Subscribe to get our FREE

GOLD IRA GUIDE

Maximize Your Wealth: A Legal and Practical Guide to Precious Metals IRA Home Storage

Traditional retirement accounts often rely on volatile paper assets like stocks and bonds, which can lose value during economic downturns. For investors seeking more control and protection from inflation, a lesser-known but increasingly discussed option is the Precious Metals IRA with home storage.

In short, this approach allows individuals to legally own and store physical gold, silver, platinum, or palladium while preserving the tax advantages of an IRA, provided strict IRS regulations are followed. Home storage IRAs are not for everyone. They require legal precision, financial discipline, and a well-structured setup.

But for the right investor, they offer flexibility, long-term value preservation, and direct control over one’s retirement assets.

In this guide, we explain how these accounts work, how to implement them correctly, and how to avoid costly mistakes. We also examine the legal framework, eligible metals, and the trade-offs between home and custodial storage, ending with a real-life example of a successful case.

Key Takeaways:

- The real advantages and risks of storing precious metals at home through an IRA, including the legal structure required to avoid IRS penalties

- How home storage compares to custodial storage in terms of cost, control, risk management, and tax implications

- Step-by-step strategies to set up a compliant home storage IRA, including choosing a custodian, establishing an LLC, and selecting eligible metals

- A real-world case study showing how one investor saved on storage fees and gained flexibility without violating IRS rules

Understanding Precious Metals IRAs

A Precious Metals IRA is a type of self-directed individual retirement account that allows you to invest in physical bullion like gold, silver, platinum, or palladium. Precious metals are historically resilient assets that get mostly untouched during times of crisis.

What you can do is setting up either a traditional or Roth version of the account, meaning your tax benefits will depend on your personal financial strategy.

In fact, these accounts have the same contribution limits and withdrawal rules as standard IRAs, but they require a custodian who can handle physical assets.

Precious metals are especially attractive in periods of inflation or economic uncertainty. Their value tends to hold or even rise when the stock market falters, making them a compelling option for diversification.

The Benefits of Home Storage for Precious Metals

Many investors are drawn to the idea of storing their metals at home for one main reason: control.

When you invest with a precious metal to IRA company, you won't have full control on your assets, as they will be stored far from you. You won't "touch" them concretely.

On the contrary, with home storage, you can access your assets immediately without relying on a third-party custodian. As a result, you will have full control on the process (but also you will own the risks).

There are also financial benefits:

You eliminate custodial storage fees

You avoid delays in asset liquidation or delivery

You retain physical access during periods of financial instability

Additionally, you can customize your security measures with a home safe, alarm systems, or private storage rooms, offering a personalized approach to asset protection.

However, these advantages come with additional legal and logistical complexities, as we’ll explore below. It is unfortunately not as easy as it seems to be.

Legal Considerations for Precious Metals IRA Home Storage

We just said that generally, the storage of IRA metals is legal only under strict conditions.

In fact, it is not possible to hold precious metals at home if you don't respect a these parameters.

- You must create a Limited Liability Company (LLC), fully owned by your IRA

- That LLC must open a separate business checking account

- You as the IRA holder must not take direct possession unless you meet IRS rules for independence and storage

- The metals must meet IRS-approved purity levels:

- Gold: 99.5% purity or higher

- Silver: 99.9%

- Platinum and Palladium: 99.95%

Failing to comply could result in the IRS classifying the entire account as a distribution, triggering income taxes and early withdrawal penalties.

To stay safe, you have to be sure to always consult both a tax attorney and a self-directed IRA specialist before proceeding any further with investing.

Types of Precious Metals Eligible for IRA Storage

Only certain metals are allowed in a precious metals IRA. Here's a quick breakdown:

Gold:

American Gold Eagle

Canadian Maple Leaf

Bars from approved mints meeting 99.5% purity

Silver:

American Silver Eagle

Canadian Silver Maple Leaf

.999 fine silver bars

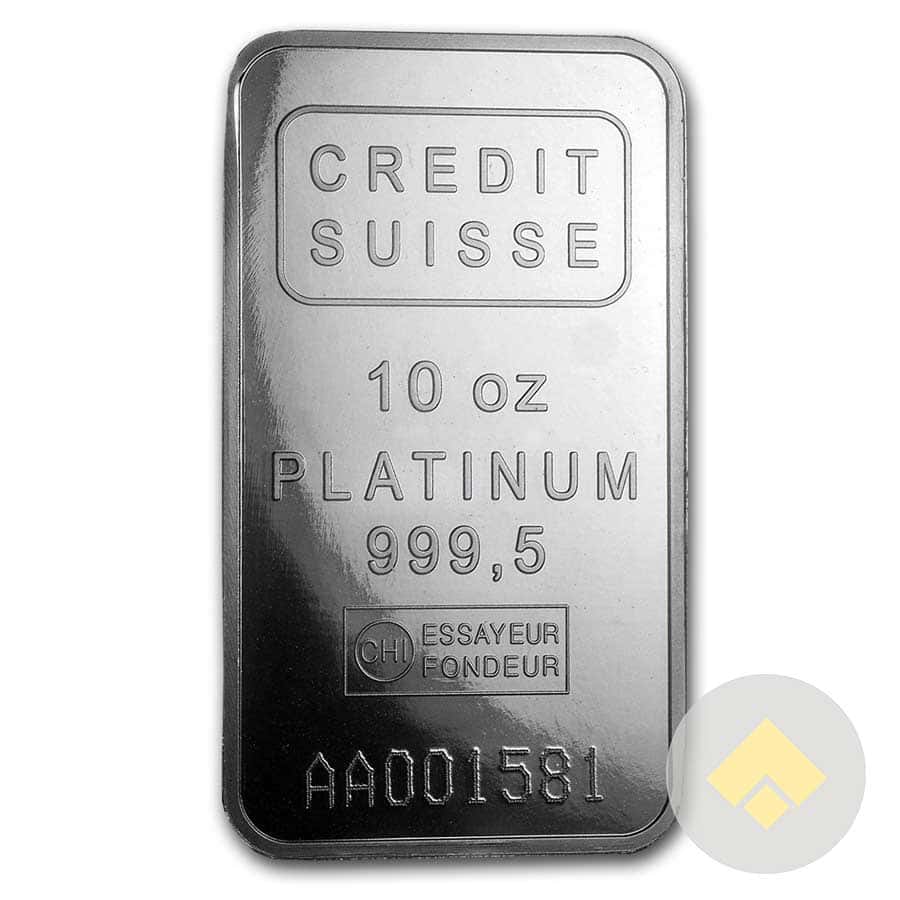

Platinum and Palladium:

American Platinum Eagle

Canadian Platinum Maple Leaf

Bars from accredited refiners (99.95% purity)

Avoid numismatic coins or collectibles. They are not IRS-approved.

How to Set Up a Precious Metals IRA with Home Storage

Find a self-directed IRA custodian with experience in precious metals and LLC structures

Form an LLC owned entirely by your IRA. This requires a custom operating agreement

Open a business bank account for the LLC

Fund your IRA through a rollover, transfer, or new contributions

Purchase approved metals through your LLC using IRA funds

Store metals in a secure, IRS-compliant location

Keep detailed documentation of each step to ensure audit-proof compliance.

Safe Home Storage: Best Practices

If you meet all legal criteria, you can store metals at home, but in this case, security is critical:

Use a high-quality fireproof safe, ideally bolted to the floor

Install security alarms and cameras

Consider a hidden or reinforced storage room

Purchase a specialty insurance policy for precious metals

Keep your storage details confidential, read: nobody has to know.

If the IRS deems your setup non-compliant, your entire IRA could be invalidated. So be careful!

Tax Implications

A traditional precious metals IRA gives you tax-deferred growth: contributions may be deductible, and withdrawals are taxed at retirement.

A Roth version is funded with after-tax dollars, but both growth and withdrawals are tax-free if rules are followed.

Important: If your home storage setup doesn't comply with IRS rules, your assets may be considered a taxable distribution. You’ll owe income taxes and possibly a 10 percent early withdrawal penalty.

Consult with a tax advisor before initiating any home storage strategy.

Case Study

Case Study

Home Storage IRA, When It Works?

Investor Profile

- Name: Jessica T., age 59

- Occupation: Retired nurse

- Strategy: Rollover from 401(k) to Precious Metals IRA with home storage

Jessica worked with a specialized custodian to create a compliant self-directed IRA with an LLC. She installed a heavy safe in her home, insured the assets, and kept complete records. Her setup passed legal scrutiny and saved her $1,200 per year in custodial fees.

Source:

https://www.investopedia.com/home-storage-gold-ira-5188305

Conclusion

A precious metals IRA with home storage offers powerful benefits: control, flexibility, and potential cost savings, but only if done right. Understanding the rules, working with the right professionals, and maintaining proper records are essential.

Whether you store metals at home or with a custodian, what matters most is that your strategy aligns with your goals and remains fully compliant. Precious metals are more than just shiny objects. They can be a long-term hedge, a store of value, and a pillar of your retirement plan.

Maximize your wealth by staying informed, acting legally, and planning carefully.

check out our

Latest Articles...

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.