Subscribe to get our FREE

GOLD IRA GUIDE

Gold IRA vs Silver IRA: Which Precious Metal is the Perfect Retirement Investment?

Are you considering investing in a precious metal IRA to secure your retirement? If so, you may be wondering whether gold or silver is the better choice.

Questioning about Gold IRA vs Silver IRA is legitimate, as both metals offer big advantages for investors. As we expressed already in our blog articles, both metals have long been regarded as safe havens during times of economic uncertainty and as we said in many articles, they have unique properties and potential for growth.

In this article, we will explore the differences between a gold IRA vs silver IRA so that we can help you to make an informed decision on which precious metal is the perfect retirement investment for you.

Why Gold ? Why Silver?

Historically, Gold has been the go-to choice for investors for centuries, prized for its rarity and resistance to corrosion. It has proven to be a reliable store of value and a hedge against inflation. On the other hand, we have to say that silver offers a more affordable entry point for investors and has a wide range of industrial applications, which can drive demand.

For this reason, we will delve into the historical performance of gold and silver, analyze the current market trends, and discuss the pros and cons of each metal for retirement investment purposes.

By the end of this article, we will give you a clear understanding of the benefits and considerations of investing in a gold or silver IRA to help you achieve your retirement goals. At the current moment, geopolitical tensions in raise, together with the changes in American politics, lead the more and more Americans to invest in precious metals to put their savings on a safe spot.

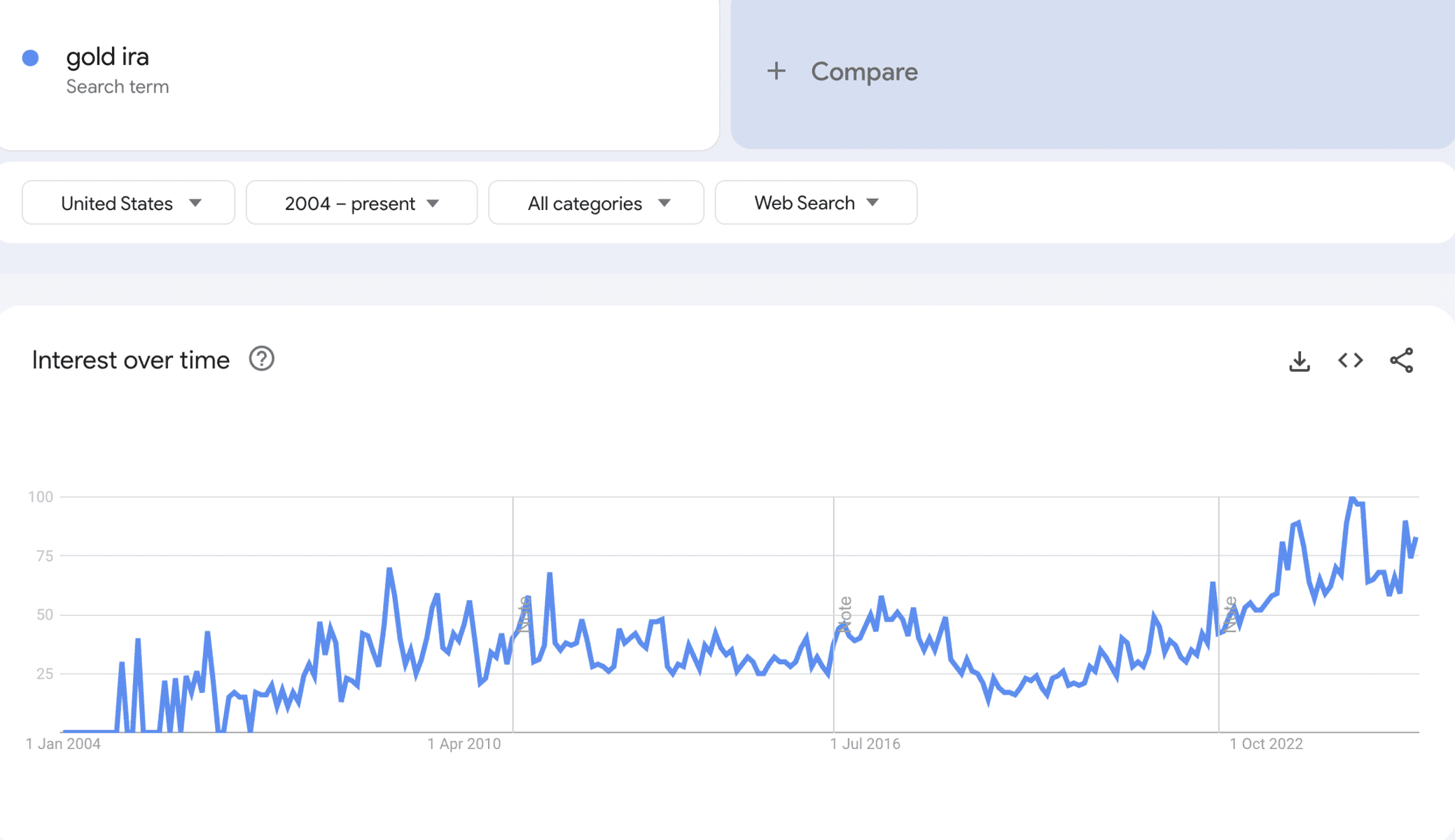

You can take a look here at this graphic, in which it is shown how the search intents for Gold IRA on Google have been in raise recently.

Understanding the differences between Gold IRA and Silver IRA

When it comes to investing in precious metals for retirement, we tell you that it's essential to understand the fundamental differences between a Gold IRA and a Silver IRA.

In fact, both offer unique benefits and have their own set of risks, making them suitable for different types of investors.

But how to have the correct information about this intricate topic?

Let’s start by saying that a Gold IRA allows individuals to invest in physical gold as part of their retirement portfolio, while a Silver IRA focuses on physical silver.

The choice between the two often depends on personal financial goals, market conditions, and individual preferences. Let’s explore them together.

Distinction: Gold VS Silver

The primary distinction between the two lies in the metals themselves. In fact, gold is often viewed as a more stable investment due to its historical performance and status as a hedge against inflation.

Furthermore, it is rarer than silver, which contributes to its higher price per ounce.

In contrast, silver is more abundant and tends to be more volatile, making it susceptible to larger price swings. On the other hand, for investors looking for a lower barrier to entry, silver may present a more affordable option. In fact, it allows them to acquire more physical metal for the same amount of capital.

Additionally, the market dynamics for gold and silver differ significantly. Gold is primarily driven by investment demand and central bank purchases, while silver has a substantial industrial demand component, particularly in sectors like electronics and solar energy.

This industrial demand can influence silver prices in ways that gold prices may not be affected, and this is the main difference between the two metals. Understanding these differences is crucial in making an informed decision about which metal aligns better with your retirement investment strategy.

Historical performance of gold and silver as investment options

The historical performance of gold and silver provides valuable insights for potential investors. Gold has long been viewed as a reliable store of value, especially during economic downturns. Its price has generally appreciated over time, particularly in response to inflation and geopolitical uncertainty.

For instance, during the 2008 financial crisis, gold prices surged as investors sought safety in tangible assets. Over the past two decades, gold has appreciated significantly, making it a favored choice among those seeking stability in their retirement portfolios.

On the other hand, silver has experienced a more erratic price history. While it has seen substantial gains during bullish market conditions, it can also face sharp declines during downturns.

For example, in the early 1980s, silver prices reached an all-time high, only to plummet shortly after. However, silver's industrial applications have contributed to its price increases in recent years.

As technology advances and the demand for renewable energy grows, silver's role in solar panels and electronics becomes increasingly significant, potentially driving prices higher in the future.

Overall, both metals have proven to be valuable investments, but their historical performance differs in terms of volatility, price appreciation, and the factors influencing demand.

We have to say that understanding these historical contexts will help investors better assess how each metal might fit into their long-term retirement strategies.

Pros and cons of investing in a Gold IRA

Investing in a Gold IRA comes with several advantages that make it an appealing option for many retirement savers.

First, one of the primary benefits is the stability that gold provides. Historically, gold has maintained its value, especially during times of economic uncertainty.

This makes it an excellent hedge against inflation and currency devaluation, allowing investors to preserve their purchasing power over time. Furthermore, gold is widely recognized and accepted worldwide, making it a liquid asset that can be easily converted to cash when needed.

However, there are also drawbacks to consider when investing in a Gold IRA.

- One significant concern is the cost associated with purchasing and storing physical gold. Investors typically incur premiums over the spot price when buying gold coins or bars, and secure storage facilities may charge additional fees.

- Moreover, the potential for price volatility exists; while gold generally trends upward, there can be periods of stagnation or decline that may impact overall returns.

- Lastly, Gold IRAs are subject to regulations and restrictions, which can complicate the investment process and limit flexibility.

In summary, the decision to invest in a Gold IRA should weigh both its benefits and drawbacks. Understanding the long-term value proposition of gold, while considering the costs and regulatory implications, will enable investors to determine if this precious metal aligns with their retirement objectives.

Pros and cons of investing in a Silver IRA

On the other side of the spectrum, investing in a Silver IRA also presents its own set of advantages and challenges.

- In fact, one of the most enticing aspects of silver is its affordability compared to gold, making it an attractive option for investors with limited capital.

- This lower cost allows individuals to accumulate more physical silver for the same investment amount, increasing their exposure to the metal.

- Additionally, silver's role in various industrial applications can drive demand and potentially increase its value over time, especially as technology evolves and new uses are discovered.

- Despite these advantages, there are notable downsides to investing in a Silver IRA as well.

- The most significant concern is silver's price volatility, which can be greater than that of gold. While this can result in substantial gains during bullish periods, it can also lead to significant losses during downturns.

- Furthermore, the storage and insurance costs for physical silver can be higher due to its bulkiness compared to gold. Investors may find that as they accumulate silver, the associated costs can erode their overall returns.

- Ultimately, investing in a Silver IRA can be a rewarding venture, particularly for those who appreciate the potential for growth linked to industrial demand. However, weighing the pros and cons is essential to ensure that this investment aligns with your risk tolerance and retirement goals.

Factors to consider when choosing between Gold IRA and Silver IRA

When deciding between a Gold IRA vs Silver IRA, several factors should be considered to ensure that the investment aligns with your financial objectives.

- In fact, one of the most critical aspects is your risk tolerance. if you prefer a more stable investment with a long-standing history of preserving value, a Gold IRA may be more suitable.

- Conversely, if you're willing to accept a higher level of risk for the potential of greater returns, investing in a Silver IRA might be the better choice.

- Another essential factor is the investment horizon. If you plan to hold your precious metals for the long term, the historical performance of gold could provide a more comforting prospect for your retirement portfolio.

- However, if you anticipate needing to liquidate your investment sooner, the volatility of silver may present opportunities for short-term gains, albeit with increased risk. Evaluating your timeline can help narrow down which metal aligns better with your investment strategy.

- Additionally, consider the overall diversification of your retirement portfolio. A balanced investment approach often includes a mix of assets, and incorporating both gold and silver could provide a hedge against market fluctuations.

By analyzing your existing investments, you can determine whether adding a Gold IRA, a Silver IRA, or both would enhance your overall portfolio performance and risk management.

How to set up a Gold IRA or Silver IRA

Setting up a Gold IRA or Silver IRA involves several steps, beginning with selecting a reputable custodian. This financial institution will hold your precious metals and ensure compliance with IRS regulations.

When choosing a custodian, consider their fees, reputation, and experience in handling precious metal IRAs. It's crucial to conduct thorough research and read reviews to ensure that you are working with a trusted provider.

Once you have selected a custodian, the next step is to fund your IRA.

You can do this by rolling over funds from an existing retirement account, such as a 401(k) or another IRA, or by making a direct contribution. Be aware of the contribution limits and eligibility requirements, as these can vary based on the type of account and your financial situation. Your custodian will guide you through the necessary paperwork and ensure that your account is funded correctly.

After funding your account, you can begin purchasing your desired precious metals. Whether you choose gold, silver, or a combination of both, it’s vital to select IRS-approved products. These typically include bullion coins and bars that meet specific purity standards.

Once your metals are acquired, the custodian will handle their secure storage, ensuring that your investment is protected until you decide to withdraw or liquidate it in the future.

Tips for managing and maximizing returns on your precious metal IRA

Managing a precious metal IRA effectively requires ongoing attention and a strategic approach. One essential tip is to stay informed about market trends and economic indicators that influence the prices of gold and silver.

By keeping an eye on factors such as inflation rates, geopolitical events, and changes in industrial demand, you can make educated decisions about when to buy or sell your precious metals. This proactive approach can help you maximize returns and minimize potential losses.

Another critical aspect of managing your IRA is diversification.

While gold and silver can provide stability and growth, incorporating other asset classes into your retirement portfolio can further enhance returns and reduce overall risk. Consider balancing your investments with stocks, bonds, and real estate to create a well-rounded portfolio.

This diversification strategy can help you weather market volatility and achieve your long-term financial goals.

Lastly, be mindful of the costs associated with owning a Gold or Silver IRA. Storage fees, insurance, and transaction costs can add up, eroding your potential returns over time.

Regularly review your account statements and fees to ensure you are getting the best value for your investment. If necessary, consider transferring your IRA to a different custodian that offers lower fees or better services, allowing you to keep more of your hard-earned returns.

Expert opinions on Gold IRA vs Silver IRA

Expert opinions on investing in Gold IRAs vs Silver IRAs often reflect a consensus that both metals have their merits, but the choice ultimately depends on individual circumstances. Many financial advisors recommend gold for those seeking a stable, long-term investment with a history of preserving value during economic uncertainty.

Gold's reputation as a safe haven can provide peace of mind for retirees concerned about market fluctuations.

In contrast, some experts advocate for silver, particularly for younger investors or those looking to capitalize on industrial demand. Silver's lower price point allows for greater accumulation, and its diverse applications mean that demand could surge in the future.

Additionally, analysts often highlight silver's potential for substantial price appreciation during bullish markets, making it an intriguing option for risk-tolerant investors.

Ultimately, seeking diverse perspectives from financial professionals can help clarify your investment strategy. Engaging with experts who have experience in precious metals can provide valuable insights, helping you weigh the pros and cons of each option and make informed decisions that align with your retirement goals.

Conclusion and final thoughts on the best retirement investment option

In conclusion, both Gold IRAs and Silver IRAs offer compelling opportunities for retirement investors looking to diversify their portfolios with precious metals. Gold is often viewed as the safer option, providing stability and a hedge against inflation.

Its historical performance and global recognition as a valuable asset make it a preferred choice for those seeking security in their retirement savings. However, the allure of silver lies in its affordability and potential for industrial demand-driven growth, appealing to those willing to embrace a higher level of risk.

Ultimately, the best retirement investment option depends on individual financial goals, risk tolerance, and market conditions. By carefully considering the unique properties of each metal, understanding their historical performance, and aligning them with your investment strategy, you can make an informed decision.

Whether you choose a Gold IRA, a Silver IRA, or a combination of both, the key is to stay informed and actively manage your investments to maximize returns and secure your financial future. As you prepare for retirement, remember that precious metals can play a vital role in achieving your long-term financial objectives.

We advise to you to take a look at the IRS Guidelines. Also, this article on Investopedia might help to have further information.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.