Palladium IRAs: A Practical Path to Diversifying Retirement Wealth

In an investment world mostly dominated by stocks, bonds, and real estate, the American investors are looking elsewhere, especially right now with the new war started with Iran and the following global economy consequences.

American look elsewhere not out of speculation, but out of a need for resilience. That’s where precious metals IRAs, and palladium IRAs in particular, come in.

In fact, Palladium is a rare metal with real-world demand, especially in sectors like automotive manufacturing and industrial technology. Its supply is limited, its uses are essential, and its price has reflected that volatility and value over time. For those thinking long-term, it offers something different: a physical asset with economic relevance.

Therefore, this guide will break down what a Palladium IRA is, how it works, and why you might take into consideration to add it to your retirement account.

Key Takeaways:

- What a Palladium IRA Is and How It Works

A practical breakdown of self-directed IRAs that hold physical palladium—how they’re structured, what the IRS requires, and why they’re gaining traction. - Types of Palladium Assets You Can Include

A comparison of eligible investment options—bullion bars, coins, and ETFs—along with pros, cons, and what to consider when building your IRA. - Tax Benefits and Compliance Essentials

A clear explanation of the tax advantages of traditional and Roth Palladium IRAs, plus key IRS rules you need to follow to avoid penalties. - How Palladium Compares to Other Precious Metals

A head-to-head analysis of palladium versus gold, silver, and platinum IRAs—helping you decide where it fits in your long-term retirement strategy.

What Is a Palladium IRA?

At its core, a Palladium IRA is a self-directed retirement account that lets you hold physical palladium instead of just traditional financial instruments. You’re not buying shares in a mining company, you’re buying and physically owning the metal itself, in the form of IRS-approved bars or coins, stored in a secure depository.

Why bother? Because traditional markets don’t always move in your favor. Holding physical assets like palladium can be helpful to protect you against inflation, currency erosion, and systemic risk. It’s not about predicting the future, It’s about not putting all your eggs in the same basket.

On the other hand, there are rules, of course. The metal has to meet purity standards. Storage must be handled by a qualified custodian. You can’t keep it in your safe at home. But once it’s in the account, it behaves like any other IRA asset: it grows tax-deferred until retirement withdrawals begin.

Why Palladium? Why Now?

Palladium belongs to the platinum group metals (PGMs), but its demand profile is different. It’s not just a luxury good, it’s used mostly for industrial applications. Nearly every gasoline-powered vehicle on the road needs a catalytic converter, and palladium is a key component in that system. Without it, emissions control breaks down.

But supply is tight. Most of the world’s palladium comes from just two countries, Russia and South Africa, both of which face ongoing production and geopolitical challenges. As a result, that imbalance between supply and demand has kept palladium valuable, and occasionally volatile.

For an investor thinking about the next 10 to 30 years, that matters. You’re buying scarcity, utility, and independence from the usual Wall Street machinery and the stock market itself.

How to Set Up a Palladium IRA

Opening a Palladium IRA isn’t complicated. The process is very similar to Silver IRA and Gold IRA as we described them in other articles, but it does require a few specific steps and some attention to detail.

Here's how to approach it.

1) Choose the Right Custodian

Not all IRA custodians handle physical metals. You’ll need one that specifically deals with self-directed IRAs and has experience managing precious metal holdings. Therefore, the custodian will be responsible for holding your palladium in an approved depository and ensuring everything stays compliant with IRS rules.

Look for firms with:

- A clear fee structure (no hidden storage or transaction costs)

- A track record in handling gold, silver, or palladium IRAs

- Solid customer support (you’ll want real people answering your questions)

- Transparent processes for buying and storing metals

Since you’re trusting them with long-term retirement assets, you must take into consideration that reputation matters.

2) Open and Fund Your Account

Once you’ve chosen a custodian, the setup begins. You’ll fill out an application, provide some basic ID and financial information, and then decide how to fund the account.

There are typically three funding options:

- Transfer: Move funds from an existing IRA with no tax consequences

- Rollover: Shift funds from a 401(k) or similar account (often after changing jobs)

- Direct contribution: Add fresh capital, within IRS limits

If you're unsure which route fits your situation best, the custodian company you will choose will walk you through it.

3) Choose Your Palladium Investment

With funds in place, it’s time to select your palladium assets. Most investors go with bullion bars or IRS-approved coins, physical metal held securely offsite. Some may also consider ETFs backed by physical palladium, although not all self-directed IRAs allow these.

Even though you don’t need to be an expert in precious metals pricing, you however should understand what you’re buying, how it’s stored, and what costs are involved. Your custodian (or a metal dealer they work with) should provide clear, objective options. They have to be oriented to provide you a clear and effective service, not only to sell you metals.

4) Keep Track Over Time

Palladium, like all commodities, moves with supply and demand. Keep an eye on long-term market trends, global production (especially in Russia and South Africa), and how policy shifts might affect industrial demand.

Even in a retirement account, you’re still the manager of your strategy. Check in periodically to make sure your holdings still fit your goals, and don’t be afraid to take the necessary adjustments if the landscape changes.

Types of Palladium Investments for Your IRA

When you open a Palladium IRA, you have more than one way to hold the metal. The most common options are physical bullion, government-issued coins, and in some cases, palladium-backed ETFs. Each comes with its own pros and trade-offs.

Physical Palladium Bullion

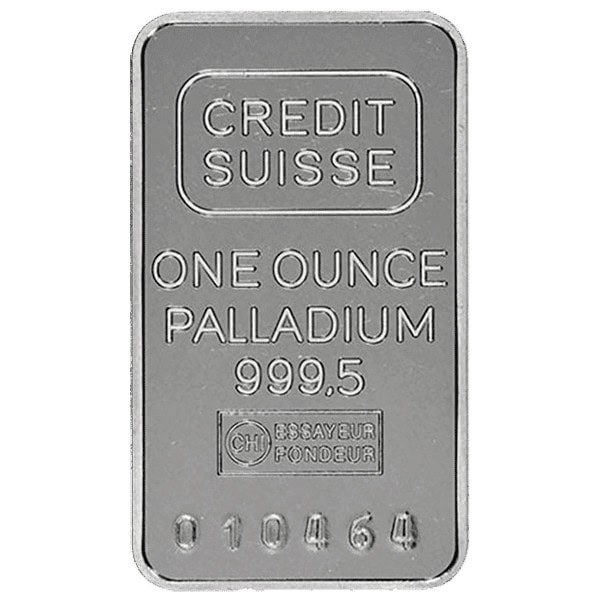

The simplest and most direct option is physical bullion, which practically are bars of palladium in weights ranging from one ounce to several kilos. These are not collectibles or derivatives: you're buying the metal itself.

In fact, holding bullion gives you pure exposure to the price of palladium. That means no added premiums for design or rarity, just the value of the metal itself, tracked closely to the global spot price.

To be IRA-eligible, the bars must meet the IRS purity standard of 99.95% and be sourced and stored through an approved custodian. You can’t store it at home, but the metal is yours, sitting in a secure vault under your name.

Palladium Coins

Another option is palladium coins from recognized government mints. The most well-known examples include:

- The Canadian Palladium Maple Leaf

- The American Palladium Eagle

These coins meet the same purity standards as bullion bars and are also eligible for IRAs, but they tend to carry slightly higher premiums due to their design, mintage, and collectibility. That extra value can work in your favor, especially if the coins become more desirable over time, but it also adds a layer of pricing complexity.

For some investors, coins offer a good balance: you're still holding physical palladium, but in a form that may retain additional market appeal beyond just metal weight.

Palladium-Backed ETFs

For those who prefer not to deal with physical storage at all, some custodians allow palladium-backed exchange-traded funds (ETFs) inside IRAs. These funds are backed by real palladium stored in vaults and traded like any stock.

They offer high liquidity and easy access, and you can buy or sell shares at any time through your brokerage. But there are trade-offs:

- Management fees can reduce long-term gains.

- Tracking errors may create a gap between the ETF price and the actual price of palladium.

- You don't actually own the metal, you own a share in a fund that holds it.

That’s not necessarily a problem, but it’s important to understand the difference.

Palladium vs. Other Precious Metal IRAs

Before deciding to focus on palladium, it’s worth comparing it to the other metals commonly held in IRAs, gold, silver, and platinum. Each offers a different role in a diversified portfolio.

Gold IRAs

Gold is the benchmark for precious metals in retirement accounts. Its reputation as a store of value spans centuries, and it tends to hold up well during economic shocks.

If your goal is long-term stability, gold is hard to beat. It doesn’t move as dramatically as palladium, which means less upside, but also less risk. The market is deep, liquid, and globally recognized. For many investors, gold is the foundation of their precious metals strategy.

Silver IRAs

Silver plays a dual role: it’s both a precious metal and an industrial input. That means its price is more sensitive to swings in manufacturing and tech demand. The upside? Higher volatility and potentially higher gains. The downside? You’re also taking on more risk.

Silver is cheaper per ounce, so your investment buys more volume, but that also means more storage costs and potentially more price swings. It can be a useful piece of the puzzle if you’re comfortable with a more dynamic profile.

Platinum IRAs

Like palladium, Platinum is a platinum group metal (PGM) with heavy industrial use, especially in catalytic converters and specialized manufacturing. It has similar supply constraints and geopolitical risk exposure.

The platinum market is smaller and less liquid than gold or silver, which can lead to sharper price shifts in both directions. Over the last decade, palladium has significantly outperformed platinum in terms of price growth, but that trend could shift again depending on shifts in demand, especially in the automotive sector.

For investors choosing between the two, it’s worth looking not just at past performance but at future supply chains, industry trends, and technological developments that might influence demand for each metal.

Tax Implications of Investing in a Palladium IRA

In addiction to all we said, A Palladium IRA comes with tax advantages, but only if you follow the rules. Understanding how the IRS treats these accounts is essential if you want to maximize long-term returns and avoid unpleasant surprises.

Tax-Deferred Growth with Traditional IRAs

If you open a traditional Palladium IRA, your contributions may be tax-deductible (depending on income and other retirement accounts). The real benefit, though, is tax deferral:

- No taxes are due on gains as long as the money stays in the account

- Taxes only apply when you withdraw funds in retirement, ideally at a lower tax bracket

This allows your palladium investment to compound over time without being eroded by annual taxes. The longer your horizon, the more this can work in your favor.

Tax-Free Growth with Roth IRAs

If you choose a Roth Palladium IRA, the rules flip:

- Contributions are made with after-tax money (no deduction today)

- But all future growth and qualified withdrawals are tax-free

This setup is especially useful if you expect your income, or tax rate, to rise in the future. In that case, paying taxes now in exchange for tax-free income later may be the smarter move.

Compliance Is Non-Negotiable

To maintain tax advantages, you must follow IRS guidelines:

- Palladium must be at least 99.95% pure

- It must be held in an IRS-approved depository (not at home or in a personal safe)

- All purchases must go through a qualified custodian

If these conditions aren’t met, the IRS can treat your metal as a distribution, triggering taxes and penalties. Working with a custodian who knows the terrain can help you stay compliant from day one.

Case Study: How Fund Manager Michael Gentile Earned +161% on Physical Palladium in Just 14 Months

A notable real-world example comes from Michael Gentile, a portfolio manager based in Montreal, who achieved a 161% return over 14 months by investing directly in physical palladium.

According to reports, Gentile:

Invested approximately $12.4 million in palladium in late 2018, when prices were around $1,100 per ounce

Sold his position in early 2020 at roughly $2,875 per ounce, realizing a gain of $21.1 million

Based his strategy on industrial demand forecasts (especially stricter emissions regulations in Europe and China) and supply-side disruptions in Russia and South Africa

Conclusion: Is a Palladium IRA the Right Fit for You?

To conclude what I wrote above, Palladium IRA isn’t for everyone, but it can be a smart move if you’re looking to diversify your retirement savings with a real asset that behaves differently from traditional markets.

Palladium’s unique mix of industrial utility, constrained supply, and global relevance makes it attractive in times of uncertainty. It’s a bet not just on metal, but on the demand for clean technology, supply chain friction, and the value of physical assets in a financial system heavily tilted toward paper wealth.

On the other hand, let’s be clear: this isn’t a guaranteed win. Palladium is volatile, its market is smaller and more concentrated than gold, and liquidity can vary. That’s why a Palladium IRA is best used as one component of a broader strategy, not the whole plan. It is smart to consider a percentage of palladium in your investment basket, together with other precious metals like gold or silver for example.

Furthermore, If you’re comfortable with the risks, clear on the regulations, and working with a qualified custodian, it can be a strong addition to a long-term portfolio, especially if you're aiming to hedge against inflation, currency erosion, or systemic shocks.

In conclusion, the key is alignment: if palladium fits your view of the future, your risk profile, and your retirement timeline, then it deserves serious consideration.

check out our

Latest Articles...

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.

Click HERE to download our free Gold IRA Guide in PDF

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.