process involves third parties, and every transaction must follow a specific set of rules.

Most importantly, the IRS has laid out strict guidelines:

- Only certain types of silver are eligible

- Specific purity standards must be met

- You must use an approved custodian to manage storage and regulatory compliance

Because the rules are non-negotiable, you’ll need to work with a trusted third-party company to guide you through the process. Skipping steps or misunderstanding the requirements could lead to penalties, and no one wants to risk that with their retirement savings.

Types of Silver Investments Eligible for IRAs

Not all silver is created equal, at least not according to the IRS.

If you want to include silver in a self-directed IRA, it needs to meet very specific standards.

So, what exactly qualifies as “IRA-approved” silver?

To start, the silver must be at least 99.9% pure, commonly referred to as .999 fine silver. This level of purity qualifies the metal as investment-grade, distinguishing it from collectible or numismatic coins, which are not permitted in IRAs.

When it comes to coins, the IRS favors widely recognized, government-issued bullion. Two of the most popular choices are the American Silver Eagle, minted by the U.S. Mint, and the Canadian Silver Maple Leaf, produced by the Royal Canadian Mint. Both meet the .999 purity requirement, are highly liquid, and are trusted worldwide.

They’re essentially the gold standard of silver coins—only in silver.

Coins aren’t your only option, though.

You can also invest in silver bars, provided they meet the same .999 purity requirement. Bars come in a variety of sizes, from small one-ounce pieces to large 100-ounce blocks, offering flexibility depending on your investment goals and storage preferences.

That said, not just any bar will do. It’s essential to choose bars from well-established, reputable mints to ensure quality and authenticity. Trusted names include Johnson Matthey, Engelhard, and the Perth Mint, among others.

We created this page specifically to help you to understand which products will fit better your purposes.

Most Common IRA-Approved Silver Coins

To help you stay on track, here’s a list of silver bullion coins that meet the IRS standards for IRA inclusion. These coins are widely recognized, have consistent purity, and are typically easier to liquidate when the time comes:

- American Silver Eagle

- Canadian Silver Maple Leaf

- Austrian Silver Vienna Philharmonic

- Australian Silver Koala

- Australian Silver Lunar Series

- Mexican Silver Libertad

- South African Silver Krugerrand

- Silver Morgan Dollar

- Silver Peace Dollar

All of the above coins meet the .999 purity standard and are issued by reputable national mints. When purchasing for your IRA, make sure your custodian confirms the eligibility and source of each item.

Silver IRA Rules

If you’re thinking about holding silver in your IRA, there’s one key rule you need to know upfront:

You can’t store it yourself. The IRS doesn’t allow it, especially if you want to preserve the tax advantages that come with a Traditional or Roth IRA.

To benefit from tax-deferred growth or tax-free withdrawals, your silver must be held by an IRS-approved third-party custodian. In other words, a regulated institution is responsible for both purchasing and securely storing your silver, usually in an approved depository.

This rule applies whether you're investing in silver coins, bullion bars, or even silver-backed ETFs through a self-directed IRA.

So why the strict rules?

Because if you take personal possession of the silver, the IRS treats it as a distribution—which can trigger immediate taxes and potential penalties. Even worse, if you're holding the silver yourself, it may be considered a collectible.

That reclassification could expose your gains to a maximum capital gains tax rate of 28%, instead of the more favorable treatment IRA assets typically receive.

That’s exactly why reputable companies like Augusta Precious Metals and other IRS-compliant custodians exist. They serve as a secure bridge between you and your silver investment, ensuring that every step, from purchase to storage, follows IRS regulations to the letter.

This structure is what turns silver from just another asset into a qualified holding inside your IRA.

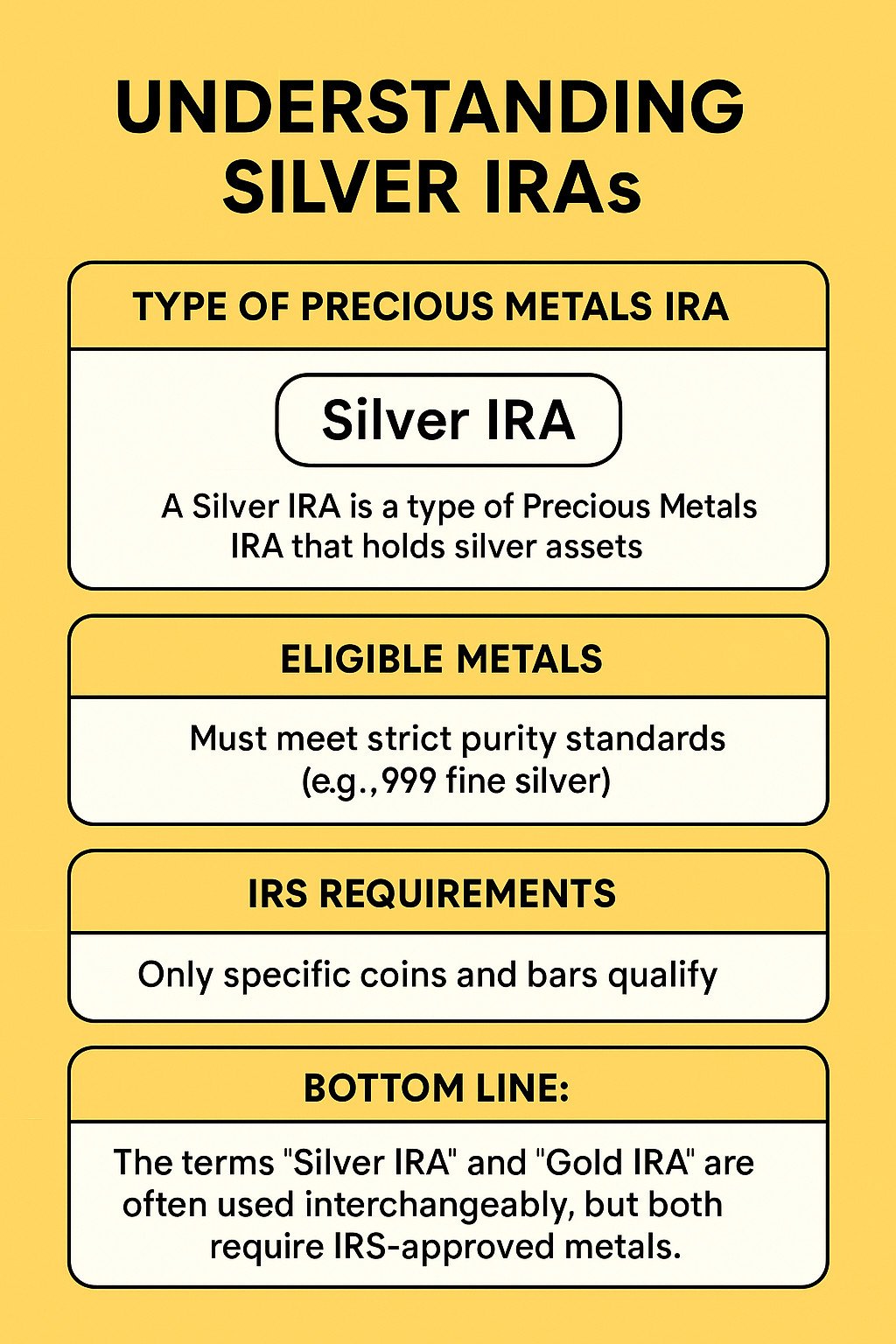

Silver IRA: What Does It Mean?

A Silver IRA is actually a specific type of Precious Metals IRA, a broader category that can also include gold, platinum, or palladium. While terms like “Gold IRA” and “Silver IRA” are often used interchangeably, the core idea remains the same: only certain precious metals products are eligible.

The IRS is very clear on this. Only specific coins and bars that meet strict purity standards, typically .999 fine silver, can be included in an IRA.

Some silver items that are popular with collectors, especially limited-edition or numismatic coins, are not eligible simply because they don’t meet the required purity or lack proper certification.

Now let’s look at how to choose the right company to handle your investment with confidence and compliance.

Silver IRA Rollover Rules: What You Need to Know

If you have a 401(k) or another employer-sponsored retirement plan, here’s some good news: you may be able to roll those funds into a Silver IRA.

This option gives you the flexibility to move your savings from traditional paper-based assets like stocks and bonds into physical silver, allowing you to diversify and strengthen your retirement portfolio with something tangible.

The rollover process is usually more straightforward than most people expect.

Once you receive the funds from your original account, you have 60 days to deposit them into your new Silver IRA. If you miss that deadline, the IRS will treat the transaction as a distribution, which could mean paying income tax—and possibly a 10% early withdrawal penalty if you're under 59½.

Keep in mind that the IRS allows only one tax-free rollover per person per year, so it's important to plan carefully.

If you're rolling over from a 401(k), be sure to check with your employer first. Some plans limit or restrict rollovers into alternative assets like precious metals. While there are often ways to work around those restrictions, it’s best to understand any potential hurdles before you get started.

Silver IRA Transfer Rules: A Simpler, Tax-Friendly Alternative

While rollovers involve moving funds from a 401(k) or similar retirement account, transferring money from one IRA to another, such as from a Traditional or Roth IRA to a Silver IRA, is considered a direct transfer, and the rules are slightly different.

The biggest advantage of a transfer is that the funds never pass through your hands. They move directly from one IRA custodian to another.

That means there’s no need to worry about the 60-day rule, early withdrawal penalties, or triggering a taxable event. This makes transfers a safer and more efficient option for many investors.

Another benefit is that IRA transfers don’t need to be reported on your IRS Form 1040, and there’s no limit to how many transfers you can make in a single year.

If you’re looking to move existing retirement funds into precious metals without added tax complexity, a direct IRA transfer is often the cleanest and most straightforward way to go.

For anyone serious about adding silver to their retirement strategy without unnecessary friction, a direct transfer is usually the smartest place to start.

Conclusion: Why Silver Deserves a Place in Your Portfolio

To wrap things up, silver can be a strong alternative to gold in any well-balanced retirement strategy.

It’s more affordable, widely used in industry, and remains a timeless store of value.

Even if you don’t choose to invest exclusively in silver, allocating a portion of your portfolio to it, alongside gold, platinum, or palladium, can help you build a more resilient and diversified investment mix.

We’ll continue exploring this topic in future articles on our blog, so stay tuned. And if you haven’t already, download our free guide to get a clearer picture of how silver fits into a smart long-term investment plan.

Latest Blog Articles

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.