The Ultimate Guide to Choosing the Right Silver IRA Custodian

The precious metals sector has long been considered an evergreen market, one that continues to gain momentum. As said in many previous articles, the times we are living in are very uncertain.

Therefore, many investors are turning to precious metals, and silver in particular, as a way to diversify their portfolios. Silver’s relatively lower price compared to gold makes it an attractive entry point.

As a result, navigating the complexities of IRAs can be challenging. As we’ve discussed in previous articles on the subject, the rollover process to a self-directed IRA is typically handled by an external company, and a qualified custodian must be involved.

So how do you choose the right custodian for your silver IRA? And what criteria should you be looking at to make a confident, informed decision?

Key Takeaways:

- Choosing the right silver IRA custodian is essential to ensure your investment complies with IRS rules and is stored securely in an approved depository.

- Reputation and transparency matter. Look for custodians with a proven track record, clear communication, and positive independent reviews.

- Fee structures can vary widely. Understand setup, maintenance, and storage costs—flat fees vs. percentage-based models can significantly impact your long-term returns.

- Storage options affect both cost and peace of mind. Decide between segregated or commingled storage based on your security preferences and budget.

Understanding Silver IRAs: What You Need to Know

Silver IRAs are a type of self-directed individual retirement account that allows investors to include physical silver in their retirement portfolio. This kind of investment provides a tangible hedge against market volatility and inflation, thanks to the intrinsic properties of silver as a precious metal.

These accounts follow the same contribution limits and tax advantages as traditional IRAs, but they require a custodian to ensure legal compliance and to arrange for secure storage of the metal.

The custodian plays a key role in handling the paperwork, managing transactions, and making sure the investment remains fully compliant with IRS regulations.

Silver IRAs are particularly appealing to investors looking to diversify with a hard asset that has historically maintained its value over time.

How to Choose a Custodian for Your Silver IRA

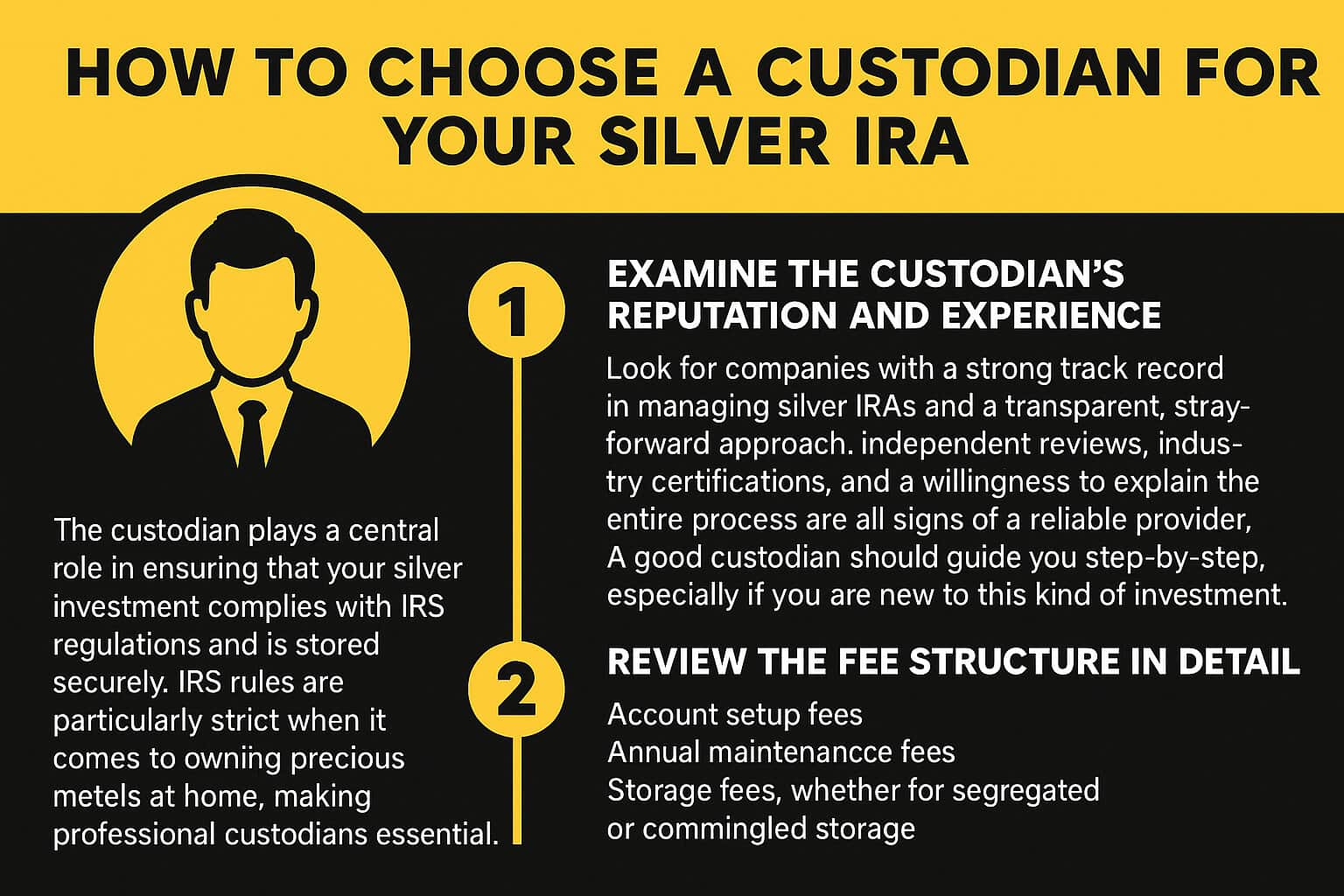

The custodian plays a central role in ensuring that your silver investment complies with IRS regulations and is stored securely. IRS rules are particularly strict when it comes to owning precious metals at home, making professional custodians essential.

These are specialized companies that understand the legal and logistical requirements of holding physical silver within a retirement account. They handle the heavy lifting, processing paperwork, coordinating with approved depositories, and keeping everything aligned with IRS guidelines, so you can focus on evaluating your investment with less stress.

Here’s how to approach the selection process effectively.

- First, examine the custodian’s reputation and experience. Look for companies with a strong track record in managing silver IRAs and a transparent, straightforward approach. Independent reviews, industry certifications, and a willingness to explain the entire process are all signs of a reliable provider. A good custodian should guide you step-by-step, especially if you are new to this kind of investment.

- Second, review the fee structure in detail. Some custodians charge a flat annual fee, while others base their fees on a percentage of your total account value. These differences can have a major impact on your returns over time, so it’s important to ask about:

- Account setup fees

- Annual maintenance fees

- Storage fees, whether for segregated or commingled storage

Silver IRA Storage Options

According to IRS regulations, any silver held within an IRA must be stored in an approved depository. Storing it at home is not allowed under any circumstance.

Most custodians offer two main storage options.

- The first is segregated storage, where your silver is kept in a dedicated space under your name. This option usually comes at a higher cost, but it offers a greater level of transparency and security.

- The second option is commingled storage, where your silver is stored together with that of other investors. While this solution is more cost-effective, it may feel less personal and secure, depending on your expectations.

Ultimately, the choice between segregated and commingled storage will depend on your priorities when it comes to cost, control, and peace of mind.

Some of the most widely used IRS-approved depositories for silver include

- Brink’s Global Services

- Delaware Depository Service Company,

- HSBC Bank USA

- JPMorgan Chase Bank NA

- ScotiaMocatta Depository

- CNT Depository

Comparing Fees and Charges of Different Custodians

Understanding and comparing fee structures is crucial to avoid hidden costs that could erode your returns over time. Most custodians apply a combination of fees, and knowing exactly what you’re being charged for will help you make more informed decisions.

Typically, you can expect a one-time setup fee when opening your IRA account. Annual maintenance fees are also standard and may vary based on the size of your account or be charged as a flat rate. Storage fees depend on how your silver is held—some are based on the total value or weight, others are fixed, depending on the storage provider and the type of storage you choose. Transaction fees may also apply whenever you buy or sell silver within the IRA.

To avoid surprises, it’s essential to ask for a complete and transparent fee breakdown before committing to any custodian. This allows you to accurately calculate the long-term cost of maintaining your silver IRA.

Evaluating Custodian Reputation and Trustworthiness

Choosing a custodian you can trust is fundamental. Start by reading independent reviews and client testimonials to get a sense of the company’s reputation. Look into their history in the industry and verify how long they’ve been managing silver IRAs.

It’s also wise to check for any regulatory actions or complaints filed with institutions, like the Better Business Bureau (BBB) or the Financial Industry Regulatory Authority (FINRA). These sources can reveal red flags that may not be visible at first glance.

A reliable custodian will provide clear and honest communication, be transparent about their processes and pricing, and demonstrate a commitment to high ethical standards in everything they do.

The Role of Customer Service in Your Custodian Choice

The quality of customer service can significantly influence your overall experience. A custodian that offers prompt, knowledgeable, and personalized support is invaluable, especially if you’re new to precious metals investing.

Look for indicators such as timely responses to your inquiries, access to educational resources, and the availability of dedicated account managers. These factors show that a custodian is not just handling your assets but is also committed to helping you understand your investment and make confident decisions.

Regulatory Compliance and Security Measures

Compliance with IRS regulations is non-negotiable when it comes to managing a silver IRA. Your custodian must ensure that all transactions, documentation, and storage procedures strictly follow the rules to prevent penalties or disqualification of your IRA.

Security is another vital aspect. Reputable custodians store silver in approved depositories equipped with robust physical protection measures such as surveillance systems, access controls, and full insurance coverage.

But security doesn’t stop at the vault. In today’s digital age, it’s equally important to consider how your personal and financial data are protected. Look for custodians with solid cybersecurity protocols, including encryption, secure servers, and regular system monitoring.

Silver IRA Scams and Common Pitfalls to Avoid

Like any promising investment, silver IRAs come with real opportunities, but also real risks.

While investing in physical silver can add valuable diversification to your retirement portfolio, it's important to approach this space with a healthy dose of caution. Unfortunately, there are bad actors out there who target new investors with misleading claims and overpriced products.

One of the biggest red flags? Anyone who tells you that silver IRAs are “recession-proof” or guaranteed to make you rich.

In fact, no investment is completely immune to market shifts, and anyone promising otherwise is either misinformed or trying to sell you something at your expense.

Another common trap involves collectible or numismatic coins. Some brokers will aggressively push these high-markup items under the guise of them being rare or valuable. But in most cases, these coins are significantly more expensive than standard bullion—and far harder to resell at a profit. The reality is that you might never recoup the premium you paid, especially if you're buying from a dealer who marks them up excessively.

If your goal is long-term value and stability, it’s usually best to stick with IRA-approved silver bullion, not proof coins or collectibles. While proof coins and bullion may contain the same purity level, the difference lies in their pricing and purpose.

Bullion is designed for investment, while proof coins are minted for collectors and come with a much higher price tag.

We will talk completely about this topic on the next article. In the meantime, don’t forget to download our guide.

Conclusion

Choosing the right silver IRA custodian is one of the most important steps you can take in protecting and growing your retirement savings.

The right custodian won’t just store your silver, they will act as a long-term partner in safeguarding your investment. With the proper guidance and support, a well-managed silver IRA can offer both stability and diversification in uncertain economic times.

For a deeper dive into the topic, be sure to download our complete guide

Articles on all your favorite subjects

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.