Subscribe to get our FREE

GOLD IRA GUIDE

How to open a gold IRA account

Could opening a Gold IRA account be your golden ticket to securing your financial future?

In fact, if we analyze researches on the internet, how to open a gold IRA account is a very searched query on Google. Investors often ask themselves if it’s worth the hype and if it can be a good way to protect their financial future for retirement.

This type of investment is often the result of a misconception: Precious metals into IRAs are only destined to people that are on the edge of retirement. Nothing can be more wrong than this.

We will discover that it’s not always the case, and even if you are in your middle age or younger, having a safe-investing mentality can help you to avoid troubles in the long therm.

Therefore, in this comprehensive guide, we'll walk you through the step-by-step process of setting up your very own Gold IRA account while clarifying every step to take and every potential advantage or risk.

Furthermore, this guide is your roadmap to navigating the ins and outs of the process. From selecting a reputable custodian to understanding IRS regulations and choosing the right gold assets, we've got you covered at every turn.

Key Takeaways:

- A Gold IRA is a self-directed retirement account that allows you to invest in physical gold and other IRS-approved precious metals.

- To open a Gold IRA, you need to choose a qualified custodian, set up an account, and fund it through a rollover, transfer, or direct contribution.

- Investors must purchase IRS-approved gold products and store them in an authorized depository to comply with tax regulations.

- A Gold IRA can provide portfolio diversification, inflation protection, and long-term financial security, making it a valuable investment option for retirement planning.

Understanding the Benefits of Gold IRA Investments

Investing in a Gold IRA offers several significant advantages to enhance your financial portfolio.

Main Benefits:

First: protection against inflation.

Historically, gold has maintained its value over time, often increasing in price when the value of paper currency declines.

This characteristic makes gold a reliable hedge against inflation, allowing investors to preserve their purchasing power while holding tangible goods that are less immune to crisis and economic shocks.

In fact, as the economy fluctuates, having gold, silver or platinum in your retirement account can provide a sense of security, ensuring that your savings do not erode in value.

You can read more about this subject on this other article.

Second: diversification it brings to your investment strategy.

Many financial experts advocate for a diversified portfolio as a way to mitigate risks.

As a result, including precious metals, like gold or silver, can help you to balance out the volatility of stocks and bonds.

In particular, Gold often moves independently of traditional financial markets, which means that during economic downturns, while your stocks may plummet, your gold assets could retain or even increase their value.

This diversification not only protects your investments but can also enhance your overall returns in the long run.

Third: Gold IRAs offer the allure of tangible assets.

Unlike stocks or mutual funds, gold is a physical commodity that you can hold in your hands.

This tactile and concrete nature often provides investors with a sense of security and confidence: they are holding they can openly feel and perceive under their hands. This simple feeling provides an increased sense of security.

In times of economic uncertainty, many turn to gold as a safe haven, enhancing its desirability as an investment. The psychological comfort that comes with owning a physical asset cannot be underestimated, making Gold IRAs an attractive option.

However, it’s worth mentioning that also Silver could be a viable way to add precious metals into your IRA, as you can read in this article.

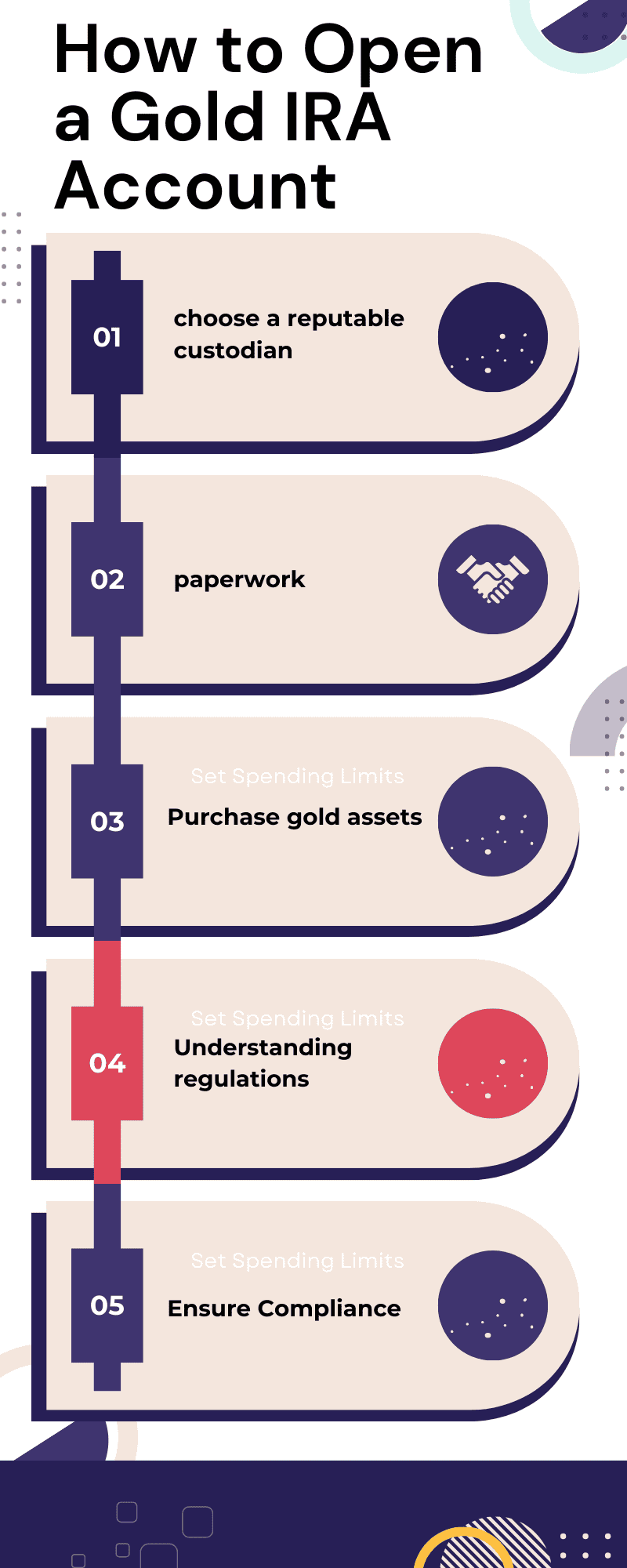

How to Open a Gold IRA Account

Opening a Gold IRA account is a very simple yet straightforward process, but it requires careful planning and execution.

The first step is to choose a reputable custodian who specializes in self-directed IRAs. This custodian will be responsible for managing your account and facilitating the purchase of gold.

It is crucial for you to conduct thorough research, comparing fees, services, and customer reviews of various custodians. Look for a custodian that is IRS-approved and has a solid track record in handling precious metals IRAs.

Look for reviews, comparisons and search on websites like TrustPilot to see how customers react to the offers.

Once you have selected a custodian, the next step is to fill out the necessary paperwork to establish your Gold IRA account. This usually involves completing an application form and providing identification documents.

Additionally, you may need to fund your account through a rollover from an existing retirement account or by making a direct contribution. If you are rolling over funds, ensure that you follow the IRS guidelines to avoid any penalties.

The rollover process typically takes a few weeks, so be prepared for some waiting time before your account is fully funded.

Next, after your account is set up and funded, you can begin purchasing gold assets. Your custodian will guide you through the options available and help you make informed decisions. It is essential to stay within the IRS regulations regarding the types of gold you can hold in your IRA.

Understanding these regulations will ensure that you are compliant and that your investments remain tax-advantaged. You will avoid tax penalties and further issues, not to mention hidden costs. Therefore, it’s crucial to have a look at the IRS rules.

Take your time during this phase to ensure that you are selecting the best possible gold assets for your retirement portfolio.

Choosing the Right Gold IRA Custodian

Selecting the right Gold IRA custodian is a critical step in your investment journey. We realize that you will have many options in front of you. Therefore, it's essential to evaluate potential custodians based on several key criteria.

- First, consider their experience in handling Gold IRAs and their reputation in the industry. Look for custodians that have been in business for several years, as this often indicates stability and reliability.

As we previously mentioned, checking online reviews and testimonials can provide insight into their service quality and customer satisfaction.

- Additionally, fees are another crucial factor to consider when choosing a custodian. Different custodians have varying fee structures, including setup fees, annual maintenance fees, and transaction fees.

It’s essential to understand all applicable costs upfront to avoid any surprises later. A transparent custodian will provide a detailed fee schedule and be willing to answer any questions regarding their charges.

While it might be tempting to choose the custodian with the lowest fees, also consider the quality of service and support they provide, as these factors can significantly impact your overall experience.

- Lastly, ensure that the custodian offers a range of investment options. While your focus may be on gold, a good custodian should also provide access to other precious metals like silver, platinum, and palladium.

Additionally, be sure to inquire about their educational resources and customer support services.

A custodian that prioritizes client education and provides robust support can help you navigate the complexities of investing in a Gold IRA with greater confidence.

Selecting Gold Investments for Your IRA

When it comes to selecting gold investments for your IRA, there are specific regulations and options to consider. The IRS has strict guidelines about the types of gold that can be held in a Gold IRA.

Generally, only gold bullion and coins that meet certain purity standards (at least 99.5% pure) are eligible. This includes popular options such as American Gold Eagles, Canadian Gold Maple Leafs, and gold bars from approved refiners.

In addition to meeting purity standards, consider the liquidity of the gold assets you choose. Liquidity refers to how easily an asset can be converted into cash without significantly affecting its price.

Bullion bars and well-known coins tend to have higher liquidity, making them preferable choices for many investors. This is particularly important if you anticipate needing to sell your gold in the future.

Moreover, it’s wise to diversify within your gold investments. While gold is a stable asset, different forms of gold can react differently to market conditions.

For instance, coins may have numismatic value beyond their gold content, while bullion bars are typically valued solely based on their weight.

By investing in a mix of coins and bars, you can create a more balanced portfolio that leverages the strengths of each type of investment.

Gold IRA Rules and Regulations

Understanding the rules and regulations governing Gold IRAs is essential for maintaining compliance and maximizing the benefits of your investment. The IRS has specific guidelines regarding the types of metals that can be held in a Gold IRA, as previously mentioned.

Additionally, all gold must be stored in an approved depository to ensure security and compliance. This means you cannot physically hold the gold yourself; it must be managed by your custodian in a secure location.

Another important regulation pertains to the contributions and distributions from your Gold IRA. Like traditional IRAs, there are annual contribution limits that you must adhere to. For 2023, the contribution limit for individuals under 50 is $6,500, while those aged 50 and above can contribute up to $7,500.

It’s crucial to keep track of these limits to avoid any penalties. Furthermore, distributions from your Gold IRA are subject to taxation, and withdrawing gold in-kind can trigger additional tax implications.

Lastly, understanding the rollover process is critical if you decide to transfer funds from another retirement account into your Gold IRA. The IRS allows for tax-free rollovers, but there are specific timeframes and procedures that must be followed.

For instance, you have 60 days to complete the rollover after receiving the funds to avoid penalties. It’s important to understand the difference between a self-directed rollover and a transfer.

Familiarizing yourself with these rules and regulations will help you navigate the complexities of your Gold IRA and make informed decisions regarding your investments.

Tax Implications of Gold IRA Accounts

Investing in a Gold IRA has distinct tax implications that can significantly affect your overall investment strategy. One of the primary benefits of a Gold IRA is that it allows for tax-deferred growth.

This means that you do not pay taxes on the gains from your gold investments until you withdraw funds from the account. This can allow your investments to compound more effectively over time, as you are not losing a portion of your returns to taxes each year.

However, it’s important to recognize that when you do take distributions from your Gold IRA, those withdrawals will be taxed as ordinary income.

This is a critical consideration when planning for retirement and assessing your tax bracket at the time of withdrawal. Understanding your future tax liabilities can help you make more informed decisions about when and how to take distributions.

Additionally, if you withdraw gold from your IRA for personal use, you may face a hefty tax bill and potential penalties.

Another point to consider is the impact of Required Minimum Distributions (RMDs). Once you reach the age of 73, the IRS mandates that you begin taking RMDs from your Gold IRA.

The minimum amount is calculated based on your life expectancy and the total value of your account. Failing to take your RMD can result in severe penalties, so it’s crucial to stay informed about your obligations.

Gold IRA Rollover vs. Transfer

When considering how to fund your Gold IRA, you may come across two common methods: rollover and transfer. Understanding the differences between these two processes is essential for making informed decisions.

A rollover involves moving funds from an existing retirement account, such as a 401(k) or traditional IRA, into your Gold IRA. This process can be tax-free if completed correctly, typically within 60 days of receiving the funds.

Rollovers can be advantageous for investors looking to consolidate their retirement accounts and take advantage of the benefits offered by a Gold IRA.

On the other hand, an IRA transfer is generally a more straightforward process. It involves directly moving funds from one IRA custodian to another without the investor taking possession of the money.

This method eliminates the risk of tax penalties because the funds never come into the account holder's control. Transfers are often preferred by investors because they are simpler and can be completed more quickly than rollovers.

Additionally, there is no 60-day deadline, making it easier to manage your retirement investments.

Both rollovers and transfers have their advantages and can be effective strategies for funding your Gold IRA. The choice between the two often depends on individual circumstances and preferences. It’s advisable to consult with your IRA custodian or a financial advisor to determine which option aligns best with your investment goals.

Conclusion and Final Thoughts

In conclusion, opening a Gold IRA account is a strategic move for those looking to diversify their investment portfolio and protect their retirement savings. On the other hand, the journey towards establishing a Gold IRA requires careful consideration, from selecting a reputable custodian to choosing the right gold assets.

As usual, we recommend you to stay informed about the rules and regulations and understanding the tax implications, you can navigate the complexities of Gold IRAs with confidence.

Ultimately, the key to successfully opening and managing a Gold IRA lies in thorough research and strategic planning.

Consult with financial advisors, seek out educational resources, and stay informed about market trends. By doing so, you can harness the power of gold to safeguard your financial future and pave the way for a prosperous retirement.

Embrace the opportunity that a Gold IRA presents and take the necessary steps to secure your wealth and achieve your long-term financial aspirations. You can find here our latest articles about this subject.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.