Gold IRA Kit: A Clear Guide to Protecting Your Retirement Savings

Planning for retirement is surely a challenging task. Parameters like inflation, market volatility, rising taxes, and the cost of living can all put years of hard work at risk.

Considering the difficult political and economic environment we are currently facing, we have prepared our Gold IRA kit, which provides you with the necessary information to combine the tax benefits of a retirement account with the long-term stability of precious metals.

You will learn the practical steps you can take to decide if investing in precious metals is the right move for your investor profile. Inside our kit, you will have the basic knowledge and clear insights on how to protect your wealth and diversify your portfolio.

Furthermore, inside our FREE PDF Guide, you’ll also find the key criteria for choosing a gold IRA provider and the most common mistakes to avoid when setting up your account.

Key Takeaways:

- Understanding What a Gold IRA Is: A clear explanation of how a Gold IRA works, how it fits into a retirement plan, and how it differs from traditional or Roth IRAs.

- Why Diversify with Precious Metals: The main advantages and potential risks of holding gold and other metals as a hedge against inflation and market volatility.

- Step-by-Step Guide to Opening a Gold IRA: How to choose a custodian, transfer funds, select eligible coins or bars, and store them safely in an IRS-approved depository.

- Common Mistakes and How to Avoid Them: How to identify trustworthy companies, avoid hidden fees, and stay away from promotional “free kits” that lack educational value.

Understanding Gold IRAs: How They Work and Why They Matter

A gold IRA is built around a special type of Individual Retirement Account (IRA), that lets you hold physical gold and other precious metals as part of your portfolio. While traditional IRAs focus on paper assets like stocks or bonds, a Gold IRA gives you direct exposure to tangible assets that can act as a protection against inflation, global economy, or political shocks and market uncertainty.

We talked about this topic on our Full Guide, but here’s how it works in practice:

You can roll over funds from an existing retirement account into a Gold IRA without paying penalties. In fact, once your account is set up, you’re allowed to purchase IRS-approved gold, which can be coins, bars, or bullion, and they will be stored in a secure, regulated depository.

As a result, the value of your account will rise or fall with the price of gold, offering a different type of growth potential compared to stocks or mutual funds.

Furthermore, a key part of the process is choosing the right custodian, which is the financial institution that ensures your IRA stays compliant with IRS rules, manages the paperwork, and arranges secure storage for your metals. This is an essential step if you desire peace of mind and a safe and proficient setup.

If you’re unsure how to evaluate custodians or providers, we’ve put together an article that covers the most important factors to look for before opening your account.

The Importance of Diversifying Your Retirement Portfolio

But why concretely you should you invest in precious metals for securing your retirement account? The answer is diversification. Diversification is a fundamental principle of investing, aimed at reducing risk by spreading investments across various asset classes.

- In the context of retirement planning, it helps to protect your portfolio from the volatility of the markets. In fact, relying solely on traditional assets like stocks and bonds can expose your retirement savings to significant risk, especially during economic downturns.

- If you include alternative investments such as gold, you can create a more resilient portfolio that can withstand market fluctuations.

- Gold (but also Silver and other precious metals) is often considered a "haven" asset, meaning it tends to retain or increase in value during periods of economic instability. This characteristic makes Gold an excellent tool for diversification, even if it responds to its market laws (it is not immune to price changes).

- When the stock market is volatile or experiencing a downturn, gold prices often rise, providing a counterbalance to the losses in other parts of your portfolio. Including gold in your retirement investments can help smooth out returns and provide a buffer against market volatility.

- Moreover, diversification with gold can also offer protection against inflation. Over time, the purchasing power of fiat currencies tends to decline due to inflation. Gold, on the other hand, has historically maintained its value.

Key Components to Look For When You Download a Gold IRA Kit

Clear educational resources

Accurate lists of IRS-approved metals

Transparent information on custodians and depositories

Almost every company will offer you a gold IRA kit before asking you to invest. They do it because they want to heat you before you invest. The problem? Not all of these guides are created equal to truly inform. Some kits are little more than marketing brochures designed to push you into a funnel to make you open an account quickly, without giving you the full picture and the pros and cons.

A good kit, on the other hand, should educate you first and help you make confident, informed decisions.

The most trustworthy gold IRA kits include:

- Clear educational resources that explain how a Gold IRA works, the potential benefits, and the risks you should be aware of. This might take the form of detailed guides, FAQs, or step-by-step instructions that go beyond sales language.

- Accurate lists of IRS-approved metals. Gold IRAs can only include certain coins, bars, and bullion that meet IRS purity standards. A reliable kit should spell this out clearly and also mention other eligible metals like silver, platinum, and palladium.

- Transparent information on custodians and depositories. Since your custodian manages compliance and your depository safeguards your metals, the kit should guide you on what to look for in a trustworthy provider rather than just listing one “preferred partner.”

If the kit you receive doesn’t include these essentials, or if it feels like it’s pushing you into an investment without teaching you anything, that’s a red flag.

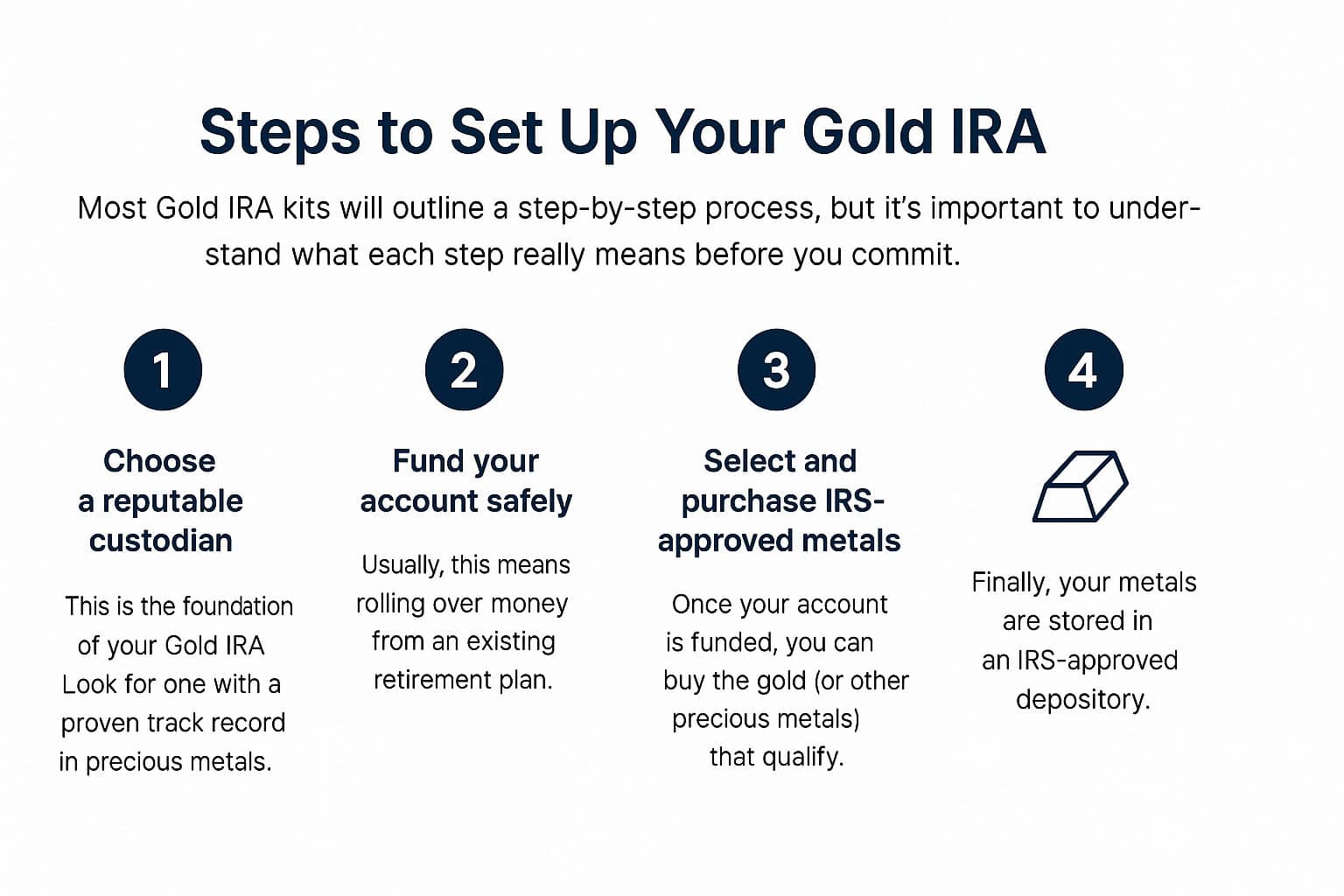

Steps to Set Up Your Gold IRA

Most gold IRA kits will outline a step-by-step process, but it’s important to understand what each step really means before you commit. Here’s what the process typically looks like when done the right way:

- Choose a reputable custodian. This is the foundation of your Gold IRA. The custodian is the institution that opens your self-directed account, handles the paperwork, and keeps you compliant with IRS rules. Look for one with a proven track record in precious metals, not just retirement accounts in general.

- Fund your account safely. Usually, this means rolling over money from an existing IRA, 401(k), or another retirement plan. The rollover needs to be handled carefully to avoid penalties, which is why a good custodian will walk you through the process step by step.

- Select and purchase IRS-approved metals. Once your account is funded, you can buy the gold (or other precious metals) that qualify. A balanced mix of coins and bars can give you more flexibility, and some investors also add silver, platinum, or palladium for extra diversification.

Finally, your metals are stored in an IRS-approved depository. The custodian coordinates secure storage and ongoing reporting, so you can focus on your long-term strategy instead of logistics.

Choosing the Right Gold IRA Custodian

And here’s another important passage to take into consideration: when you download a gold IRA kit, one of the first things you’ll notice is that every provider talks about their “trusted custodians.” But here’s the truth: not all custodians are the same, and choosing the wrong one can cost you in both fees and peace of mind.

A custodian’s job is to set up and manage your self-directed IRA, keep your account compliant with IRS rules, and coordinate secure storage for your metals. That’s why your choice matters so much.

- Look for a custodian with a strong reputation, proven experience in handling precious metals, and solid customer reviews from real investors, not just marketing claims.

- Fees are another key point. Custodians usually charge for account setup, annual maintenance, transactions, and storage. The problem is that fee structures can vary widely, and hidden costs can eat into your returns. A good custodian will be upfront about every charge and explain clearly how their pricing works.

- Finally, pay attention to storage. By law, your metals must be stored in an IRS-approved depository, but not all depositories are the same. The most reliable options provide high-level security, insurance protection, and sometimes segregated storage so that your metals aren’t mixed with anyone else’s.

Common Mistakes to Avoid With Gold IRAs

A gold IRA kit can give you a head start and fresh information, but it won’t protect you from the most common mistakes investors make. Knowing what to avoid is just as important as knowing the right steps.

- One of the biggest errors is rushing into a custodian without proper research. Many investors simply go with the first name they see, only to end up paying inflated fees or dealing with poor service. Always compare custodians carefully, look at their track record, transparency, and how they handle storage.

- Another frequent mistake is putting everything into gold alone. While gold is the anchor, a strong IRA often includes silver, platinum, or palladium as well. Even within gold, it’s smart to mix coins and bars, so your holdings aren’t tied to a single format. Diversification protects you from unnecessary risk.

- Finally, avoid the temptation of timing the market. Gold prices rise and fall in the short term, and trying to “buy at the perfect moment” often goes against you. A steadier approach, like dollar-cost averaging, lets you build your holdings gradually and focus on long-term growth instead of daily price swings.

Case Study: McNulty v. Commissioner – When the Custodian/Structure Backfires

In McNulty v. Commissioner, a taxpayer (Donna McNulty) used a self-directed IRA and formed an LLC (Green Hill Holdings) to purchase American Eagle gold coins. The custody arrangement was flawed: the custodian only held title formally, while McNulty physically stored the coins at her home.

The IRS and the Tax Court ruled that her physical possession triggered a taxable IRA distribution, effectively voiding the tax benefits of the IRA. Additionally, the court imposed penalties for underpayment because McNulty relied on internet-based “advice” rather than professional guidance

Source: Journal of accountancy

What can we learn?

Even if a custodian appears “on paper,” if actual control or possession rests with the investor, IRS rules can override the arrangement.

Improper custody arrangements or overreliance on promotional “self-storage” schemes can lead to a full distribution event and heavy tax burden.

The investor may be penalized not just for the distribution but also for inaccurate reporting, especially if professional advice was ignored.

It highlights the necessity of selecting a custodian who enforces strict compliance, understands IRS rules regarding precious metals, and doesn’t rely on “loophole marketing.”

To sum up: Securing Your Financial Future With Gold

A Gold IRA can be a smart way to protect your retirement savings. By adding gold and other precious metals to your portfolio, you’re not just relying on paper assets; you’re including something tangible that has held value for centuries. The right approach can help you hedge against inflation, diversify effectively, and bring more stability to your long-term plan.

But success with a Gold IRA isn’t about rushing into the first offer you see. It’s about making informed decisions, choosing a custodian you trust, diversifying your metals, and understanding the rules that keep your account compliant.

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.