Subscribe to get our FREE

GOLD IRA GUIDE

Why Gold Shines Bright: Investing in Precious Metals During Economic Recessions

In every recession, you’ll find a pattern: stocks market fall, consumer confidence dips, and people rush to find safety as they feel scared about their future.

In these situations, humanity understand how small it is in front of calamities, and most of the time feel helpless.

In this scenario, one asset that consistently earns its place in the frame is gold (and other precious metals like silver, platinum and palladium). It’s not hype or nostalgia, it’s history: investors turn to precious metals in times of crisis. Gold has been used for thousands of years as a store of value, and every time the economy weakens, gold proves why it still matters. And it always will.

In this article, we’ll explore why gold during recessions has become a go-to strategy for investors seeking stability. We’ll cover historical examples, practical investing options, and the risks you should consider before jumping in.

Key Takeaways:

- How economic recessions impact traditional investments and why gold emerges as a reliable alternative

- The historical performance of gold during downturns like the Great Depression, 1970s stagflation, 2008 crisis, and COVID-19

- Comparison between gold and stocks, bonds, real estate, and cryptocurrencies during recession periods

- Expert-backed strategies for investing in gold safely and effectively during economic uncertainty

Why Recessions Change the Rules for Investors

The ones who were born in the '80 will perfectly remember history. How the '90 ended, the 2001 attack at the World Trade Center, the consequences. They will for sure remember the 2008 crisis, then the Covid-19, the Russia-Ukraine war, and the fragile times we are living in right now (2025).

The time we are living in is the most tense, dangerous and unstable by the 1989 Berlin Wall fall.

What did these incertitudes create so far? Economic shocks, recessions (in the worst case scenario) and investors running to precious metals.

In fact, a recession is more than just a few bad quarters of GDP. It means job losses, reduced consumer spending, and falling asset prices. When the market is in turmoil, risk tolerance disappears fast in investors. They will dump volatile assets and look for safety, and that’s where gold comes in.

What makes gold stand out during economic slowdowns is its ability to preserve purchasing power. It’s not tied to earnings reports, interest payments, or credit ratings. It’s an independent store of value, and that independence makes it invaluable in a downturn.

Historical Proof: Gold in Past Recessions

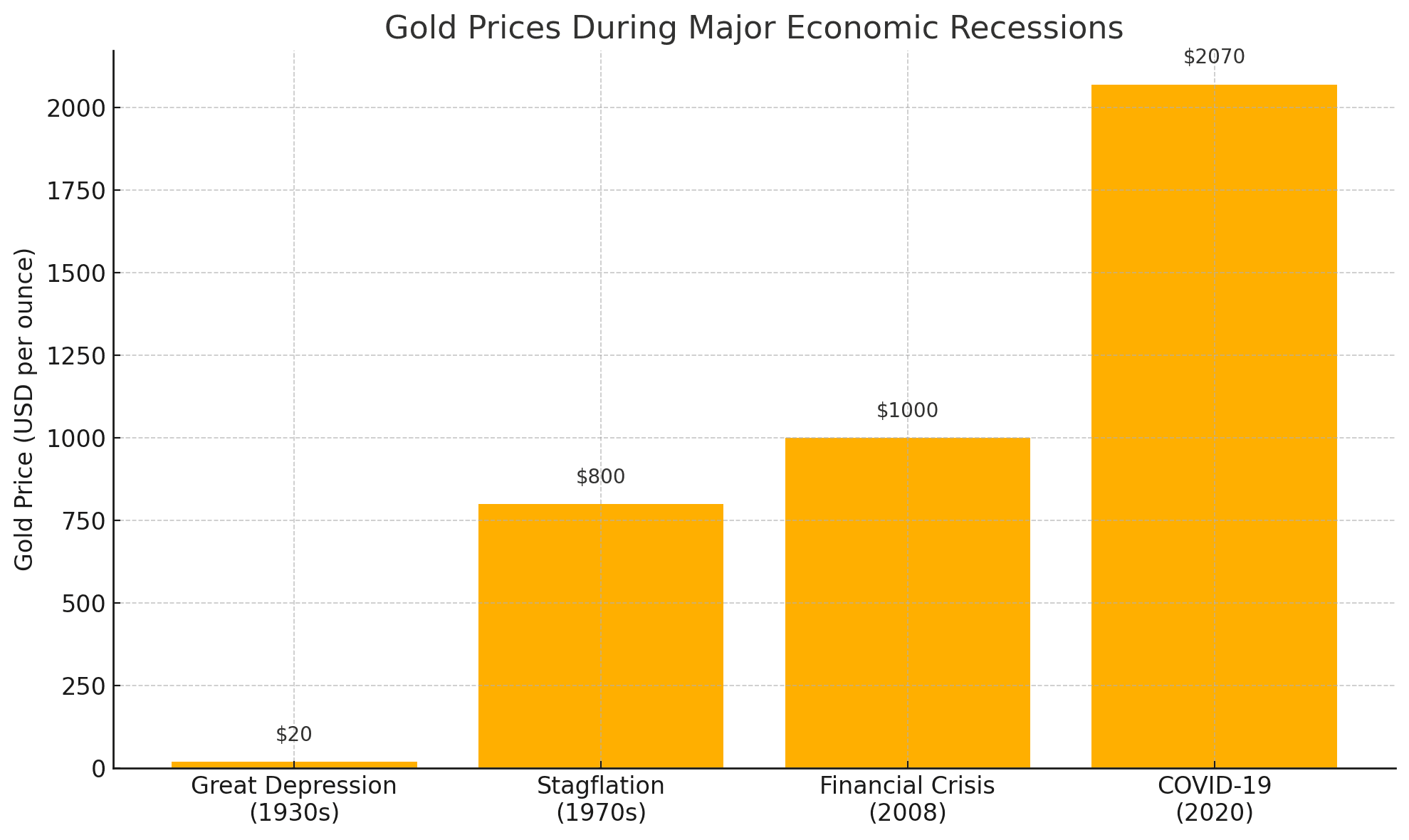

To have a clear image of how gold has been a financial safety good along history, we have to look at past trends. In which situations, gold performed well ? Let’s look at the data:

- The Great Depression (1930s): While banks failed and stock markets collapsed, gold held firm. In fact, the U.S. government had to step in and peg its value to prevent a rush on the dollar.

- 1970s Stagflation: Inflation was out of control, growth stalled, and gold soared from $35 to over $800 an ounce by the end of the decade.

- 2008 Financial Crisis: As the housing market imploded, gold rose more than 25% while equities tanked.

- COVID-19 (2020): Amid a global pandemic and market panic, gold hit an all-time high above $2,070 per ounce.

In each case, gold during recessions acted as a financial anchor while other assets sank. In this sense, we can say that gold is an evergreen asset, and it will never change. It is like this since centuries.

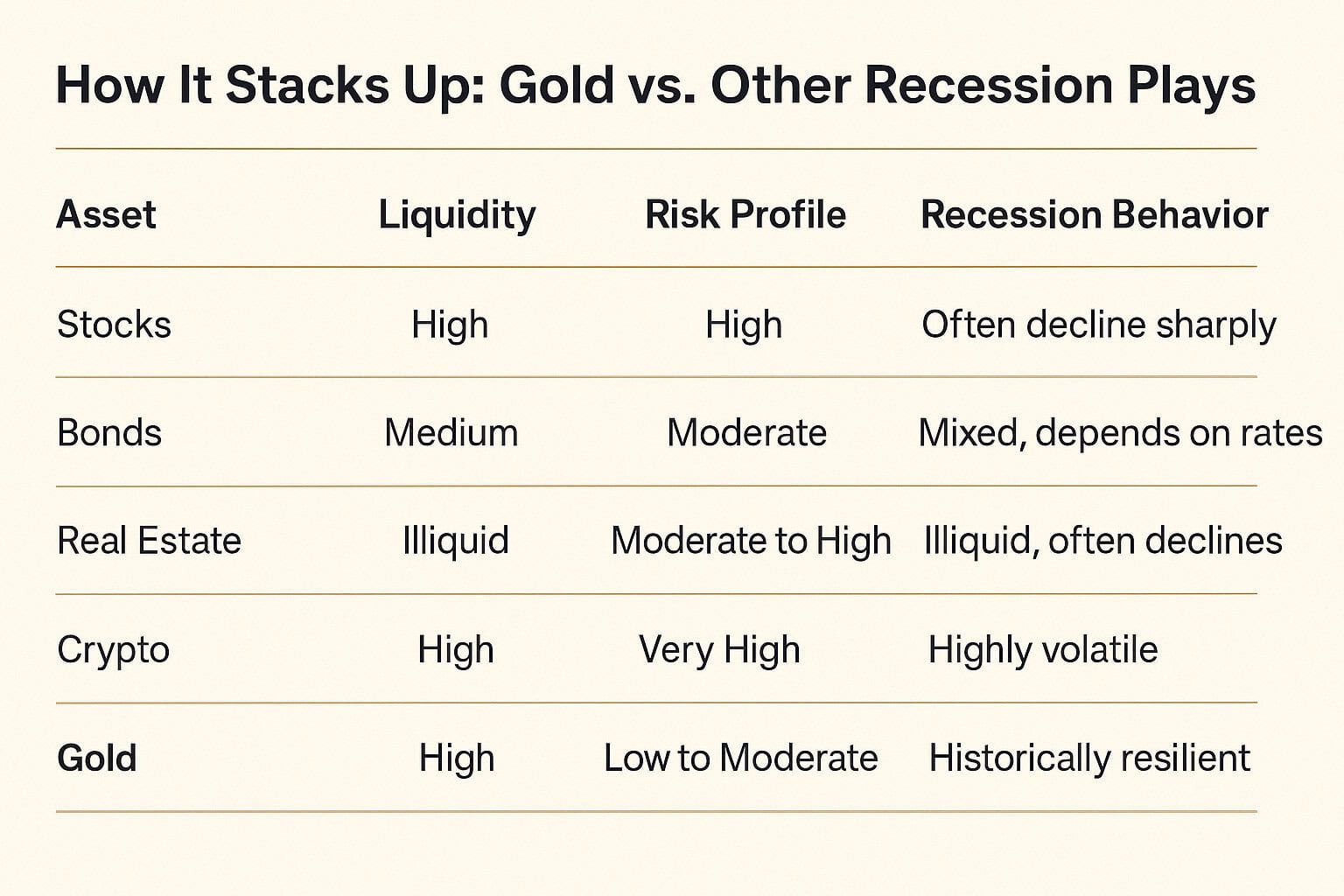

How It Stacks Up: Gold vs. Other Recession Plays

This next graphic will show you how Gold is compared with other assets, like Stocks, Bonds, Crypto and Real Estate.

It shows you are Gold performs compared to the other assets, and how it keeps high liquidity and stability despite the low to moderate risk during times of crisis.

Smart Ways to Invest in Gold

As a result, which are then your options to invest in Gold or other precious metals?

We will give you here a short prospect, but we also created this page that might also be useful for you. You’ve got a few solid options:

Physical gold (coins, bullion): Simple and direct, but you’ll need secure storage.

Gold ETFs: Tradable like stocks, backed by actual gold. Great for liquidity.

Gold IRAs: Tax-advantaged accounts that hold physical gold for retirement.

Mining stocks: Indirect exposure, but higher upside—and higher risk.

Futures/options: Advanced strategy for experienced investors.

Furthermore, if you’re in it for protection, keep it simple. Physical gold or ETFs usually make the most sense during recessions.

The Inflation Connection

Inflation tends to spike during or after recessions, especially when central banks pump money into the economy. That’s when gold really shows its strength.

In the 1970s, U.S. inflation reached double digits, and consequently gold took off. Another example we already talked about here is the Post-2008 crisis, when rates dropped and stimulus surged.

Result: gold again climbed. It reacts to currency debasement, not just to economic weakness.

If you think inflation is coming (and staying), gold deserves a serious evaluation if you care about your future.

Case Study: How Bridgewater Used Gold to Hedge in 2020

Bridgewater Associates, one of the world’s largest hedge funds led by Ray Dalio, increased its gold holdings in 2020. Dalio cited concerns over excessive money printing and long-term inflation risk.

The result? While equities swung wildly, gold delivered stability. Bridgewater’s strategy mirrored what many institutional and retail investors did: allocate a portion of their portfolio to gold as insurance.

A Word on Risk

In contrast, Gold is not bulletproof. It is detached from the stock market, yes, but it also has some downside on its own. You have to know them before thinking that it is the solution to everything. It's absolutely necessary to operate a comparison that works and it is realistic. The 3 downsides of Gold:

- Prices fluctuate, sometimes dramatically.

- It doesn’t pay dividends or interest.

- If you’re buying physical gold, there are storage and security concerns.

But here’s the key: gold isn’t supposed to replace your other investments. It complements them. It adds ballast to a portfolio that might otherwise be too exposed to recession risk.

Final Thoughts: The Role of Gold During Recessions

Gold’s role isn’t magic, it’s a practical way to protect yourself as an investor, and surely it works. It holds value when trust in other assets fades. It provides liquidity, global acceptance, and a hedge against policies that devalue currencies.

You can hold it physically at your place, or you can decide to hire a third party custodian. In any case, it stays as an asset that does not depreciate.

When the economy slows and fear rises, gold during recessions often becomes the rational and most used choice.

Not for hype or trend. Not for quick gains, not only for the aesthetics. But for long-term protection.

Anyway, in this article we also talked about Silver as a way to protect your investments, maybe it is worth taking a look.

check out our

Latest Articles...

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.