The Ultimate Guide to Platinum IRAs for a Secure Retirement

As you approach retirement, securing your financial future becomes increasingly important. For this reason, one option worth considering is including platinum as a metal in your IRA.

While not as widely discussed as gold or silver, platinum offers similar benefits as a hedge against economic volatility, along with the prestige of holding a rare and valuable physical asset.

This is the reason why we’ll explore what Platinum IRAs are, how they work, and why they could be a smart addition to your retirement strategy. A Platinum IRA may help you build a more resilient, diversified portfolio for long-term financial security.

Key Takeaways:

- Platinum offers rare diversification

Unlike traditional IRAs focused on paper assets, Platinum IRAs let you hold physical platinum—a tangible, inflation-resistant asset that adds real-world balance to your portfolio. - Strong hedge against volatility

With limited supply and high industrial demand, platinum often retains or increases in value when markets drop, helping preserve purchasing power during uncertain times. - Self-directed flexibility with long-term benefits

Platinum IRAs require a hands-on approach with a specialized custodian, but they offer more control and potential for tax-deferred growth, rollovers, and estate planning advantages. - Ideal for investors seeking resilience

If you value protection, real assets, and a hedge against systemic risk, a Platinum IRA can be a powerful tool to build a stable, growth-ready retirement strategy.

Understanding Platinum IRAs: What They Are and How They Work

A Platinum IRA is a type of self-directed retirement account that allows you to invest in physical platinum, which is an asset known for its scarcity, industrial demand, and ability to retain value.

Traditional IRAs are generally limited to stocks, bonds, or mutual funds. On the other hand, a Platinum IRA gives you the option to diversify by adding tangible assets, just as many investors have done with gold or silver.

These accounts are managed by specialized custodians who handle the purchase and secure storage of IRS-approved platinum bullion or coins. The metals must meet strict purity requirements and be stored in a certified depository to remain compliant with IRS rules.

As with other precious metal IRAs, setting one up involves selecting a custodian, funding the account, choosing approved platinum products, and arranging secure storage.

A Platinum IRA gives you direct ownership of a physical asset, one that has historically maintained or increased in value during times of economic uncertainty, often at a lower price point than gold or silver.

The Benefits of Investing in Platinum for Your Retirement

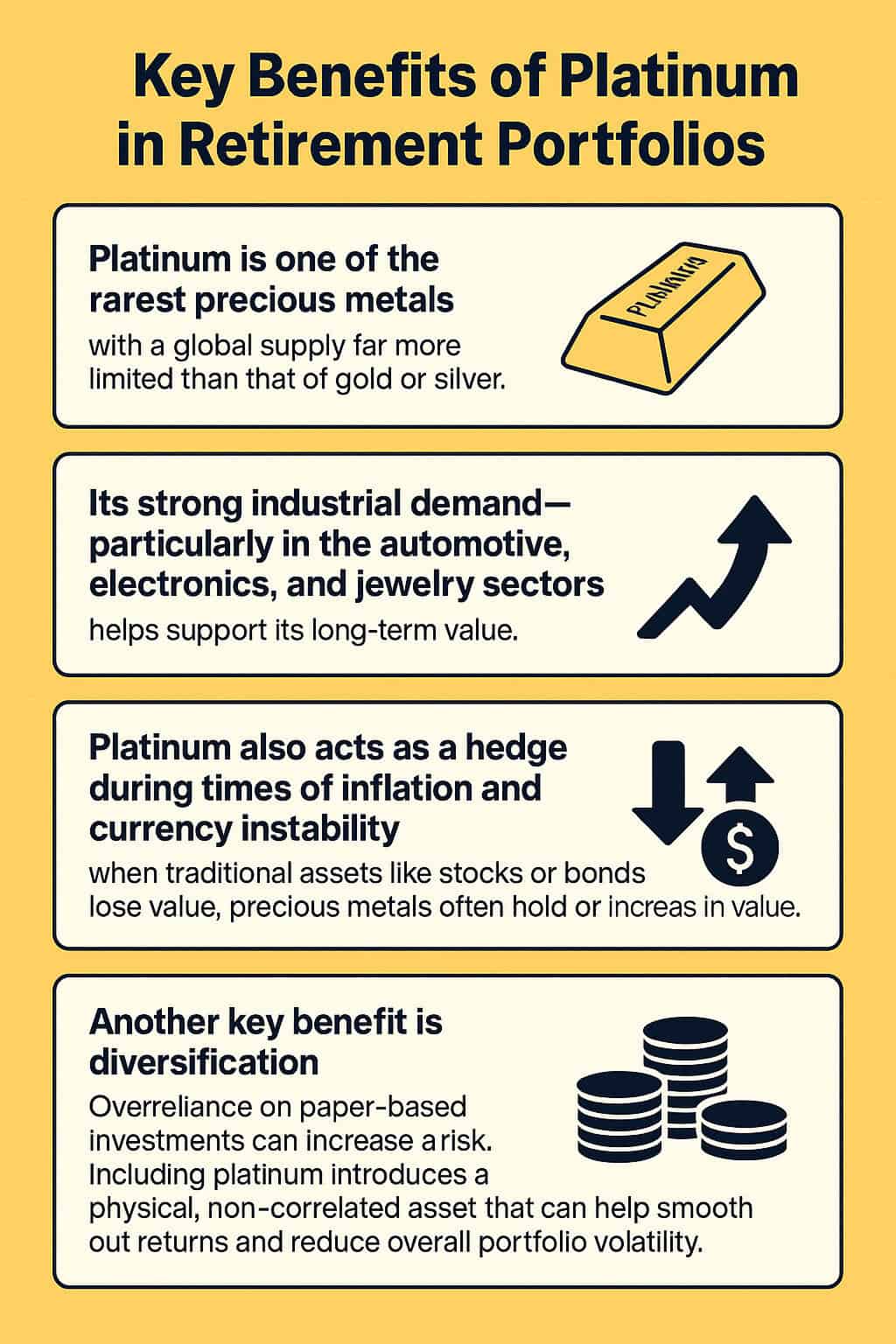

Adding platinum to your retirement portfolio offers several clear benefits, particularly in terms of preserving and potentially growing your wealth.

In fact, Platinum is one of the rarest precious metals, with a supply far more limited than that of gold or silver. Its strong industrial demand, especially in the automotive, electronics, and jewelry sectors. Therefore, it supports long-term value.

Platinum also acts as a hedge in times of inflation and currency instability. As discussed in previous articles on gold and silver, when traditional assets like stocks or bonds decrease in value, precious metals often hold or gain value.

For retirement investors, this makes platinum an attractive tool for protecting purchasing power and bringing added stability to an otherwise volatile portfolio.

Another major benefit is diversification. Over reliance on paper-based investments can increase risk exposure. Including platinum introduces a physical, non-correlated asset that can help smooth out performance and reduce overall portfolio volatility.

Comparing Platinum IRAs to Traditional and Roth IRAs

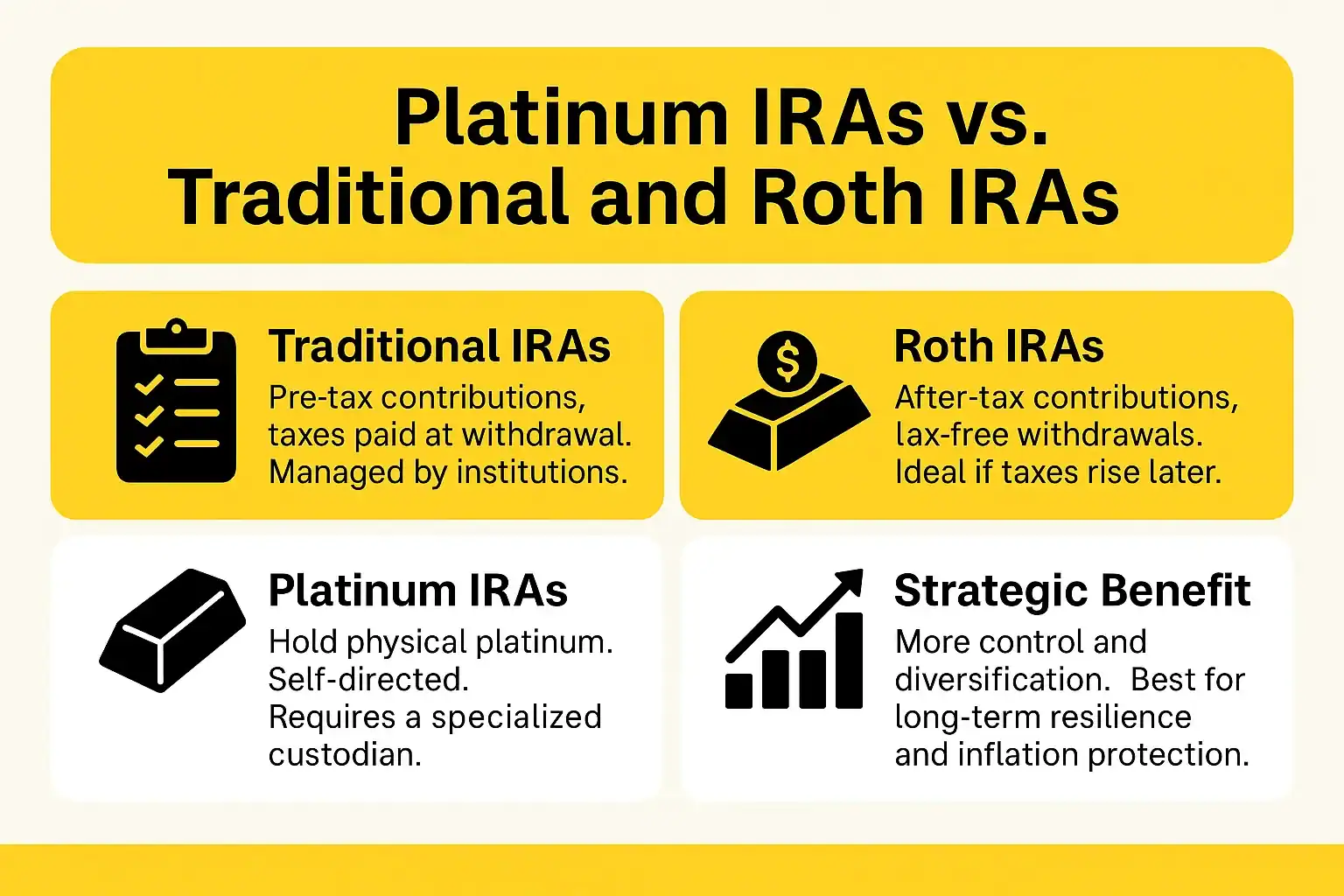

Before opening a Platinum IRA, it’s important to understand how it compares with more familiar options like traditional and Roth IRAs.

Traditional IRAs let you contribute pre-tax income and defer taxes until retirement withdrawals. Roth IRAs use after-tax contributions but offer tax-free qualified withdrawals, ideal for those expecting higher tax brackets in retirement.

The primary difference with a Platinum IRA lies in the asset class. While traditional and Roth IRAs focus on paper-based investments, Platinum IRAs allow you to hold physical platinum, offering a layer of diversification and inflation protection that standard portfolios often lack.

Platinum IRAs are self-directed, giving you more control over investment choices. However, this also means working with a specialized custodian who handles purchases, storage, and compliance.

Although this adds complexity, it provides direct access to a tangible asset. In contrast, traditional IRAs are typically managed by large financial institutions, making them more hands-off.

The best choice depends on your goals. If you prioritize diversification and resilience against market volatility, a Platinum IRA can be a strategic component, just be prepared to take a more active role and choose your custodian carefully.

How to Set Up a Platinum IRA: Step-by-Step Guide

Setting up a Platinum IRA is straightforward, but following the right steps is essential for compliance and effectiveness.

- Start by selecting a custodian with proven experience in self-directed IRAs and precious metals. Compare their services, fees, and reputation before committing.

- Next, open the account and complete the necessary documentation. You can fund your IRA through a rollover from a 401(k), traditional IRA, Roth IRA, or another qualified plan. Direct contributions are also possible, within annual limits. A good custodian will walk you through this process and help you avoid potential tax pitfalls.

- Once your account is funded, you’ll choose from a list of IRS-approved platinum products. The custodian will handle the purchase and ensure the metals are stored in a secure, IRS-approved depository.

Proper storage is a legal requirement to maintain tax-advantaged status, and your custodian will manage all documentation and compliance, allowing you to focus on long-term planning.

Choosing the Right Custodian for Your Platinum IRA

The custodian is a key partner in managing your Platinum IRA. They handle account administration, facilitate platinum purchases, and ensure everything complies with IRS rules.

Look for one with solid experience specifically in precious metals IRAs—not just general retirement accounts.

Some custodians offer only basic services, while others include portfolio support, educational tools, and strategic guidance. Choose a provider whose services align with your needs. Also, pay close attention to fees. High or hidden costs can reduce your returns over time.

Storage is another vital factor. Ensure your custodian works with IRS-approved depositories offering secure, insured storage with high safety standards, insurance coverage, and regular audits.

Knowing your assets are physically protected gives you greater peace of mind.

Diversifying Your Retirement Portfolio with Platinum

Diversification is at the heart of any strong investment strategy. Adding platinum to your retirement portfolio improves both its balance and long-term potential.

Platinum stands out due to its rarity and industrial utility, from car manufacturing to electronics to jewelry. These real-world applications help sustain demand, supporting its value over time.

But platinum isn’t just about protection, it also offers meaningful growth potential. With limited global supply and expanding uses, it can perform well in the right market conditions.

Allocating part of your retirement savings to platinum positions your portfolio to benefit from future shifts, while helping reduce reliance on traditional asset classes.

Tax Implications and Advantages of Platinum IRAs

Platinum IRAs offer the same core tax benefits as traditional IRAs, tax-deferred growth. Your investments can compound over time without being reduced by annual tax obligations.

Another advantage is the ability to roll over funds from other retirement accounts, such as 401(k)s or Roth IRAs, into a Platinum IRA without incurring immediate taxes. This enables you to diversify into platinum without triggering a taxable event, as long as the rollover follows IRS guidelines.

Platinum IRAs can also offer benefits for estate planning. Assets held in the account can be passed on to beneficiaries, often with favorable tax treatment.

For instance, if your spouse inherits the account, they may be able to take over ownership without immediate tax consequences. These features make platinum a potentially valuable part of your legacy strategy.

Case Study: Rob’s Precious Metals IRA (Including Platinum)

Background

Rob rolled over his retirement account into a precious metals IRA (including platinum, gold, and silver). In early 2022—during a market downturn—he chose an in-kind distribution and walked away with a single check for all his holdings. Favorable metal prices meant his returns surpassed those of traditional IRAs. Later, he easily found a reputable buyer, enabling a quick liquidation process and efficient withdrawal

.

Key Takeaways

Holding physical platinum within the IRA provided real asset exposure and market resiliency.

The in-kind distribution avoided forced selling into a weak market.

Strong infrastructure via IRA custodian and precious metals dealer facilitated a smooth transaction.

Common Myths and Misconceptions About Platinum IRAs

Several misconceptions surround Platinum IRAs. One is that precious metal investing is only for the wealthy or experienced. In reality, Platinum IRAs are accessible to many investors, even those starting with modest funds or rolling over existing savings.

Another myth is that Platinum IRAs are too complicated to manage. While they do require a more active role than traditional IRAs, reputable custodians handle most of the complexity, including compliance and storage.

Lastly, some assume platinum only serves as a hedge, not a growth asset. But its limited supply and rising industrial demand suggest otherwise. With the right strategy, platinum can serve both defensive and growth roles within a retirement portfolio.

Tips for Maximizing Your Returns with Platinum Investments

To get the most out of a Platinum IRA, stay informed and apply a thoughtful strategy. Watch for key market drivers, economic conditions, interest rates, industrial demand, and global events can all affect platinum prices.

Diversify within your holdings. Bars often offer lower premiums, while coins may be easier to sell and can carry added value. A mix can give you flexibility and balance. We also created this page in which you can find general information about platinum in IRAs. It will be useful for you.

Reevaluate your strategy periodically. As markets shift or your goals change, consider adjusting your asset allocation or rebalancing your portfolio.

Staying proactive and working closely with your custodian can help keep your investments aligned with your objectives.

Conclusion: Is a Platinum IRA Right for Your Retirement Plan?

A Platinum IRA offers something unique: a physical, inflation-resistant asset with long-term growth potential. Its rarity, industrial demand, and safe-haven qualities make it an appealing option in today’s uncertain environment.

If you’re looking to diversify beyond traditional markets and add a layer of protection to your retirement savings, a Platinum IRA is worth serious consideration. While it requires more involvement, the long-term benefits, in terms of wealth preservation, inflation protection, and portfolio balance, can be substantial.

With the right custodian and a clear strategy, a Platinum IRA can become a valuable part of your overall retirement plan, helping you build security, resilience, and lasting peace of mind.

In the end, a Platinum IRA isn’t about following trends. It’s about building a retirement plan with real-world durability. With proper research and guidance, it can become a powerful tool in your long-term financial strategy, one that not only protects your savings, but positions them to grow in a changing world.

Latest Articles

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.