Subscribe to get our FREE

GOLD IRA GUIDE

Please note that our content is for informational purposes only and should not be considered financial advice. Consult your financial advisor for personalized guidance. We may receive compensation from the companies featured in our reviews.

Precious Metals IRA Investment: An In-Depth Analysis

Investing in a precious metals IRA has been a popular strategy for those looking to diversify their retirement portfolios.

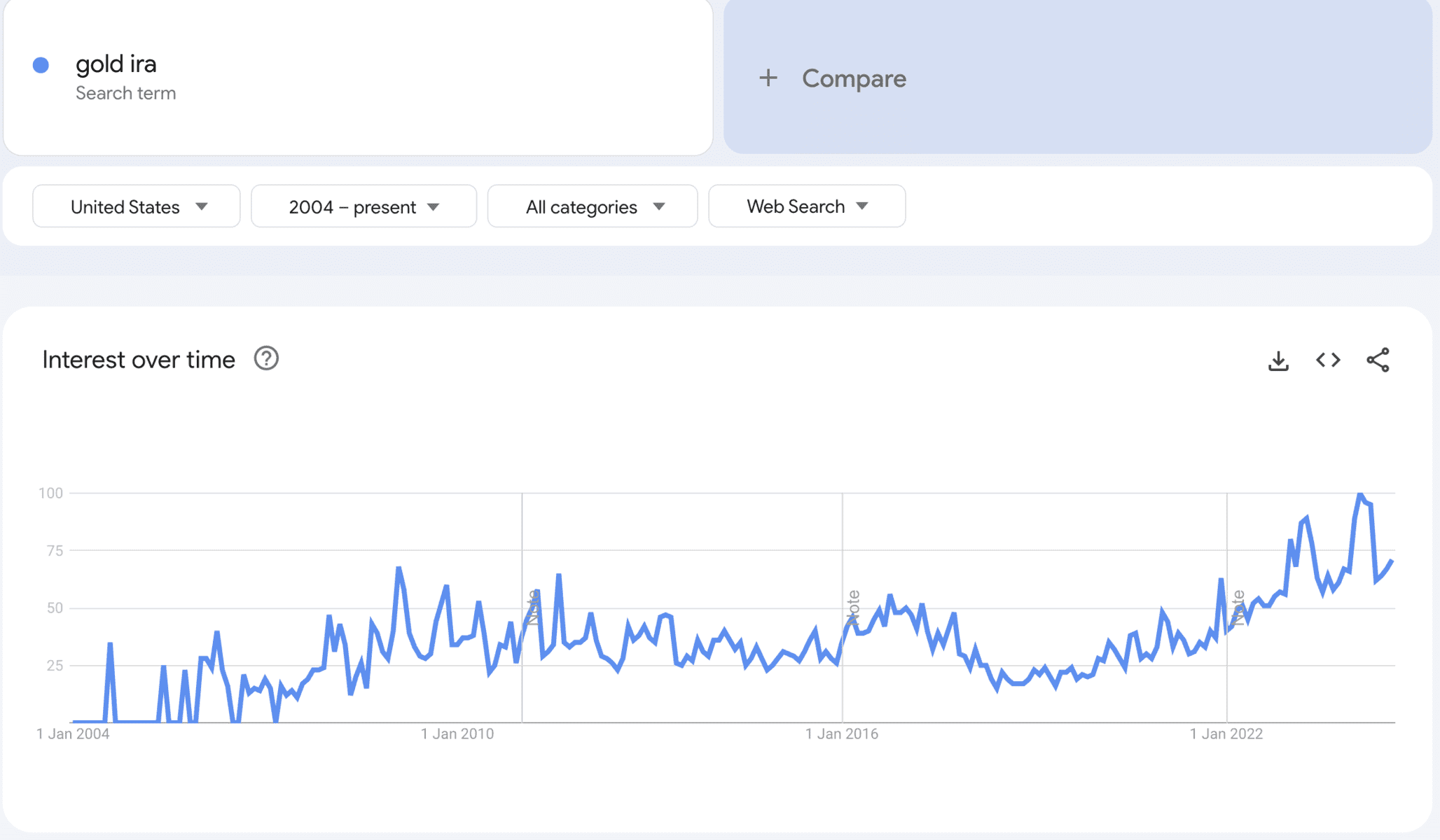

In the past ten years, the Gold IRA industry has experienced a significant growth caused by the uncertainties of the stock market and the global economic fluctuations.

Driven by economic uncertainty and market volatility, investors started to manifest the strong desire to protecting their retirement savings from inflation and geopolitical risks.

In this article we will explore the factors behind this surge, we will examine key trends, and we will provide insights into what the future may hold for this ever-expanding and now popular sector.

Why Consider a Precious Metals IRA Investment?

The popularity of Gold IRAs can be attributed to a combination of different factors that have made physical gold an attractive option for retirement portfolios. Precious metals like Gold and Silver have always been used in every period of history for exchanges.

The graphic above shows the growth of the search therm on Google during the last 20 years.

Especially during economic downturns, precious metals have shown an overall stability in prices and values, unlike other paper assets in the stock markets.

Consequently, when global economic crises manifest like in the 2008, precious metals raise in value considering the investor's aversion to risks. Unlike traditional IRAs, which are typically composed of paper assets such as stocks and bonds, Gold IRAs allow investors to hold physical gold, silver, platinum, or palladium within their retirement accounts, allowing them to diversify their portfolios.

But why exactly this diversification is appealing to investors, and which are the reasons ?

Let's explore them together:

- Economic Uncertainty: The last decade has seen significant economic disruptions, from the 2008 financial crisis lingering into the early 2010s, to more recent issues such as global trade tensions, the COVID-19 pandemic and the wars in Ukraine and Middle East. These events have driven investors to seek out stable, tangible assets like gold, which historically retains its value during times of crisis, in order to avoid risks provoked by the economic downturns.

- Inflation Concerns: As central banks around the world have engaged in quantitative easing and other monetary policies to stimulate their economies, fears of inflation have grown. Despite the last data from Biden's administration show a certain stability in inflation rates (2024), Gold is still viewed as a hedge against inflation, making it a popular choice for those looking to preserve their purchasing power over time. Thus, we can't preview the next presidential election in 2024, so it's rational to say that a good part of investors tend to take conservative and more asset-oriented choices.

- Market Volatility: Stock market volatility has also played a role in the rise of Gold IRAs. With the equity markets experiencing sharp fluctuations, many investors have turned to gold as a way to mitigate risk, protect and differentiate their portfolios. Most of them use an approach tailored on the % of risks they would allow themselves to take in their portfolios, example: 60% stocks, 20% precious metals, 20% real estate etc… This approach maintains a certain amount of security in case of economic calamities.

- Geopolitical Risks: The past decade has been marked by significant geopolitical tensions, from conflicts in the Middle East to the rising influence of China. The battle for the economical supremacy between the USA and China, is pushing certain investors to adopt a more conservative approach to the investment risks. These factors have contributed to a sense of instability in global markets, prompting investors to seek refuge in gold and other precious metals.

Overview of the Taxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 (TRA97), signed into law by President Bill Clinton on August 5, 1997, introduced significant changes to the U.S. tax code, aimed at reducing the tax burden on individuals and families, while also encouraging economic growth and expanding investment opportunities.

This act marks a very important change in the USA internal market, as it allows citizens to diversify their risks and allow them to have access to precious metals' stocks in private form. It also gives an increasing sense of freedom and relief to investors. Let's see which are the most important changes this act introduced in the USA:

- Lowered Capital Gains Tax: The Act reduced the maximum long-term capital gains tax rate from 28% to 20% for assets held for more than a year, incentivizing long-term investments.

- Introduction of Roth IRAs: Roth IRAs were established, allowing for tax-free growth and qualified individual withdrawals, becoming a popular option for retirement savings alongside traditional IRAs.

- Enhanced Education Savings: The Act introduced Education IRAs (now Coverdell ESAs), and provided tax credits for higher education expenses through the Hope Scholarship and Lifetime Learning Credits. This had a major impact on families having to finance college studies to their children.

- Child Tax Credit: A new Child Tax Credit, initially set at $400 per child under 17, was introduced, providing financial relief to families.

- Precious Metals in IRAs: Importantly for investors, and for us since this is the core of our article: the Act permitted the inclusion of certain precious metals, such as gold, silver, platinum, and palladium, in individual retirement accounts (IRAs). This change allowed for greater diversification of retirement portfolios, offering an additional hedge against market volatility.

The inclusion of precious metals in IRAs was a pivotal change that has had lasting effects on retirement planning, leading to the growth of Gold IRAs as a popular investment strategy. This change had a huge impact on the Precious Metals to IRA market. New companies started to focus on Gold IRAs as a core business, and many personalities of medias, movies and sports, mostly in the conservative side, started to endorse these companies:

- Joe Montana and Mark Levin with Augusta Precious Metals

- Ben Shapiro and Ron Paul with Birch Gold Group

- Chuck Norris and Sean Hannity with GoldCo

- Glen Beck with Lear Capital

- Bill O'Reilly with American Hartford Gold Group

- Charlie Kirk with Noble Gold Investments

- Mike Huckabee with Gold Alliance

The Long-Term Growth of Precious Metals in IRA Accounts

The Gold IRA industry has grown substantially over the past ten years, with several trends emerging:

- Increased Adoption by Retail Investors: As awareness of Gold IRAs has grown, more retail investors have sought to include precious metals in their retirement accounts. This has led to a proliferation of companies offering Gold IRA services (as said already above), making it easier than before for individuals in the USA to invest in these assets.

- Technological Advancements: The rise of online platforms has simplified the process of setting up and managing a Gold IRA. Investors can now easily purchase, store, and monitor their gold holdings through digital interfaces in real time, making the process more accessible and transparent along the way.

- Regulatory Changes: Over the past decade, there have been regulatory changes that have clarified the rules surrounding Gold IRAs, making them a more secure and viable option for retirement planning. These changes have increased investor confidence in the product.

- Institutional Interest: Beyond retail investors, there has also been a growing interest from institutional players in the Gold IRA space. Their investments and attention have brought more liquidity and credibility to the market, further driving its growth.

The Future of Gold IRAs

Looking forward, the Gold IRA industry is expected to continue growing, supported by ongoing economic and geopolitical changes and uncertainties.

However, the industry may also face challenges such as regulatory scrutiny, environmental politics and competition from other investment vehicles.

As investors become more educated about the benefits of diversification and the role of precious metals in a balanced portfolio, Gold IRAs are likely to remain a key component of retirement strategies for years to come.

The outlook for Gold IRAs remains promising due to several key factors.

First, there is a growing interest in alternative investments as investors seek diversification and stability. Gold IRAs, with their historical safety and unique characteristics, are well-suited to meet this demand. Technological advancements, such as blockchain-based tracking and improved storage solutions, are enhancing the security and transparency of Gold IRAs, making them more attractive to investors.

Additionally, the rising focus on environmental, social, and governance (ESG) factors may drive demand for responsibly sourced precious metals, appealing to socially conscious investors. As financial literacy increases, more people are likely to recognize the benefits of diversification, further boosting the popularity of Gold IRAs.

Overall, while no investment is guaranteed, the enduring appeal of precious metals and the specific advantages of Gold IRAs suggest they will continue to be a significant component of retirement planning.

We suggest you to take a look at the US Mint website for more information.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.