Subscribe to get our FREE

GOLD IRA GUIDE

Is Palladium a Good Investment?

A Comprehensive Analysis

When considering alternative investments, many wonders, is palladium a good investment?

Palladium, often overlooked, offers unique opportunities for portfolio diversification as it is a precious metal with unique characteristics.

This precious metal has increasingly caught the attention of investors, alongside other precious metals like gold, silver, and platinum. With a $16.5 billion USD market value, this white metal is known for its brilliant sheen and catalytic properties.

As a consequence, Palladium has seen an enormous rise in value over the past few decades, driven by industrial demand and its rarity. As new investors explore opportunities beyond traditional assets, palladium coins and bullion are starting to offer a unique option with a strong growth potential.

Thus, the market is currently raising in value, so let's deep dive into the reasons why palladium is becoming a very good alternative investment to traditional gold or silver.

Why Consider Palladium as a Good Investment?

Palladium is a rare and shining silvery-white metal, a member of the platinum group of metals (PGMs) This group also includes platinum, rhodium, ruthenium, iridium, and osmium. It has originally been discovered in 1803 by William Hyde Williston and is primarily sourced from countries like Russia, South Africa, Canada, and the United States.

Its properties are very peculiar, as it is highly resisting to tarnish, it has a high melting point, and it is an excellent catalytic. These proprieties make of it a very valuable resource for industrial uses, especially in the automotive sector for catalytic converters.

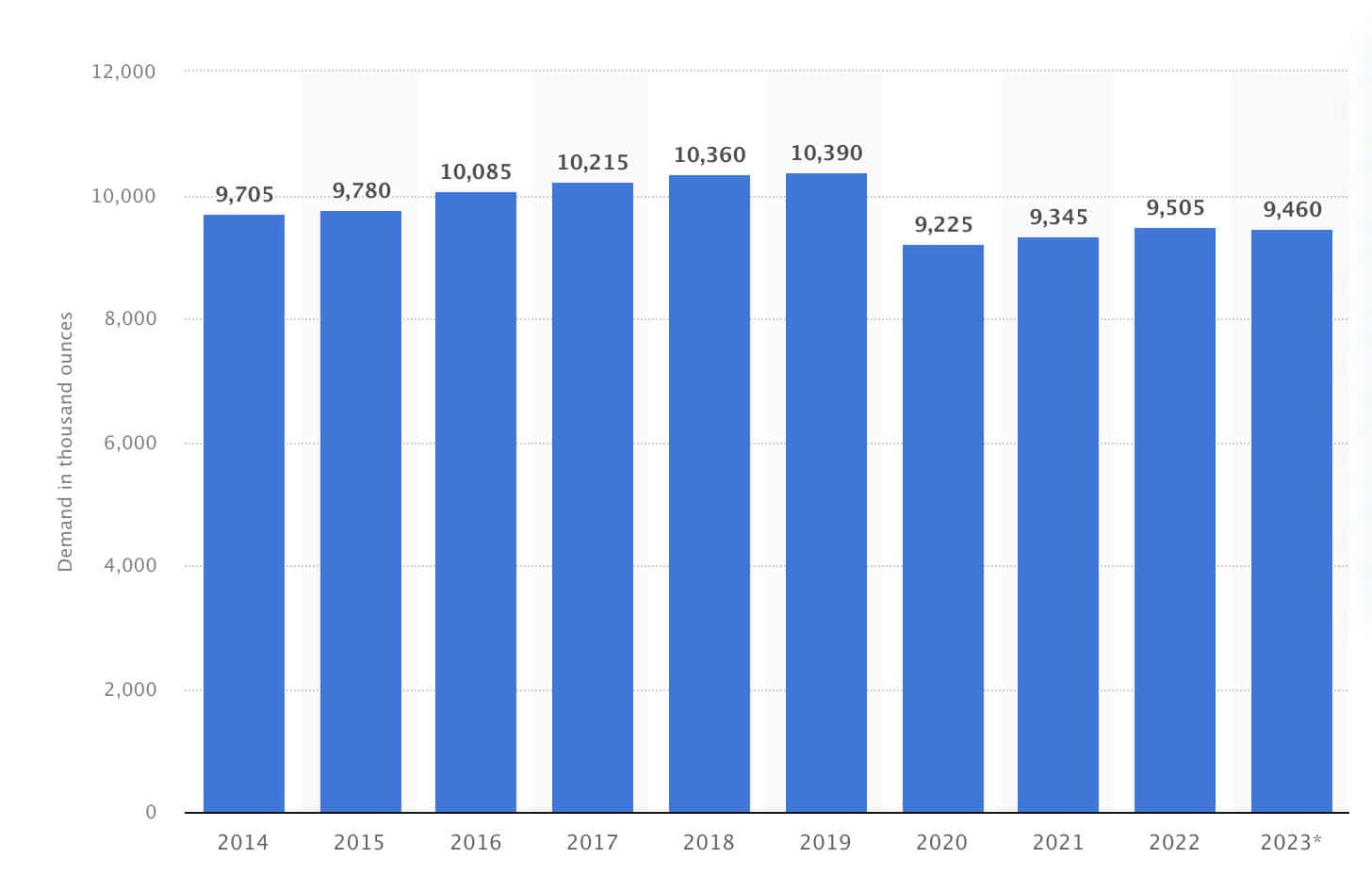

The graphic below shows the increasing demand for palladium during the latest years, and as it can be seen, the trend has been constantly growing if we don't count a small decrease between 2019 and 2020 due to Covid-19. The temporary shutdown of the automotive sector has effected the palladium demand, that has been after that constantly growing to date (2024).

Source: Statista 2024

Historical Context of Palladium Investment

Since its discovery, palladium has been utilized in various industrial applications. Thanks to its very ductile nature and the resistance to atmospheric pressure, its role as a precious metal investment started to gain traction mostly in the late 20th century.

Historically, Palladium was seen as a by-product of platinum mining, often overlooked by investors. Its value increased after the growth of the demand for catalytic reactions in the automotive industry.

The rise in the automotive industry, especially with stricter emission regulations, significantly increased palladium demand, making Palladium ideal for use in catalytic converters, which reduce harmful emissions from vehicles.

Furthermore, the shift towards electric vehicles (EVs) and hybrid cars continues to influence the palladium market dynamics.

The combinations of all this factors makes Palladium's prices value independent of other precious metals like Gold or Silver.

Benefits and Risks of Investing in Palladium

The nations that are currently a viable source for mining Palladium are Russia, the United States, South Africa and Canada.

The supply of palladium is constrained. The majority of global palladium production comes however from Russia and South Africa, where mining operations face geopolitical risks, labor strikes, and other disruptions.

Generally speaking, Palladium is a difficult metal to mine and this makes its status of "precious metal" as the demand is way higher than the actual offer, and it is difficult to provide enough supply.

This limited supply, combined with robust industrial demand, creates a favorable scenario for Palladium's price appreciation and the overall price stability.

Considering the price, the two most important variables are:

Supply Constraints

Limited number of palladium mines, primarily concentrated in politically unstable regions that make mining and transportation difficult, dangerous and regulated by unpredictable factors.

Demand Drivers

Dominated by automotive demand, followed by electronics, jewellery, and dentistry. Since this metal is so ductile, versatile and peculiar, it is applied in many different industries. As a result, the price increases.

Rarity and Industrial Use

All the factors we have been talking about above, make Palladium approximately 30 times rarer than gold, making it a scarce and valuable asset. Consequently, its industrial applications are diverse, ranging from electronics to jewelry. It is applied in many different industries and the more the demand for automation and electronics will increase, the more palladium will be in demand, with a significant impact on the cost.

However, it is mainly the metal's critical role in reducing automobile emissions that solidify its demand and makes it stable and still growing.

Environmental Impact

Stricter emission standards and environmental politics increase reliance on palladium for catalytic converters. The new environmental regulations make the use of Palladium a necessity for this high-demand industry, and as a consequence this impacts the price of Palladium.

Technological Uses

Growing use in electronics, particularly in multilayer ceramic capacitors (MLCCs), which are essential components of various electronic devices. This contributes to the stability of Palladium's prices.

Forms of Palladium Investment

Investors can purchase palladium in several forms, each with distinct advantages and considerations.

Palladium Coins

Palladium coins are a popular choice for investors seeking physical bullion. They are easy to recognize and easy to trade. Coins offer a portable and recognizable form of investment, often minted by reputable government or private mints. They are shiny and beautiful, and they represent the most ancient form of wealth. Here the two most important examples:

Canadian Palladium Maple Leaf: Issued by the Royal Canadian Mint, this is one of the most widely recognized palladium coins, offering a high degree of purity (99.95%).

American Palladium Eagle: Released by the United States Mint, it features designs from historic American coins and appeals to both investors and collectors.

Palladium Bars

Bars offer a more straightforward way to own palladium, often with lower premiums over the spot price compared to coins. They come in various sizes, ranging from one gram to one kilogram, and are typically produced by private mints. Bars are generally more suitable if you want to invest in larger quantities

- Advantages of Bars: Lower premiums, suitable for larger investments, easy storage.

- Popular Brands: Credit Suisse, PAMP Suisse, and Valcambi are renowned for their high-quality palladium bars.

Top Palladium Companies

Investments in palladium can be considered straightforward because you can simply go to your precious metals dealer and buy it first hand.

This is indeed the simplest yet most effective method, even though it has some limitations:

- First, these shops often offer limited quantities, and their supply is constrained by the actual demand they physically have in their area.

- Second, they don't offer palladium for IRA services, which is another significant limitation due to the lack of opportunity to invest with tax reduction benefits.

Self-directed IRAs (SDIRAs) are an effective way to invest in palladium while taking advantage of tax-free benefits, which can help the investment grow in value for investors over the years.

Let's take a look at which companies currently offer the best options for investing in palladium through an IRA in the U.S. market:

Augusta Precious Metals

Augusta Precious Metals is considered one of the top sources for precious metals SDIRAs in the United States. With a wide selection, endorsements from well-known personalities, and a commitment to no high-pressure sales tactics, Augusta stands out as one of the most reputable firms in the industry.

Quick Facts:

- Named "Best Overall" Precious Metals IRA company by Money magazine

- Endorsed by Hall of Fame quarterback Joe Montana

- Zero fees for up to 10 years

- Excellent customer ratings across the board

Noble Gold

Noble Gold is considered one of the top options for investing in precious metals through a self-directed IRA. Established in 2017, this firm offers some of the lowest fees in the industry ($100 annually, plus $250 for yearly storage) and partners with the industry-leading Equity Trust Company for custodial services. Based in California, Noble Gold has received Gold IRA Guide’s highest global rating of 5 stars.

Quick Facts:

- Among the lowest fees in the industry

- Minimum account value of just $2,000

- “No-quibble” buyback policy

- Founded by industry veteran Collin Plume

Comparing Palladium to Gold and Silver Investments

When it comes to precious metals investing, gold and silver have long been the dominant choices.

However, palladium offers a unique opportunity with its distinct advantages. Unlike gold, which is often seen as a stable store of value, palladium’s price tends to be more influenced by industrial demand, especially in the automotive and technology sectors.

While silver also has industrial uses, its market is more volatile due to its dual role as both an investment and an industrial metal. Palladium's rarity makes it more susceptible to supply shortages, which can lead to rapid price increases.

As a result, investors looking for diversification and potential growth might find palladium to be a compelling alternative to the more traditional gold and silver investments

Final Thoughts

Investing in palladium presents a unique opportunity for those looking to diversify their portfolios beyond traditional assets like gold and silver.

As a rare and highly sought-after metal, especially in the automotive and technology industries, palladium has demonstrated strong demand and growth potential.

While its price can be more volatile compared to other precious metals, this volatility can also provide significant upside for investors who understand the market dynamics.

Palladium's role as a hedge against inflation, coupled with its industrial applications, makes it an appealing choice for both conservative and aggressive investors.

By incorporating palladium into a self-directed IRA, investors can benefit from tax advantages while capitalizing on the metal's potential for value appreciation.

However, as with any investment, it's crucial to do thorough research and consider working with reputable companies and custodians to ensure secure and efficient investment processes.

By taking these steps, investors can confidently add palladium to their portfolios and enjoy the benefits of this "out-of-the-box" investment.

For more information about platinum investment, you can take a look at the World Platinum investment council.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.