Subscribe to get our FREE

GOLD IRA GUIDE

Top Crypto IRA Companies in 2024: Secure Your Retirement with Cryptocurrency

What is a Crypto IRA and Why You Should Consider It?

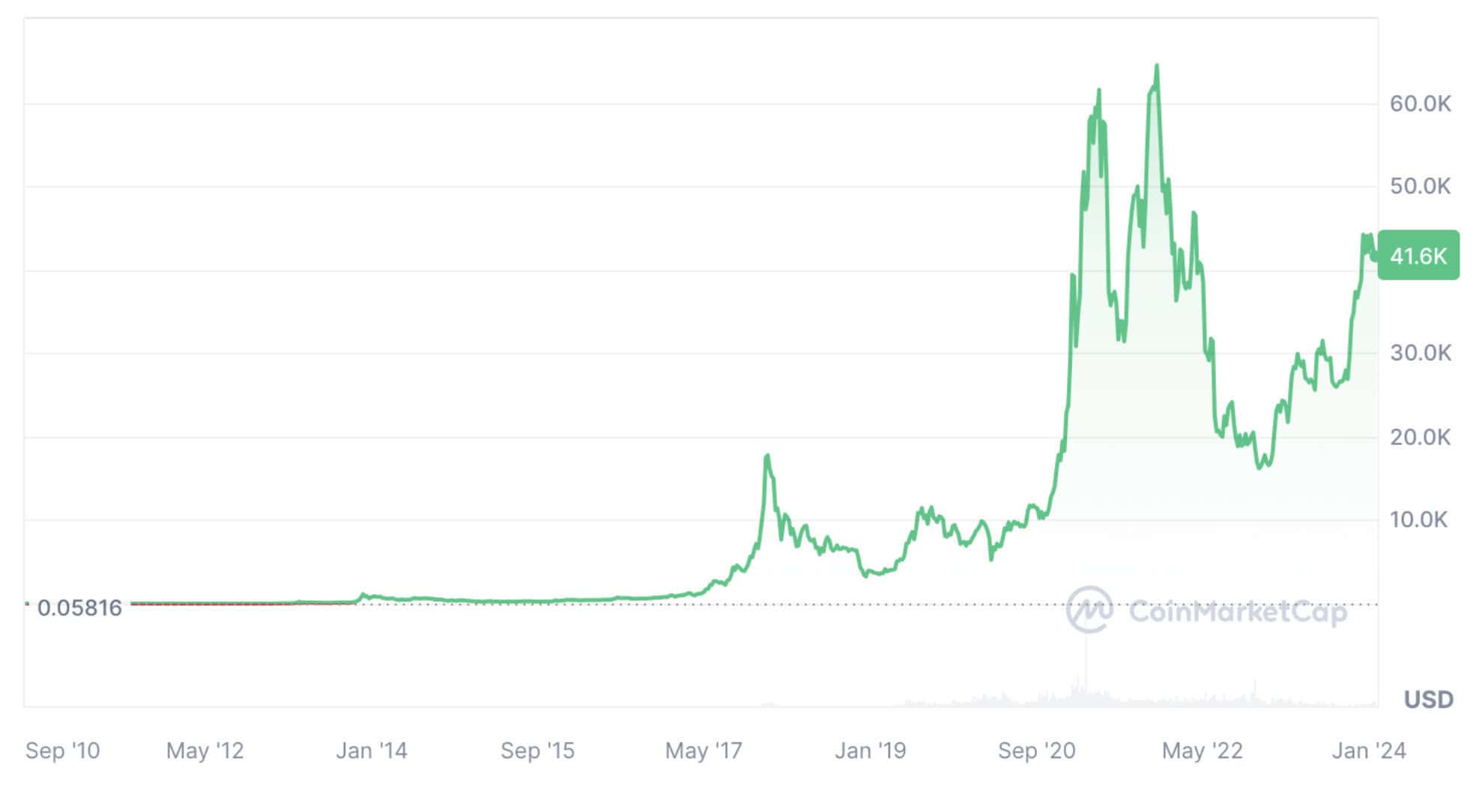

BTC price history, 2011-2024 (Source: CoinMarketCap)

Investing in a crypto IRA is an increasingly popular way to diversify your retirement savings with digital assets. With the growing interest in cryptocurrencies like Bitcoin and Ethereum, many investors are looking to secure their financial future by integrating these assets into their retirement plans. In this guide, we’ll explore the best crypto IRA companies available today and how they can help you build a more robust retirement portfolio.

In recent years, the allure of cryptocurrencies has surged, attracting investors eager to capitalize on the growth potential of digital assets like Bitcoin. While initially regarded with skepticism, the idea of including cryptocurrencies in retirement portfolios is gaining traction. This comprehensive guide will walk you through the intricacies of investing in cryptocurrencies for your IRA or 401(k), including the benefits, risks, and practical steps to get started.

The Evolution of Retirement Investments

Traditionally, retirement accounts like IRAs and 401(k)s have been dominated by stocks, bonds, and mutual funds. However, with the rise of digital currencies, the landscape is shifting. Cryptocurrencies offer a new frontier for diversification and potential growth.

Types of Accounts

401(k)

These are employer-sponsored plans, where contributions are often matched by the employer. Recently, some 401(k) providers like Fidelity have started offering Bitcoin as an investment option. This is a significant step towards mainstream acceptance of cryptocurrencies in retirement planning

IRA

Individual Retirement Accounts come in various forms. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement. For those looking to invest in cryptocurrencies, a Self-Directed IRA (SDIRA) is the best option. SDIRAs allow for a broader range of investments, including digital currencies .

what are the benefits?

Benefits of Investing in a Cryptocurrency IRA

Risks and Challenges

1) Volatility

Cryptocurrencies are notorious for their price volatility. This can be a double-edged sword—while it offers the potential for high returns, it also carries significant risk. For instance, Bitcoin has experienced price swings of over 50% in a matter of months .

2) Regulatory Concerns

The regulatory environment for cryptocurrencies is still evolving. Changes in regulations could impact the value and legality of cryptocurrency investments. It’s crucial to stay informed about regulatory developments and understand how they might affect your retirement investments .

3) Security Risks

The digital nature of cryptocurrencies makes them susceptible to hacking and fraud. Ensuring that your assets are stored securely is paramount. Custodians like Bitcoin IRA and BitIRA offer robust security measures, including cold storage and insurance .

4) High Fees

Crypto IRAs often come with higher fees compared to traditional IRAs. These fees can include setup costs, annual maintenance fees, and transaction fees. It's essential to understand these costs and how they will impact your overall investment.

How to Choose the Best Crypto IRA for Your Retirement

Considering the investment risks associated with cryptocurrencies, it is essential to find the best way to choose the right account. Here are the two most profitable options for this type of investment.

401(k) with Crypto Options

If your employer offers a 401(k) with cryptocurrency options, this can be a straightforward way to include digital assets in your retirement portfolio. Providers like Fidelity now offer Bitcoin as an option, allowing you to allocate a portion of your 401(k) to cryptocurrency .

Self-Directed IRA (SDIRA)

For more control and a broader range of investment options, consider a Self-Directed IRA. SDIRAs allow you to invest in various alternative assets, including cryptocurrencies. You'll need to choose a custodian that specializes in cryptocurrency investments

Funding Your Account

There are several ways to fund your crypto-compatible retirement account:

- Direct Contributions: You can contribute to your account with cash, checks, or direct deposits.

- Transfers: You can transfer funds from an existing retirement account.

- Rollovers: If you have an employer-sponsored plan, you can roll it over into a crypto-compatible IRA .

Choosing a Custodian

Selecting the right custodian is critical. Reputable custodians like Bitcoin IRA, iTrustCapital, and BitIRA facilitate the buying, selling, and secure storage of digital assets. Ensure the custodian you choose has robust security measures and transparent fee structures .

process guide

Practical Tips for Investing

1.

Start Small

Given the high volatility and risk associated with cryptocurrencies, it’s advisable to start with a small percentage of your retirement portfolio. Experts suggest that crypto should not exceed 5-10% of your total retirement investments.

2.

Stay Informed

The cryptocurrency market is fast-paced and constantly evolving. Keeping up-to-date with the latest news, regulatory changes, and market trends is crucial for making informed investment decisions

3.

Secure Your Investments

Ensure that your custodian provides robust security measures, including cold storage and insurance for your digital assets. This can protect your investments from theft and fraud

Case Studies and Real-Life Examples

Fidelity, a leading provider of retirement plans, has introduced Bitcoin as an investment option in its 401(k) plans. This move is seen as a significant step towards the mainstream acceptance of cryptocurrencies in retirement planning. Employers like MicroStrategy have already adopted this option, allowing their employees to allocate a portion of their 401(k) to Bitcoin.

Established in 2016, Bitcoin IRA has become one of the leading providers of cryptocurrency IRAs. The platform offers 24/7 trading, secure cold storage, and substantial insurance coverage. Users can invest in a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. Bitcoin IRA's easy setup and management make it a popular choice for investors looking to diversify their retirement portfolios.

iTrustCapital allows clients to trade in over 30 cryptocurrencies and offers the option to diversify with precious metals like gold and silver. The platform's low fees and secure storage solutions make it an attractive option for investors looking to include cryptocurrencies in their retirement accounts.

The Rise of Cryptocurrency in Retirement Planning

In recent years, cryptocurrencies like Bitcoin and Ethereum have moved from the fringes of finance to the mainstream, attracting attention from both institutional investors and individual savers alike. One area where this shift is particularly noticeable is in retirement planning, where Bitcoin and Ethereum IRAs have emerged as popular options for those looking to diversify their portfolios beyond traditional assets like stocks, bonds, and mutual funds.

With the growing acceptance of cryptocurrencies and their potential for high returns, more investors are considering the inclusion of Bitcoin and Ethereum in their retirement accounts. The appeal of potentially significant growth, coupled with the increasing availability of cryptocurrency-focused IRAs, has led to a surge in interest in these types of investment vehicles.

Why Consider a Bitcoin or Ethereum IRA?

A Bitcoin or Ethereum IRA is a self-directed Individual Retirement Account (IRA) that allows investors to hold cryptocurrencies as part of their retirement portfolio. Unlike traditional IRAs, which are typically limited to stocks, bonds, and other conventional investments, a self-directed IRA offers greater flexibility, enabling investors to include alternative assets such as real estate, precious metals, and, more recently, cryptocurrencies.

Investors are drawn to Bitcoin and Ethereum IRAs for several reasons:

- Diversification: Cryptocurrencies provide an opportunity to diversify a retirement portfolio, reducing dependence on traditional assets and potentially lowering overall risk.

- Growth Potential: The explosive growth of Bitcoin and Ethereum over the past decade has led to significant returns for early investors, making them attractive options for those seeking high-growth opportunities.

- Hedge Against Inflation: As decentralized assets, Bitcoin and Ethereum are often seen as a hedge against inflation and currency devaluation, providing protection in uncertain economic times.

However, investing in cryptocurrencies through an IRA is not without its challenges and risks. The volatile nature of digital assets, regulatory uncertainties, and the complexities of managing a self-directed IRA all require careful consideration.

What Are Bitcoin and Ethereum IRAs?

Understanding Self-Directed IRAs

A Self-Directed IRA (SDIRA) is a type of retirement account that offers greater flexibility and control over the investment options compared to traditional IRAs. While traditional IRAs are typically limited to a predefined selection of assets, such as stocks, bonds, and mutual funds, SDIRAs allow investors to explore a broader range of assets, including real estate, private equity, precious metals, and cryptocurrencies.

SDIRAs are particularly appealing to investors who want to diversify their retirement portfolios and take advantage of alternative investments that are not available through conventional IRAs. The ability to include cryptocurrencies like Bitcoin and Ethereum in an IRA is a relatively recent development, driven by the increasing interest in digital assets and their potential for high returns.

Benefits of Bitcoin and Ethereum IRAs

- Diversification:

- Asset Diversification: Adding Bitcoin and Ethereum to a retirement portfolio provides diversification beyond traditional assets, potentially reducing overall portfolio risk.

- Non-Correlated Assets: Cryptocurrencies often behave differently from traditional financial markets, offering a way to hedge against market volatility.

- Growth Potential:

- High Returns: Bitcoin and Ethereum have historically shown the potential for significant price appreciation, offering the possibility of high returns over the long term.

- Early Adoption Advantage: Investors who include cryptocurrencies in their portfolios now may benefit from being early adopters in a market that continues to grow and evolve.

- Hedge Against Inflation:

- Decentralization: Bitcoin and Ethereum are decentralized, meaning they are not controlled by any government or central bank. This makes them attractive as a hedge against inflation and currency devaluation.

- Limited Supply: Bitcoin, in particular, has a fixed supply of 21 million coins, which adds to its appeal as a store of value.

Potential Risks and Considerations

- Volatility:

- Price Fluctuations: Cryptocurrencies are known for their volatility, with prices capable of significant swings in short periods. This can lead to substantial gains but also to steep losses.

- Market Uncertainty: The relatively young and evolving nature of the cryptocurrency market means that it is subject to greater uncertainty compared to more established markets.

- Regulatory Risks:

- Changing Regulations: The regulatory environment for cryptocurrencies is still developing, with potential changes in laws and regulations that could impact the value and legality of digital assets in IRAs.

- Tax Implications: Cryptocurrency transactions may have complex tax implications, and investors need to be aware of how these assets are taxed within an IRA.

- Complexity of Management:

- Custodial Challenges: Managing a cryptocurrency IRA often requires working with specialized custodians who understand the unique requirements of digital assets.

- Security Concerns: Safeguarding cryptocurrencies involves robust security measures, such as cold storage and private keys, to protect against theft and hacking.

Overview of the Cryptocurrency Market

A Brief History of Bitcoin and Ethereum

01.

Bitcoin:

Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin was the first cryptocurrency and remains the most well-known and widely used. It was designed as a peer-to-peer digital currency that allows for decentralized transactions without the need for intermediaries like banks. Bitcoin's popularity and adoption have grown significantly, making it a leading asset in the cryptocurrency space.

02.

Ethereum:

Introduced in 2015 by Vitalik Buterin, Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). While Bitcoin is primarily a store of value, Ethereum offers a broader range of uses, particularly in the realm of decentralized finance (DeFi). Ethereum's native cryptocurrency, Ether (ETH), is the second-largest by market capitalization.

Current Market Trends

- Institutional Adoption:

- Growing Interest: Increasingly, institutional investors are incorporating Bitcoin and Ethereum into their portfolios, viewing them as legitimate asset classes.

- ETFs and Mutual Funds: The introduction of cryptocurrency ETFs and mutual funds has further legitimized digital assets and made them more accessible to traditional investors.

- Decentralized Finance (DeFi):

- Expansion of DeFi: Ethereum has played a crucial role in the growth of the DeFi sector, where financial services like lending, borrowing, and trading are conducted on decentralized platforms without intermediaries.

- Impact on Traditional Finance: The rise of DeFi has challenged traditional financial systems, offering new opportunities for investors and entrepreneurs.

- Environmental Concerns:

- Energy Consumption: The energy-intensive process of mining Bitcoin has raised environmental concerns, leading to debates about the sustainability of proof-of-work cryptocurrencies.

- Ethereum's Transition to Proof-of-Stake: In response to these concerns, Ethereum is transitioning from a proof-of-work to a proof-of-stake consensus mechanism, which is expected to significantly reduce its energy consumption.

How Bitcoin and Ethereum Perform Compared to Traditional Assets

- Volatility vs. Stability:

- Higher Risk, Higher Reward: Bitcoin and Ethereum are more volatile than traditional assets like stocks and bonds, but they also offer the potential for higher returns.

- Market Cycles: Cryptocurrencies have experienced multiple bull and bear cycles, with prices sometimes moving independently of traditional financial markets.

- Correlation with Traditional Markets:

- Low Correlation: Historically, Bitcoin and Ethereum have shown low correlation with traditional asset classes, making them attractive as diversification tools.

- Changing Dynamics: As institutional adoption increases, cryptocurrencies may become more correlated with traditional markets, affecting their diversification benefits.

Regulatory Landscape

- Global Regulations:

- Varying Approaches: Different countries have taken varied approaches to regulating cryptocurrencies, ranging from outright bans to full legal acceptance.

- Impact on IRAs: Regulatory changes can impact the use of cryptocurrencies in IRAs, with potential implications for taxation, custody, and legality.

- Future Outlook:

- Evolving Frameworks: As the cryptocurrency market matures, regulatory frameworks are expected to become more defined, providing greater clarity for investors.

- Potential Challenges: Ongoing debates around topics such as privacy, security, and the role of central banks may shape the future of cryptocurrency regulation.

Final Thoughts

As the world continues to evolve and the digital economy expands, the roles of traditional assets like Gold and Silver are being reexamined in light of new technologies. Bitcoin and Ether have emerged as potential digital counterparts to these precious metals, offering new opportunities for wealth preservation and growth in an increasingly interconnected world.

Bitcoin, with its fixed supply and decentralized network, shares many characteristics with Gold, making it a potential store of value in the digital age. Ether, with its utility within the Ethereum network, offers a different type of value proposition, one that extends beyond mere speculation to the very infrastructure of the future internet.

However, while these digital assets offer exciting possibilities, they also come with risks, particularly due to their volatility and the still-developing regulatory environment. As such, investors should approach Bitcoin and Ether with careful consideration, understanding that while they may offer the potential for high returns, they also carry significant risks.

In conclusion, while Bitcoin and Ether may not entirely replace Gold and Silver, they certainly offer compelling alternatives and additions to a diversified portfolio, particularly for those looking to embrace the future of digital finance.

For more information, we advise you to have a look at the IRS website.

FAQ

Consider your investment goals, level of experience, and the features you need, such as low fees, a wide range of cryptocurrencies, or user-friendly platforms. Our reviews provide detailed comparisons to help you make an informed choice.

The companies listed are known for their strong security measures, such as two-factor authentication and cold storage, along with regulatory compliance. However, always conduct your own research and be aware of the inherent risks in cryptocurrency investing.

Fees vary by company, typically covering trading, withdrawals, and deposits. Most of these companies offer mobile apps, enabling you to manage your investments and trade on the go.

Yes, many platforms are beginner-friendly with educational resources and intuitive interfaces. If you encounter any issues, most companies provide customer support through email, live chat, or phone.

Copyright 2025 Bestgoldmoney.com, all rights reserved.

Get in touch: info@bestgoldmoney.com

Affiliate & Financial Disclaimer:

Best Gold Money takes part in affiliate marketing programs, meaning we may earn commissions on qualifying purchases made through links on our site, at no extra cost to you. These commissions help us provide quality content and maintain the website.

All information provided is for educational purposes only and should not be considered professional financial advice. We recommend consulting a licensed financial advisor before making any investment decisions. Best Gold Money is not responsible for any financial actions taken based on the information provided.

Our content is based on trusted sources such as the IRS, SEC, FINRA, Investopedia, and leading financial publications.

Thank you for your trust and support.