Subscribe to get our FREE

GOLD IRA GUIDE

What is a Gold IRA? Everything You Need to Know

A Gold IRA, or Individual Retirement Account, is a self-directed retirement account that allows investors to hold physical gold and other precious metals as part of their retirement portfolio. Many investors are asking, "What is a Gold IRA?" because it offers unique advantages compared to traditional IRAs.

Unlike standard IRAs, which typically include stocks, bonds, or mutual funds, this type of account focuses on tangible assets like gold bars, coins, and bullion, providing a hedge against inflation and market volatility. Nowadays, there are many companies that are offering this service in the USA, and it might be overwhelming for investors to get to conclusions and start to invest while being aware of the possible risks.

In this comprehensive guide, we’ll answer the question, "What is a Gold IRA?" in detail. You’ll learn how it works, what types of precious metals can be included, the potential benefits and risks, and how to open one.

A Gold IRA is a unique form of individual retirement account (IRA) that allows investors to hold physical gold and other precious metals as part of their retirement portfolio. Precious Metals to IRAs can be considered as a safe investment: unlike standard IRAs that may include mutual funds, stocks, and bonds and other financial not-tangible products, these types of accounts are self-directed, enabling the account holder to include tangible assets, like precious metals bars, coins and other related products.

Consequently, we will also analyze in detail which are The best Gold IRA companies in the USA market and why you should, or should not, invest with one of them.

Furthermore, a Gold IRA rollover is another important process we will discuss in another article.

This process offers great advantages, as Gold IRAs offer the same tax convenience as other IRAs, whether they are Roth IRAs, which allow for tax-free withdrawals, or Traditional IRAs, where contributions grow tax-deferred.

To be classified as a Gold IRA, the account must invest a portion of its funds in physical gold, making it a truly diversified retirement option for those interested in Gold IRAs.

These accounts are not limited to just gold. They can also include other precious metals like Silver, Platinum, Palladium and other various alternative assets such as cryptocurrencies or annuities, together with traditional investments like stocks and bonds. The strategic key point of this type of account is the diversification of the investments so that you can be protected from risks on one side, while collecting dividends from the other one.

It's however important to say that Gold IRAs need to be managed by accredited custodians specialized in self-directed retirement accounts.

In fact, they are not typically available through standard brokerage services. Their service is very specific. Here you can take a look at the article we made about the precious metals to IRA rollover process, we are sure it may be beneficial and explaining for you.

Considering the previous reasons, many investors consider Gold IRAs a prudent choice for diversifying their retirement savings, protecting against market volatility and global crises while preserving wealth.

However, potential investors should be aware of the inherent risks and costs associated with gold or precious metals investments.

For this reason, we also strongly recommend you to take a look at the IRS Guidelines for Gold IRAs so that you can have more elements to calibrate your investments.

Down you can find a short comparison of the most important companies offering this service, so that you can have a clearer idea before proceeding.

Understanding How a Gold IRA Works

Some historical data

With the passage of the Taxpayer Relief Act of 1997, American investors earned the ability to include physical gold and other precious metals in their self-directed IRAs individually.

This legislation allowed SIMPLE IRAs, SEPs, and traditional IRAs to incorporate precious metals investments managed by third-party specialized custodians.

This was an historical opportunity, both for investors and companies, as it created a new market and it gave an incredible advantage to investors, as they could finally diversify their portfolios and invest in tangible goods with a more simplified process.

Despite this opportunity, some investors still remain cautious about the option of allocating funds to gold and other precious metals, due to the limited contribution space within IRAs.

To assess whether incorporating gold into retirement portfolios is beneficial, here you can find analysis of historical data and a specific study that we decided to report into this article.

The 3 types of portfolios when opening an investment account.

When investing in a Gold IRA, it's essential to understand the different portfolio strategies that can help diversify your retirement assets. Here are the three primary types of portfolios to consider:

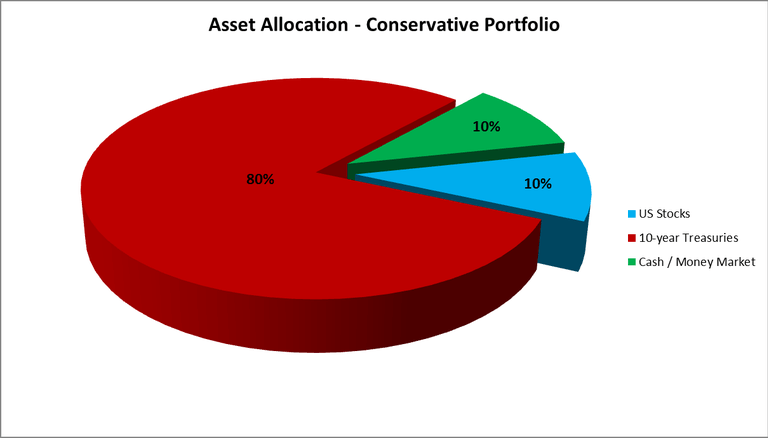

- Conservative Portfolio

- This portfolio focuses on preserving capital and minimizing risk. It typically includes a higher percentage of traditional assets like bonds, cash, and a smaller portion of gold (around 10-15%).

- Ideal for investors nearing retirement who want to protect their wealth against market volatility.

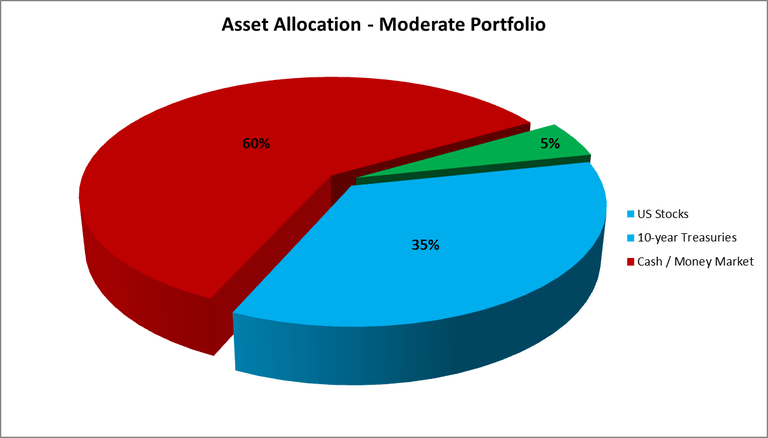

- Balanced Portfolio

- A balanced portfolio aims to achieve steady growth while managing risk. It combines an equal mix of traditional assets (stocks, bonds) and gold, with gold making up about 20-30% of the total portfolio.

- This strategy is suitable for investors who want to enjoy growth potential while maintaining a level of security.

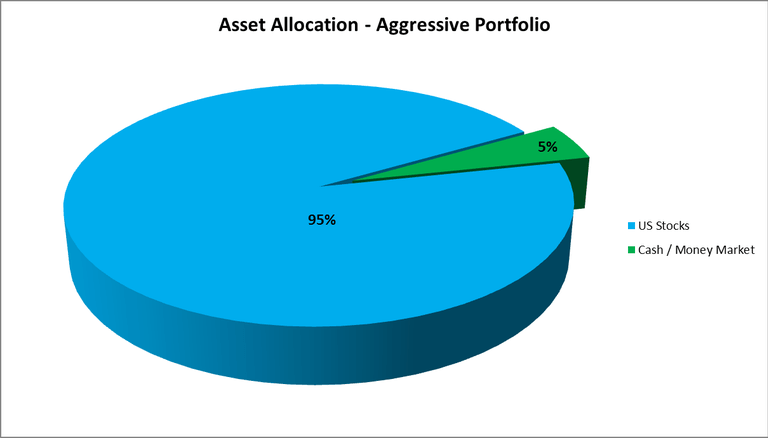

- Aggressive Portfolio

- An aggressive portfolio is designed for investors with a higher risk tolerance, focusing on maximizing returns. In this strategy, gold can make up 40% or more of the total portfolio, with the remaining assets invested in stocks, real estate, or alternative investments.

- Ideal for younger investors or those looking to capitalize on gold’s potential growth over the long term.

Choosing the right portfolio type depends on your financial goals, investment horizon, and risk tolerance. It's always wise to consult a financial advisor to tailor your portfolio to your specific needs.

Analyzing Gold Allocations (1972-2015)

To determine if gold enhances IRA performance, an independent study was conducted, evaluating the impact of gold holdings on retirement accounts using historical market data from 1972 to 2015. Each investor has personal projection to accepting risks and investing as a consequence.

Some investors can be more conservative, some of them more aggressive. Here we decided to examine 3 times of portfolios: conservative, moderate and aggressive.

Three baseline IRA portfolios were examined:

- Conservative Portfolio: 10% in U.S. stocks

- Balanced Portfolio: 35% in U.S. stocks

- Aggressive Portfolio: 95% in U.S. stocks

Each portfolio contained the same stock selections, differing only in the proportion of stocks held. The analysis used actual market data from the following benchmarks:

- Vanguard Total Market Index Fund (VTSMX), 1993-2015

- CRSP Market Decile 1-10, 1972-1992

- Vanguard Intermediate-Term Treasury Fund (VFITX), 1992-2015

- Treasury Bills Risk-Free Return Benchmark, 1972-2015

The moderate portfolio was composed of 35% American stocks, 60% 10-year U.S. Treasuries, and 5% in money market funds and cash. The conservative and aggressive portfolios had a more aggregated assets allocation: the aggressive tends to allocate the 95% in stocks, and the conservative tends to allocate the 80% in treasuries and the rest of 20% in cash and stocks.

Figure 1: Performance with Gold Allocation

Results of the Study

From 1972 to 2015, the average annual growth rate for the moderate portfolio was 8.53%. Starting with an initial investment of $1,000,000, this portfolio would grow to $36,713,972 over the 43-year period.

This impressive return is further enhanced when gold or precious metals are included in the portfolio.

Incorporating gold and precious metals into IRA portfolios can significantly boost long-term growth. Even for conservative investors can benefit from allocating a small portion of their assets in precious metals. This strategy not only helps hedge against market volatility but also preserves and creates wealth over time.

By integrating gold into your retirement portfolio, you can potentially achieve higher returns and greater financial security. However, potential investors should consider the associated risks and consult with financial advisors to tailor their investment strategy accordingly.

We will see the risks associated with this type of investment immediately down below. It must also be considered that this type of investment is only for the long therm.

If you are searching for a type of investment that gives you dividends in the short therm, you should think about investing in stock market products instead.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA can be advantageous for some, but not ideal for everyone. It's a peculiar form of investment that does not create immediate return and dividends, but it is mostly used to protect investors in the long run, while however generating wealth overtime.

Here’s a balanced look at the pros and cons of precious metals to IRAs, with a focus on gold IRAs.

Pros

Cons

Are Gold IRAs Suitable for Me?

While investment professionals typically recommend allocating a portion of a portfolio to gold as a hedge against inflation and for diversification purposes, some gold IRA companies allow clients to convert 100% of their existing IRA into precious metals.

Given the less regulated nature of the physical precious metals market, consulting a fee-based financial advisor could be a wise decision.

Steps to Open a Gold IRA

Investors looking to open a gold IRA should be aware that this process is more complex due to numerous rules and regulations established by the IRS. Despite the added complexity, gold IRAs provide several benefits that many investors find appealing.

Here are the steps involved in opening a gold IRA:

1) Choose a Gold IRA Custodian:

To open a gold IRA, you must select an IRS-approved custodian. The custodian will help set up your account and complete the necessary paperwork to establish the IRA. Most gold IRA custodians manage and drive the customer through the entire process, including facilitating the purchase of gold and arranging for its shipment to a depository for storage.

However, investors often have the option to choose their own gold dealer and storage facility, provided these entities are IRS-approved. It’s crucial for investors to research and select companies whose terms and processes match their expectations and investment style.

2) Fund Your Gold IRA:

After setting up the gold IRA, you need to fund the account. You can do this by wiring funds, mailing a check, or rolling over an existing IRA or 401(k) into the new account.

It’s important to remember that gold IRAs are subject to the same contribution limits as traditional and Roth IRAs set by the IRS. For instance, the contribution limit for gold IRAs in 2024 is $7,000, or $8,000 for investors over 50 years old.

3) Select a Depository

You must choose a depository where your gold investments will be securely stored. Many custodians partner with specific depositories to simplify this process, but they may also recommend a depository.

However, you are free to choose any IRS-approved depository. Note that you cannot hold the physical gold yourself or combine it with other IRA accounts invested in stocks, bonds, or mutual funds.

4) Purchase Gold:

Once the funds are available in your gold IRA account, instruct the custodian to buy gold on your behalf. You need to purchase from a dealer that sells IRS-approved gold, with Gold coins and bars being the most common choices. After the custodian places the order and sends payment to the dealer, the gold is shipped to the depository, where it is securely stored and recorded for tax purposes.

What Is the Difference Between a Gold IRA and a Traditional IRA?

To understand the differences between gold IRAs and traditional IRAs, it helps to first look at their similarities. They present some common elements, so let's deep dive into this.

Both types of IRAs share common tax-related features. First, you can contribute to either a gold IRA or a traditional IRA regardless of your income level, as there is no income cap or phaseout range for eligibility.

Contributions to both types of IRAs are made with pre-tax money, meaning the amount you contribute is deducted from your taxable income, providing you with a tax deduction.

Additionally, funds within both types of IRAs grow tax-deferred, meaning the earnings are not subject to annual taxation.

Another similarity, also related to tax rules, is that both gold IRAs and traditional IRAs are available in Roth formats. You can set up a gold IRA with after-tax contributions.

While this method does not offer an immediate tax deduction, it allows you to withdraw contributions at any time without incurring taxes or penalties. Moreover, qualified earnings can also be withdrawn tax-free.

Gold IRA Storage Options

When it comes to storing the wealth in your precious metals IRA, the IRS ensures security by allowing only specific pre-approved facilities to handle such valuable assets. Let’s explore the storage options you can have when investing in precious metals to IRA and the important factors to consider. Always keep in mind, depositories have to be managed by qualified personnel, so please make your careful research before proceeding.

IRS-Approved Precious Metals Depositories in the U.S.

In the United States, there are six main depositories approved by the IRS to hold precious metals for IRAs:

- Delaware Depository

- Brinks Security

- HSBC Bank USA

- JPMorgan Chase Bank North America

- Scotia Mocatta

These depositories offer a secure way to store your gold, silver, platinum, and palladium. Some also provide international storage options in key global trading hubs like London, Singapore, Dubai, Zurich, Toronto, and Hong Kong.

Offshore Storage vs. Local Storage

Many gold IRA companies now offer additional offshore storage options. Offshore storage means your assets are held outside the U.S territory. This option can offer an additional level of security, but sometimes it comes with additional costs. Common locations for offshore storage include:

- Brinks Security (London)

- HSBC (London, Zurich, Singapore, Hong Kong)

- JPMorgan Chase (London, Singapore)

- Scotia Mocatta (Toronto)

Choosing offshore storage can be a beneficial option, as it provides additional protection against political and economic instability. Historical events, such as the U.S. government's gold confiscation in the 1930s, highlight the potential risks of keeping all assets domestically.

Co-mingled vs. Segregated Storage

Co-mingled Storage: in this setup, your precious metals are stored together with those of other clients. It’s a cost-effective option that has an overall impact on the final costs, but doesn’t provide individual allocation.

Segregated Storage: your metals are stored separately from others, ensuring individual inventory and a fully personalized allocation. This option is more secure, but typically comes with higher fees. In this case, the higher fees are justified by the peace of mind that comes with storing your metals only in your designed space, without sharing with anyone else.

When opting for storage, always ask for segregated storage to ensure your assets are individually accounted for.

This way, they remain protected even if the depository faces financial issues.

Home Storage: Not possible.

One of the common questions is : Can precious metals be hold at home ? The answer is no. Storing IRA metals at home is illegal, despite some fraudulent schemes may suggest otherwise, so keep an eye open. The IRS requires that only approved and certified financial institutions act as custodians for IRAs. These institutions must meet strict and precise criteria, including fiduciary experience and financial responsibility.

What Metals Can You Store?

Not all metals are eligible for IRA investment. The IRS has set specific purity standards for metals to be approved into IRAs:

- Gold: 0.995 or higher

- Silver: 0.999 or higher

- Platinum: 0.9995 or higher

- Palladium: 0.9995 or higher

Collectors' coins or rare metals generally do not meet these requirements and are not allowed in IRAs. You can read more about this subject in this article. By understanding your storage options and the regulations, you can make informed decisions to secure your gold IRA investments. Always follow IRS guidelines to avoid penalties and ensure the safety of your assets.

Gold IRA Rules and Regulations

The IRS has established strict rules for gold IRAs to ensure compliance and security. Here’s a simplified overview of these regulations:

Account Administrator Rules

To set up a gold IRA, you must use an IRS-approved administrator. It’s important to note that you cannot buy gold or other precious metals with your IRA funds personally, as it is forbidden. Instead, your IRA administrator will take care of all the transactions on your behalf: from purchasing to shipping, while insuring the precious metals in your account.

Storage Rules

You are not allowed to keep IRA-included coins or precious metals in your possession. If you do, the IRS will consider these metals as distributed and will impose penalties and taxes. Your custodian will store your metals in an IRS-approved third-party depository. You can request segregated storage for added security, even if this may incur in higher fees.

Tax Regulations and Contribution Limits

The annual contribution limit for self-directed IRAs in 2024 is $7,000, increasing to $8,000 for those aged 50 and above. If you withdraw from your IRA before age 59½, you’ll face income tax and a 10% penalty on the value of the metals withdrawn. Additionally, a 28% capital gains tax applies to any profits from the original cost basis.

Retirement Age Limits

You can’t access your gold IRA funds without a penalty until you reach age 59½. By age 70, you must begin taking regular distributions from your account.

Early Withdrawal Penalties and Exceptions

The IRS imposes a 10% penalty for early withdrawals but provides exceptions for specific circumstances, such as permanent disability, significant medical expenses, death, unemployment, education costs, and first-time home purchases.

Learn more about Gold IRA regulations on IRS official website.

Is a Gold IRA Right for You?

In this article, we explained to you in details why you should invest in Gold (or other precious metals) to IRA and which are the main rules. You can also take a look at this article we also wrote, to have a better insight about the pros and the cons of this type of investment.

Generally speaking, investing in a Gold IRA is a fantastic option to create wealth overtime, grow and diversify your portfolio while maintaining it far from risks.

Consequently, it can be seen as a good option to keep safe and secure a part of your asset. On the other hand, we must advise being careful before investing with Precious Metals to IRA companies. There might be inner costs and charges. It is also important to say that gold does not create dividends and that its price can fluctuate with the market as well, even if generally less than stock markets. For this reason, we highly recommend you to seek advice from an investments' consultant before proceeding.

FAQ

A Gold IRA is a self-directed individual retirement account allowing investments in physical gold and other precious metals. It offers the same tax benefits as standard IRAs but requires an IRS-approved custodian to manage the assets.

Benefits include diversification, protection against market volatility, tax advantages, and potential for long-term growth.

Eligible metals include gold (0.995 purity), silver (0.999), platinum (0.9995), and palladium (0.9995).

- Open a self-directed IRA with an IRS-approved custodian.

- Choose a reputable precious metal's dealer.

- Fund the account through contributions, transfers, or rollovers.

- Purchase IRS-approved metals to be stored in an approved depository.

You can choose between co-mingled or segregated storage in IRS-approved facilities. Offshore storage is also available.

Costs include setup fees, storage fees, and custodial fees. These can impact overall returns.

Risks include higher fees, storage limitations, counterparty risks, and opportunity costs compared to other asset classes.

Gold IRAs must comply with IRS rules regarding custodians, storage, tax regulations, and contribution limits. Early withdrawals may incur penalties.

A rollover involves moving funds from one retirement account to another within 60 days, while a transfer directly moves funds between custodians without penalties or taxes.

Consider factors such as reputation, storage options, years in business, and compliance with IRS regulations.