Subscribe to get our FREE

GOLD IRA GUIDE

Best Gold IRA Companies 2026

Are you looking for the Best Gold IRA Companies in 2026? If so, then a Gold IRA might be the perfect choice for you.

In fact, when it comes to planning for retirement, it's essential to diversify your portfolio and protect your hard-earned money. And that's where Gold IRA comes in: it will help you to protect your savings from economical shocks, inflation, geopolitical tournaments and global politics changes.

The price of gold (like other precious metals) is independent of the stock market dynamics, and this can turn at your advantage.

By investing in precious metals, you can hedge against economic uncertainties, inflation, and market volatility.

On the other hand, finding reputable and trustworthy retirement investment companies can be overwhelming, especially with so many options available. There is too much information out there, and it is sometimes difficult to understand who you should trust and why, to take this very important investment step. Therefore, we picked up for you the Top 5 best companies so you can have a clearer idea in your mind.

In this comprehensive guide, we'll explore the best options for this investment, providing insights into their reputation, customer service, fees, and investment options.

Our article will equip you with the knowledge you need to make an informed decision about your retirement investment strategy.

So, sit back, relax, and get ready to delve into this article!

Understanding the Importance of Retirement Investments:

Best Gold IRA Companies for Safe Retirement

Planning for retirement is a crucial aspect of financial health that requires careful consideration and strategic planning.

In fact, as individuals approach their retirement years, they must ensure they have a sufficient financial cushion to support their lifestyle. This is where the importance of retirement investments comes into play.

Retirement investments are essential because they not only help grow your wealth over time but also provide a safety net during your non-working years. The earlier you begin investing, the more you can benefit from compound interest, which can significantly enhance your retirement savings.

Moreover, relying solely on Social Security benefits is not advisable as it usually does not cover all expenses. In fact, many retirees find that their Social Security income is insufficient to maintain their desired standard of living.

We wrote an article concerning this topic, as many Americans are currently forced to work even after their retirement age because of this reason.

Consequently, diversifying your income sources, including retirement accounts, pensions, and personal investments, is vital for a secure retirement. By establishing a well-rounded investment portfolio, you can mitigate risks associated with economic downturns and inflation, ensuring that you have adequate financial resources to draw upon in later years. You can find more about this topic on this page. We also wrote more about this topic here.

The landscape of retirement investment options is constantly evolving, and understanding these changes is crucial for making informed decisions. With various investment vehicles available, such as stocks, bonds, real estate, and precious metals, it's important to stay informed about how each option can fit into your overall retirement strategy.

Gold IRAs, in particular, have garnered significant attention in recent years for their ability to provide a hedge against market volatility and inflation. By comprehensively understanding the significance of retirement investments, you can make choices that align with your financial goals and prepare you for a comfortable retirement.

Benefits of Investing in Gold IRA Companies

Investing in a Gold IRA presents numerous advantages that can enhance your retirement planning strategy. One of the most significant benefits is the hedge against inflation that Physical gold offers.

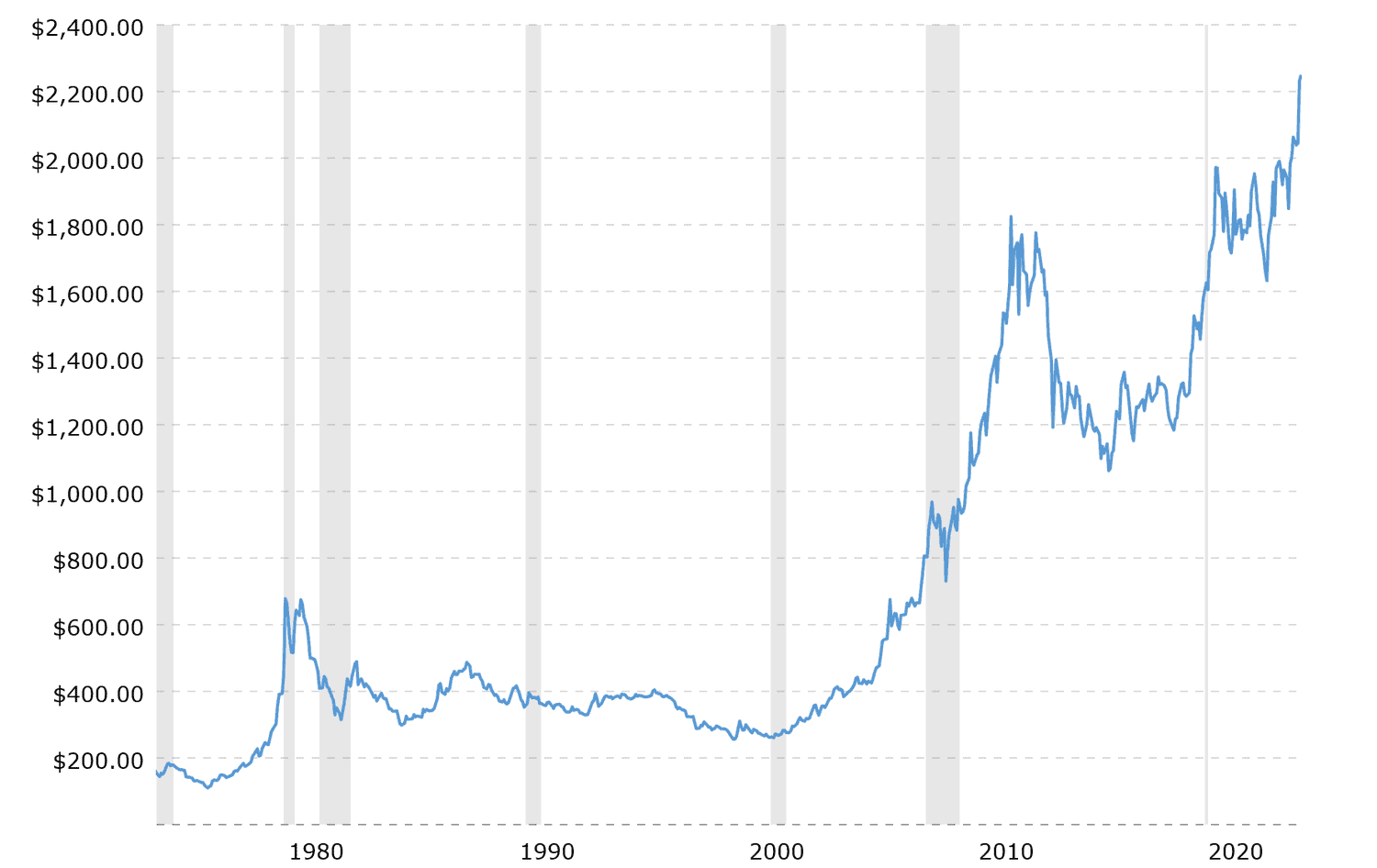

Over the years, gold has proven to be a reliable store of value, often retaining its purchasing power even when fiat currencies fluctuate. In this chart, you can take a look at the prices of Gold in history, and especially nowadays after Trump elections (2025), the price of gold is still raising due to the demand, consequent to Trump's new politics.

Gold Prices along history chart. Source: Investopedia

As inflation rises, the value of gold usually mirrors this increase, allowing investors to protect their wealth. This characteristic makes gold an attractive option for those seeking to safeguard their retirement savings from depreciation due to economic instability. The conclusion is that Gold stays stable, no matter what.

Another advantage of a Gold IRA is diversification. A well-diversified portfolio is essential for minimizing risk, and adding physical gold to your investment mix can help achieve this goal.

Gold typically has a low correlation with traditional assets such as stocks and bonds, meaning when those markets are underperforming, gold may remain stable or even appreciate in value. This diversification can provide a buffer against potential losses in other areas of your portfolio, ultimately leading to a more secure financial future.

Finally, investing in a Gold IRA allows for tax advantages that can be beneficial for retirement savers. Gold IRAs are classified as self-directed retirement accounts, meaning you can hold physical gold and other precious metals without incurring immediate tax liabilities. Here you can read another article concerning the main differences between gold and silver.

When you eventually withdraw funds from your Gold IRA during retirement, you only pay taxes on the distributions, allowing your investment to grow tax-deferred until you need to access it. This feature can significantly enhance your retirement savings strategy, making Gold IRAs an appealing option for long-term financial planning.

Factors to Consider When Choosing a Retirement Investment Company

When selecting a retirement investment company for your Gold IRA, several key factors warrant careful consideration. First and foremost, we advise you that it's essential to evaluate the company's reputation and credibility in the industry.

You must look for firms with a proven track record of successful operations, positive customer reviews, and a strong presence in the market. Researching third-party ratings, such as those from the Better Business Bureau or Trustpilot, can provide insight into the company's reliability and customer satisfaction levels.

Furthermore, another important factor is the fees associated with opening and maintaining a Gold IRA. In fact, we experimented that fees can vary significantly among different providers, and they can impact your overall investment returns. It's important to communicate clearly with the companies so that you can be sure that there won't be surprises.

In this article, you can find a complete guide about How to open a Gold IRA account.

In fact, common fees to consider include account setup fees, annual maintenance fees, storage fees for holding physical gold, and transaction fees for buying or selling gold. You must be aware of the fact you are purchasing a third-party service, and that it implies costs to sustain in the long-therm.

It’s crucial to understand how these fees will affect your investment over time and to choose a company that offers transparent pricing structures without hidden charges.

Lastly, consider the range of services offered by the retirement investment company. A reputable firm should provide comprehensive support, including educational resources to help you understand the nuances of Gold IRAs, personalized investment advice, and robust customer service options.

Additionally, ensure the company has a secure and efficient process for purchasing, storing, and managing your gold investments. We strongly advise you to do not be shy and ask detailed questions.

Moreover, you will have to be secure of the fact that there won’t be hidden costs during the process.

Tips for Selecting the Best Gold IRA Company

Choosing the right Gold IRA company is a critical step in securing your financial future. To ensure you make the best decision, start by conducting thorough research on potential firms. Look for companies with solid reputations, positive customer reviews, and a history of transparency in their operations.

Reading third-party reviews, checking with regulatory bodies, and seeking recommendations from trusted sources can help you identify reputable firms that prioritize client satisfaction and ethical practices.

Remember: their focus must be on client satisfaction above everything else.

Next, consider the level of customer service offered by the Gold IRA company. A good provider should offer responsive and knowledgeable support to help you navigate the complexities of investing in gold. Look for companies that assign dedicated account representatives to guide you through the process and answer any questions you may have.

Additionally, assess the availability of educational resources, such as webinars, articles, and personalized consultations, which can empower you to make informed investment decisions.

Finally, evaluate the company's storage and security options for your physical gold. A reputable Gold IRA provider should offer secure storage in a reputable depository, ensuring that your investment is protected.

Inquire about the insurance policies in place to safeguard your assets and confirm that the company complies with all regulatory requirements. By prioritizing these factors, you can confidently select a Gold IRA company that aligns with your investment goals and provides the necessary support for your retirement planning.

Common Misconceptions About Gold IRA Investments

Despite the growing popularity of Gold IRAs, several misconceptions persist that may deter potential investors.

First, one common myth is that gold investments are only suitable during times of economic crisis. While it is true that gold can provide a hedge against inflation and market volatility, it can also be a valuable long-term investment in any economic climate.

In fact, gold has historically maintained its value over time and can serve as a stable component of a diversified investment portfolio, regardless of market conditions.

Another misconception is that investing in a Gold IRA is overly complicated and only for wealthy individuals. In reality, Gold IRAs can be accessible to a wide range of investors. Many providers offer low minimum investment requirements, making it easier for individuals to start building their gold holdings.

Additionally, the process of setting up a Gold IRA has become more streamlined, with many companies providing comprehensive support to guide investors through each step.

Lastly, some individuals believe that Gold IRAs are not as liquid as other investment types, which can be a deterrent. While it is true that selling physical gold may take more time than liquidating stocks or bonds, reputable Gold IRA providers can facilitate the sale of your gold investments when necessary.

Furthermore, we have to stress again the fact that the value of gold tends to rise over time, making it a worthwhile long-term investment that can yield significant returns when the time comes to sell.

You might take a look at our Gold IRA Guide Article concerning this topic. Also, be sure to download our E-book, that will guide you through the entire process.

By dispelling these misconceptions, potential investors can gain a clearer understanding of the benefits and accessibility of Gold IRAs.

Conclusion: Making Informed Decisions for Your Retirement Investment Plan

In conclusion, planning for your retirement is a critical endeavor that requires thoughtful consideration and strategic investment choices. A Gold IRA offers a unique opportunity to diversify your retirement portfolio, protect against inflation, and secure your financial future.

As we approach 2026, it is essential to evaluate reputable Gold IRA providers to find one that aligns with your investment goals and offers the support you need for successful retirement planning.

By understanding the importance of retirement investments, the benefits of Gold IRAs, and the key factors to consider when choosing an investment company, you can make informed decisions that will positively impact your financial future.

We strongly advise you to take the time to compare fees and services, seek out expert advice with a reputable investment advisor, and educate yourself about the investment process. By doing so, you will be better equipped to navigate the complexities of retirement investing and set the stage for a secure and prosperous retirement.

Ultimately, investing in a Gold IRA can be a valuable addition to your retirement strategy, providing both stability and growth potential. As you embark on this journey, remember to remain vigilant in your research and continuously adapt your investment strategy to meet your evolving financial goals. With the right approach and the support of a reputable Gold IRA provider, you can confidently pave the way for a successful and fulfilling retirement.

As usual, we recommend paying attention to the IRS rules, plus, you have to take a look at this Article on Investopedia that will help you to have more insight about the topic.

Articles on all your favorite subjects

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.