Unlocking Wealth with IRA Approved Silver

Silver isn't just a shiny metal but, as said in the previous article, it's a proven hedge against inflation and an increasingly popular choice for long-term investors looking to protect their retirement savings.

Today, the more and more people are exploring IRA approved gold or silver as a way to secure their wealth and add real diversification to their portfolio. The main question is: which are the Silver they can add to their IRA and how to find it? Which are the most reputable companies to count on?

This guide will walk you through everything you need to know about silver IRAs, from which coins and bars are eligible to how to store them safely and legally within your retirement account.

In fact, understanding how silver fits into your broader investment strategy can make a real difference. Silver is maybe less popular than Gold, but equally full of opportunities.

Let’s break down the key steps, clear up common myths, and show you how to use silver to build a stronger financial future.

Key Takeaways:

- IRA approved silver must meet strict IRS purity standards of 99.9% and be stored in an authorized depository.

- Both silver bullion bars and government-minted coins are eligible, but collectibles and numismatics are not.

- Choosing a knowledgeable custodian is essential to ensure compliance, proper storage, and secure transactions.

- Including silver in your IRA can hedge against inflation, diversify your portfolio, and strengthen long-term retirement security.

What Makes Silver Eligible for Your IRA?

An Individual Retirement Account (IRA) is one of the most powerful tools for building long-term wealth, thanks to its tax benefits and flexible structure. But not every asset qualifies for inclusion.

In fact, the IRS has strict rules that define what can and cannot be held in a retirement account. While traditional options like stocks and bonds are commonly used, precious metals, including gold, platinum, and especially silver, are also allowed. But under specific conditions.

To be considered IRA approved, silver must meet a minimum purity level of 99.9 percent. This ensures that you're investing in high-quality bullion, not collectible or numismatic coins that carry speculative value.

Just as important, the silver must be stored in an IRS-approved depository, not at home or in a personal vault. This isn’t just a formality. It’s a legal requirement that ensures your investment remains compliant and secure.

Why Silver Belongs in a Diversified IRA

Silver may not be popular like gold, but its advantages are hard to ignore.

One of its biggest strengths is affordability. With silver priced far below gold per ounce, it opens the door for more investors to get started in precious metals, even with a modest budget. This lower cost makes it possible to build a meaningful position over time without committing large sums upfront.

But silver isn’t just a cheaper alternative. It plays a critical role in many modern industries, from solar energy and electric vehicles to electronics and medical technology.

This industrial demand gives silver a practical, real-world utility that adds to its long-term value. It’s not just a metal sitting in a vault, it’s being used, every day, across the globe.

Silver also acts as a strong hedge against inflation and currency devaluation. While fiat currencies can lose purchasing power during economic downturns, silver tends to hold steady or even increase in value.

By including IRA approved silver in your retirement portfolio, you add a layer of protection that traditional stocks and bonds simply can’t offer, because simply they are dependent on the stock market ups and downs.

“

Case Study

In 2020, during the early phase of the pandemic and market crash, silver prices surged over 140% from March to August, largely driven by investor demand and industrial usage recovery. One of the largest silver-backed ETFs, iShares Silver Trust (SLV), saw a massive influx of investment, signaling strong market interest in silver as both a safe haven and a growth asset.

👉 Source: Forbes - "Why Silver Is Outshining Gold”

What Types of Silver Are Approved for Your IRA?

Not all silver qualifies for IRA inclusion. The IRS has clear standards, and only specific forms of silver are considered eligible. These fall into two main categories: silver bullion and government-minted coins.

Silver bullion typically refers to bars and rounds made of .999 pure silver. These are valued strictly by their weight and metal content, with no added premium for collectibility or design.

Bars are available in a wide range of sizes, from one-ounce bars to larger 100-ounce options, allowing you to scale your investment as needed. Silver rounds look like coins, but are not legal tender. They offer a simple, cost-effective way to gain exposure to physical silver.

Silver coins, by contrast, carry additional trust and recognition. To be IRA approved, a silver coin must be minted by a government authority and meet the IRS’s minimum purity requirement of 99.9 percent. Among the most widely accepted are the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic. These coins are backed by sovereign governments, offering an added layer of legitimacy and investor confidence.

For your investments, a combination of both bullion and coins can help you balance cost-efficiency with credibility.

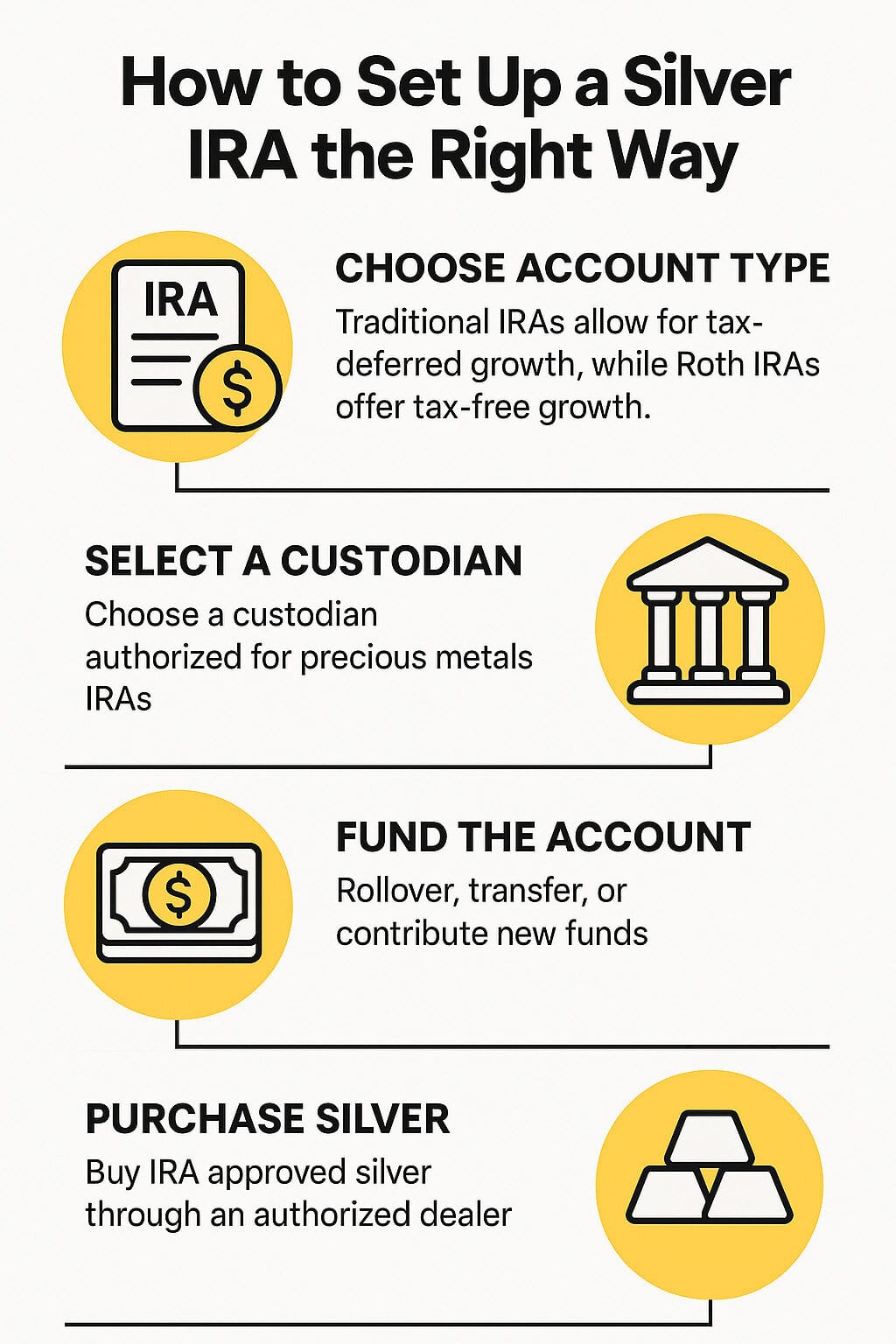

How to Set Up a Silver IRA the Right Way

Opening a Silver IRA might seem complex at first, but the steps are clear when you know what to expect. It all starts with choosing the right type of account.

Traditional IRAs allow for tax-deductible contributions and tax-deferred growth, while Roth IRAs offer tax-free growth and withdrawals. The best choice depends on your financial goals and tax situation.

Next, you’ll need to work with a custodian, a financial institution authorized to manage precious metals IRAs. Not all custodians handle physical silver, so make sure you choose one with experience in this space. They’ll also be responsible for arranging secure storage in an IRS-approved depository.

Once your custodian is selected, the account needs to be funded. You can fund it through a rollover from an existing retirement account, a transfer from another IRA, or new contributions.

After funding, you’ll be able to purchase IRA approved silver through a dealer authorized by your custodian. The purchased silver is then stored securely in a regulated vault.

With the right setup, your Silver IRA becomes a tax-advantaged way to diversify and strengthen your long-term retirement strategy.

How to Purchase Silver for Your IRA

Buying silver for your IRA doesn’t have to be complicated, but it does require following a precise process.

- After opening your account and selecting a trusted custodian, your next step is to review their list of IRS-approved dealers. These dealers specialize in precious metals that meet IRA requirements and are familiar with the legal and logistical standards you need to follow.

- Once you choose a dealer, you’ll decide what type of silver to buy. This includes approved silver coins like the American Silver Eagle or Canadian Maple Leaf, and bullion bars or rounds that meet the 99.9 percent purity standard. Your decision should reflect your budget, investment goals, and storage preferences. A balanced mix of coins and bullion can offer both flexibility and value.

- After you’ve made your selection, your custodian will handle the actual purchase and coordinate delivery to an IRS-approved depository. This ensures compliance at every step, and gives you peace of mind knowing your assets are held securely.

Tax Benefits of a Silver IRA

One of the strongest arguments for opening a Silver IRA is the tax advantage. In a Traditional IRA, your silver investments can grow over the years without being taxed annually. You won’t owe taxes until you begin taking distributions in retirement, giving your holdings time to compound and grow more effectively than in a taxable account.

There’s also the benefit of tax-deductible contributions. Depending on your income and filing status, you may be able to reduce your current tax burden by deducting what you contribute to your IRA. That frees up more capital for investment and puts more money to work in your retirement account.

If you opt for a Roth IRA, the benefits shift to the back end. You’ll contribute post-tax dollars now, but your gains and withdrawals in retirement are tax-free. That can be a powerful advantage, especially if you expect your tax rate to be higher in the future.

Beyond the tax perks, silver itself offers real-world value. As a tangible asset, it serves as a hedge against inflation and currency devaluation. Including IRA approved silver in your portfolio not only improves your tax position, but also adds a layer of security that traditional paper assets often lack.

Risks and Considerations in Silver Investments

While silver brings unique advantages to a retirement portfolio, it is important to understand the potential risks involved. One of the main concerns is price volatility. In fact, the value of silver can fluctuate significantly in response to market sentiment, geopolitical events, and shifts in industrial demand.

These price swings can impact your portfolio's performance, especially in the short term, making it essential to take a long-term view when investing in IRA approved silver.

Furthermore, Liquidity is another factor to keep in mind. Although silver is widely traded and generally considered a liquid asset, it may not convert to cash as quickly as stocks or bonds. This can pose a challenge if you need to access funds urgently, especially during periods of market stress. To manage this risk effectively, it’s important to assess the liquidity of your silver holdings and ensure you have a plan in place for emergencies.

Physical silver also requires secure storage, which often comes with added fees. Unlike digital assets, precious metals must be held in IRS-approved depositories that charge for safekeeping. Over time, these costs can eat into your overall returns. In addition, insuring your silver against theft or damage is not optional, it’s a smart way to safeguard your wealth.

Lastly, keep an eye on regulatory and tax developments. IRS rules surrounding IRA approved silver are strict, and any changes could directly affect your investment strategy. This is the reason why working with the right custodians is crucial: by working with a knowledgeable custodian and staying informed about evolving regulations, you’ll be better prepared to adjust your approach and protect your retirement assets.

Conclusion: The Future of Silver Investments in Your IRA

As you plan your retirement strategy, silver stands out as a compelling asset with long-term potential. Its combination of affordability, industrial relevance, and intrinsic value makes IRA approved silver a smart addition to a well-diversified portfolio.

To make the most of this opportunity, it's important to understand how silver IRAs work. From selecting the right type of silver and setting up your IRA to navigating tax benefits and complying with regulations, each step requires careful attention. By partnering with a reliable custodian and working with reputable dealers, you can ensure that your silver investments are secure, compliant, and aligned with your financial goals.

That said, no investment is without risks. Silver’s price can be volatile, liquidity may be limited in certain scenarios, and storage and insurance costs must be factored in. Moreover, regulatory changes could shift the landscape. Being prepared, staying informed, and working with experienced professionals will help you navigate these challenges effectively.

In the end, adding silver to your IRA is not just about diversification — it’s about building financial resilience. It allows you to hedge against inflation, reduce risk, and enhance the long-term strength of your retirement plan. Whether you're just beginning or refining an existing portfolio, understanding the power of silver investments can give you a strategic edge and greater confidence in your financial future.