The 1997 Taxpayer Relief Act: How It Made Precious Metals IRAs a Powerful Retirement Tool

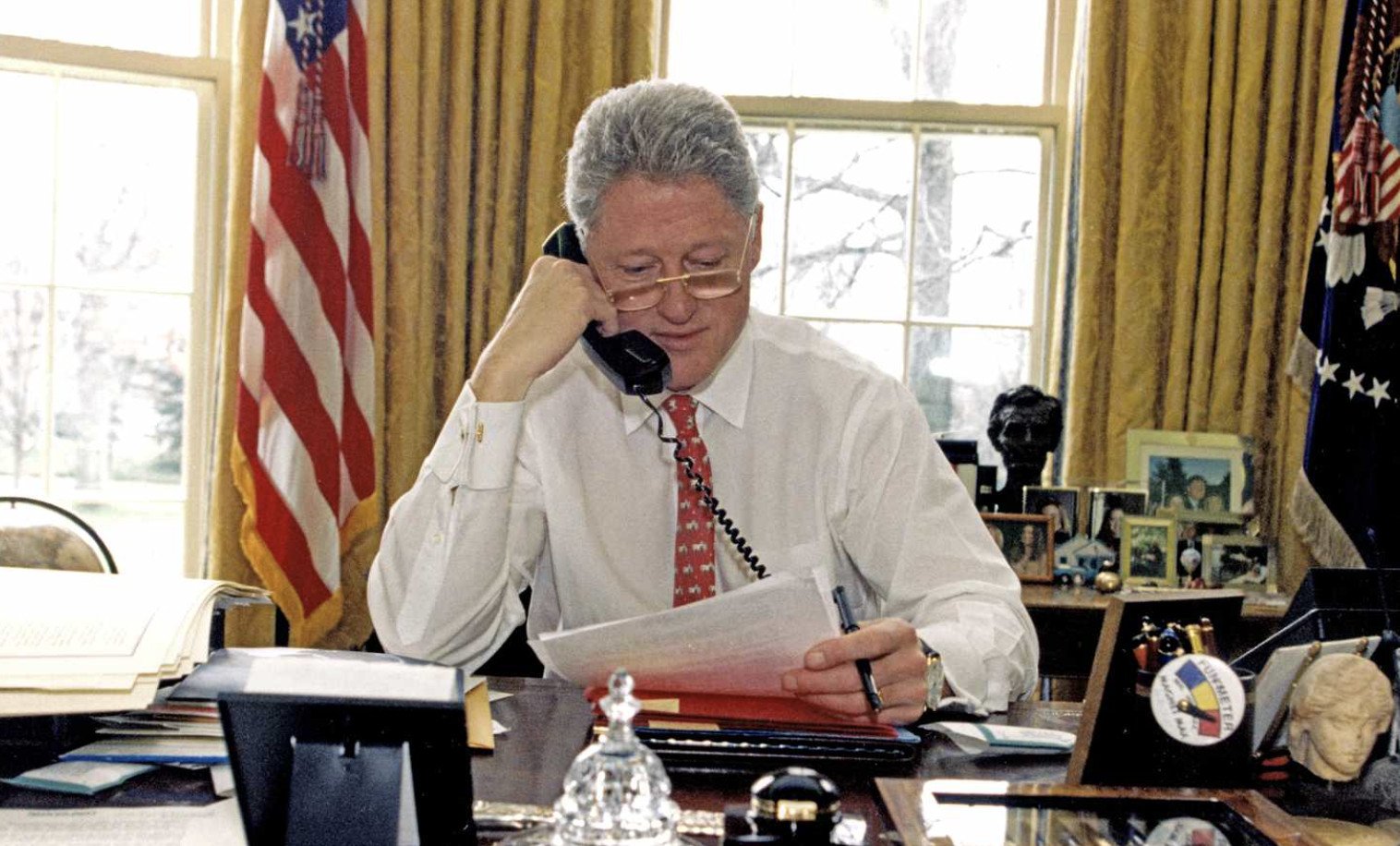

The Taxpayer Relief Act of 1997 was one of the most comprehensive tax reform laws of its time. Signed into law by President Bill Clinton, it introduced a series of measures aimed at reducing the tax burden for individuals and families.

Among its most impactful provisions were the creation of the Roth IRA, expanded eligibility for traditional IRA contributions, reduced capital gains tax rates, and new tax credits for higher education.

Critically for retirement investors, the Act also authorized the inclusion of certain physical precious metals such as gold, silver, platinum, and palladium within self-directed Individual Retirement Accounts.

Before this reform, retirement accounts were limited to traditional paper-based assets like stocks and bonds. By allowing qualified precious metals, the law effectively created the Precious Metals IRA, giving Americans a new way to diversify their portfolios with tangible, inflation-resistant assets.

In a financial landscape marked by inflation, market volatility, and currency risk, this form of IRA provides a strategic hedge and long-term value preservation.

This article explores how the 1997 Act reshaped retirement planning in the U.S., why its impact still matters in 2025, and how investors can use a Precious Metals IRA to build a more resilient and diversified retirement strategy.

Key Takeaways:

- The Taxpayer Relief Act of 1997 introduced major tax reforms, including reduced capital gains taxes, education credits, and the creation of the Roth IRA.

- One of its most impactful changes for investors was the authorization of precious metals—gold, silver, platinum, and palladium—within self-directed retirement accounts.

- This provision led to the emergence of the Precious Metals IRA, offering Americans a tangible, IRS-compliant alternative to traditional paper-based assets.

- A Precious Metals IRA helps hedge against inflation, diversify retirement portfolios, and maintain long-term purchasing power in times of economic uncertainty.

Benefits of Investing in Precious Metals

Including precious metals in your retirement portfolio, thanks to the 1997 Taxpayer Relief Act, offers three core benefits: inflation protection, crisis resilience, and long-term growth potential.

- First, precious metals like gold and silver tend to hold their value when inflation rises. Unlike paper currency, which loses purchasing power over time, gold has maintained its real value for centuries. A Precious Metals IRA lets you hedge against inflation by anchoring part of your portfolio in physical assets that don’t depreciate with the dollar.

- Second, during periods of financial or geopolitical instability, precious metals act as a safe haven. When markets are under pressure, investor demand for gold and other metals typically increases. This demand can cushion your portfolio against sharp downturns, offering stability when stocks and bonds are falling.

- Third, precious metals offer the possibility of long-term price appreciation. While they can be volatile in the short term, gold and silver have shown steady growth over decades. As part of a self-directed IRA, these assets provide not only potential returns but also the security of being physical and not tied to the credit risk of institutions.

In short, a Precious Metals IRA combines tangible security with strategic diversification, making it a useful addition for investors concerned about long-term financial stability.

Key Provisions of the Taxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 introduced a critical change to U.S. retirement law: it allowed certain physical precious metals to be held in Individual Retirement Accounts (IRAs). Before this legislation, IRA investments were limited to paper-based assets such as stocks, bonds, and mutual funds.

With the new law, investors could add physical gold, silver, platinum, and palladium, provided they met specific purity standards, directly into their retirement portfolios.

This marked a shift toward broader asset diversification within tax-advantaged accounts. To ensure quality and prevent fraud, the Act specified minimum fineness requirements for eligible metals. For example, gold must be at least 99.5% pure, silver 99.9%, platinum 99.95%, and palladium 99.95%. Only coins and bars that meet these standards can be held in a Precious Metals IRA, and they must be stored in an IRS-approved depository.

Beyond precious metals, the Act introduced other significant reforms. It reduced capital gains tax rates, raised income limits for deductible IRA contributions, and created the Roth IRA, a retirement vehicle allowing for tax-free withdrawals under certain conditions.

In short, the Taxpayer Relief Act of 1997 expanded the tools available for retirement planning. By enabling Americans to diversify their IRAs with tangible assets like precious metals, it added a layer of financial protection that is still relevant today, especially in times of economic volatility.

How a Precious Metals IRA Works

A Precious Metals IRA is a self-directed retirement account that holds physical gold, silver, platinum, or palladium instead of paper assets. Setting one up requires working with a custodian authorized to handle alternative investments.

This custodian opens your self-directed IRA, ensures IRS compliance, and coordinates the purchase and storage of your metals.

You can fund the account through a rollover from an existing IRA, 401(k), or other eligible retirement plan. Once funded, you instruct the custodian to purchase IRS-approved metals, which are then stored in a secure, IRS-approved depository. You cannot hold the metals yourself because doing so would violate IRS rules and result in penalties.

To qualify, metals must meet minimum fineness standards:

- Gold: 99.5% pure

- Silver: 99.9% pure

- Platinum: 99.95% pure

- Palladium: 99.95% pure

Only specific bullion coins and bars are allowed—such as the American Gold Eagle or Canadian Maple Leaf—while collectibles or rare coins are excluded.

One advantage of a Precious Metals IRA is that you can choose to take in-kind distributions. After age 59½, you may withdraw physical metals rather than selling them for cash. This allows you to retain ownership of tangible assets well into retirement, offering both flexibility and long-term security.

Steps to Set Up a Precious Metals IRA

1. Choose a specialized custodian

Start by selecting an IRA custodian authorized to handle physical precious metals. The custodian must offer self-directed IRAs and have experience managing gold, silver, platinum, and palladium accounts. Focus on firms with a proven track record and transparent fees.

2. Open a self-directed IRA

Once you’ve selected a custodian, you’ll open a self-directed IRA, which allows alternative investments beyond stocks and bonds. The application process requires standard identification and financial details. If you already have a retirement account, indicate whether you plan to roll over funds.

3. Fund the account

You can fund your Precious Metals IRA in two ways:

- Rollover: Transfer funds from an existing IRA, 401(k), or similar account. This is a tax-free, penalty-free transaction if done properly.

- Direct contribution: Deposit new funds into your IRA, subject to annual IRS limits.

The custodian will help you complete the transfer paperwork and ensure funds move securely into your new account.

4. Select and purchase metals

After funding, you can buy IRS-approved metals. The custodian will provide a list of eligible coins and bars that meet required purity standards. You choose the assets, and the custodian executes the purchase on your behalf.

5. Store the metals in an approved depository

All metals must be held in an IRS-approved storage facility. Your custodian will coordinate insured storage and provide regular statements. You cannot take personal possession of the metals while they remain in the IRA.

Common Mistakes to Avoid with a Precious Metals IRA

Even though a Precious Metals IRA can strengthen your retirement plan, it’s important to avoid common errors that could reduce its effectiveness or trigger IRS penalties.

1. Overconcentration in metals

Precious metals are a hedge, not a complete strategy. Allocating too large a portion of your portfolio to gold or silver can expose you to unnecessary risk. Diversification remains essential—even within a self-directed IRA. Maintain a mix of asset classes to ensure stability and long-term growth.

2. Ignoring IRS rules

The IRS imposes strict rules on which metals are eligible, how they must be stored, and how distributions work. Mistakes, like buying non-approved coins or holding metals personally—can result in the disqualification of your IRA and major tax consequences. Work only with a custodian experienced in Precious Metals IRAs, and verify that all purchases meet IRS criteria.

3. Falling for scams

The precious metals market attracts bad actors. Be wary of aggressive sales tactics, unverified dealers, or “limited-time” offers that promise unrealistic returns. If the price is far above spot value or the metal is not IRS-approved, it’s a red flag. Always use vetted custodians and licensed, reputable bullion dealers.

Staying informed and cautious helps ensure your Precious Metals IRA remains compliant, secure, and aligned with your long-term financial goals.

The Future of Precious Metals Investing and the Role of IRAs

Precious metals continue to play a vital role in long-term portfolio protection, especially in an environment shaped by inflation, geopolitical risk, and fiscal expansion. The original intent of the Taxpayer Relief Act of 1997, to diversify retirement portfolios with tangible assets, remains highly relevant nearly three decades later.

Gold remains a preferred hedge against currency devaluation, particularly as central banks maintain loose monetary policies. Similarly, silver’s growing use in solar energy and industrial applications, and platinum and palladium’s role in automotive and hydrogen technologies, are likely to support long-term demand across sectors.

For retirement investors, this reinforces the strategic value of a Precious Metals IRA. As economic cycles evolve, physical assets offer a level of protection and optionality that paper-based investments cannot.

Moreover, investors increasingly value direct ownership and transparency, two features that physical metals provide within a properly structured self-directed IRA.

Looking ahead, the combination of global economic uncertainty and industrial demand makes precious metals a relevant component of any diversified retirement plan.

The Precious Metals IRA, made possible by the 1997 Act, is still one of the most effective tools for accessing these benefits in a tax-advantaged way.

check out our

Latest Articles...

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.