Top Silver IRA Companies: is Silver Legit?

So far, we’ve been writing articles about gold, which is probably the most popular choice for investors looking to protect their capital from crises and other negative economic events.

However, it's important to mention that silver is often a valid alternative to gold, not only because of its price, but also due to its practical uses. Just because silver is less “popular,” it can offer more opportunities, as demand is less saturated.

As a result, this could translate into more attractive investment options.

In fact, silver is a timeless asset with both industrial and monetary appeal. It's also an excellent way to hedge against inflation and market volatility.

The real question is: how can you find the best way to invest in silver? And how can you identify the most reputable silver IRA companies to help you maximize your returns?

That’s exactly why we explored and reviewed the top silver IRA companies, so you can make an informed choice and get the most out of your investment.

What is a Silver IRA?

To answer to this question, we have to come back to the basics, exactly like we did in the previous articles.

Tu summarize: A Silver IRA is a type of self-directed retirement account that lets you hold physical silver, not just paper assets like ETFs or mutual funds.

What makes it stand out isn’t just the asset itself, but the level of control it gives you. You're not limited to stocks picked by a fund manager. When you decide to invest in silver, you decide to back your future with a metal that has both monetary and industrial value.

Contrarily to Gold, Silver has long played a dual role. It’s used in electronics, solar panels, and medical devices, while also being seen as a store of value. This combination makes it more than just a hedge.

While Gold tends to stay there and do not produce any concrete value, except its intrinsic value, Silver is a strategic asset that can respond to both market trends and technological demand.

Setting up a Silver IRA for you means working with a qualified custodian who helps you buy and store IRS-approved silver, usually in the form of .999 fine bullion bars or specific coins.

Then, the silver you buy is held in a secure depository, not at home, to stay compliant with tax rules.

As a result, when inflation erodes the value of cash and markets remain unpredictable, many investors see silver not as an alternative to gold, but as a complement.

This is because it offers growth potential with a lower entry point.

Why Add Silver to Your Retirement Portfolio?

One of the key reasons to invest in a Silver IRA is diversification. A well-balanced portfolio spreads risk, and silver can help you offset the ups and downs of paper-based assets like stocks and bonds.

Silver has a long history of holding its value during economic downturns. When markets drop and traditional investments lose ground, silver often moves in the opposite direction. This makes it a strong defensive asset for retirement planning.

Another important factor is inflation. Over time, the value of paper currency tends to decline. Silver, on the other hand, tends to hold its purchasing power. By including physical silver in your IRA, you help protect your savings from the silent erosion caused by rising prices.

Silver also brings something unique to the table: real-world demand. It is not just a store of value, it is a critical material used in electronics, medical devices, solar panels, and more. Unlike fiat money, silver cannot simply be created out of thin air. Its industrial applications give it a solid economic foundation, which supports its long-term value.

By holding silver in your retirement account, you benefit from its dual role as both a precious metal and a commodity with rising industrial relevance.

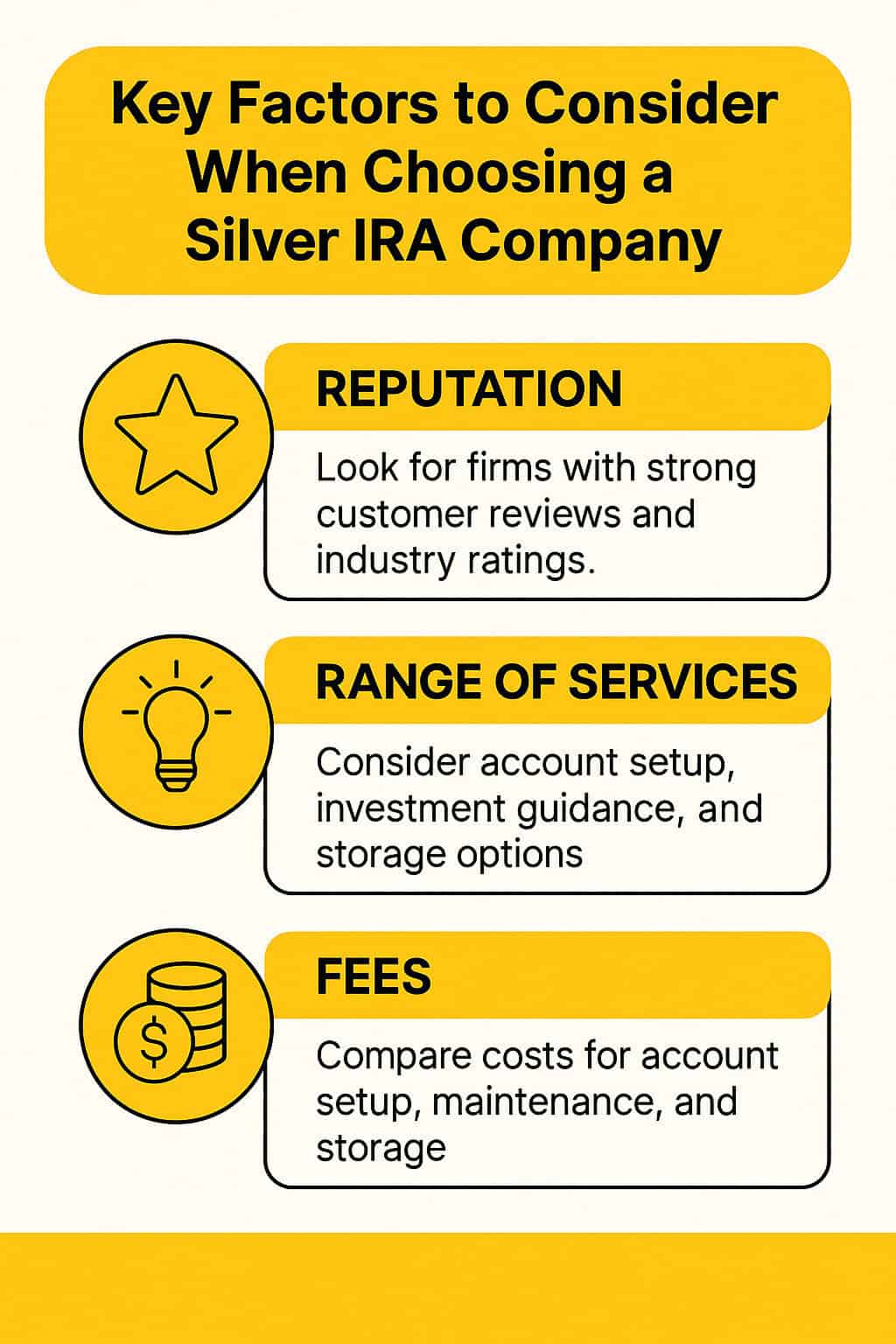

Key Factors to Consider When Choosing a Silver IRA Company

Choosing the right Silver IRA company is one of the most important steps in protecting and growing your retirement savings.

The first thing to look at is the company's reputation. Focus on firms with a solid track record in the industry, backed by strong customer reviews and high ratings from trusted sources. A reliable company will have clear feedback from real clients and a reputation built on transparency and trust.

Another essential factor is the range of services they offer. A good Silver IRA company should make the entire process easier, from setting up your account to helping you choose the right silver products.

Look for providers that also offer clear educational resources and ongoing support. Companies that take a complete, client-focused approach are more likely to help you stay informed and make the right decisions over time.

Lastly, don’t overlook the fees. These typically include account setup costs, annual maintenance fees, storage charges, and transaction costs. It’s smart to compare fee structures across different providers, but keep in mind that the cheapest option is not always the best. A slightly higher fee might come with better service, stronger security, or more personalized guidance.

Top Silver IRA Companies Overview

Here you can find an accurate selection of the most important companies, which also we are affiliated with. These companies have been chosen for their reputation, stability, attention to client and business history.

Comparing Fees and Services of Silver IRA Companies

When selecting a Silver IRA provider, it’s essential to look closely at both fees and services. Each company structures its pricing differently, so understanding what you’re paying for can make a real difference.

Common fees include account setup, annual maintenance, storage, and transaction costs. By comparing these across providers, you can find the most cost-effective option for your specific goals — without sacrificing quality or support.

Some companies keep things simple. Their transparent approach helps investors manage expenses without surprises.

But fees are only part of the picture. The quality of service can vary just as much. Companies like Augusta Precious metals and Advantage Gold focus on client education and personalized support. They walk you through the setup process and help you understand the long-term benefits of silver investing.

Others, such as Noble Gold Investments and Lear Capital, emphasize tailored solutions and secure storage, giving you peace of mind that your assets are protected.

In short, take the time to compare both the costs and the value each company brings. The right fit will depend on your budget, your knowledge level, and how much hands-on support you want along the way.

Customer Reviews and Experiences

Customer feedback is one of the most reliable ways to understand how a Silver IRA company truly performs. While marketing claims can sound impressive, real reviews show how companies actually treat their clients once the account is set up.

So, how can you assess a company’s reputation through customer reviews?

Start by visiting platforms like Trustpilot. Serious companies not only have fewer negative reviews, but they also respond respectfully to all comments, both positive and negative.

When facing angry or frustrated feedback, the best companies answer calmly and assertively. They acknowledge any mistakes, apologize when needed, and offer practical solutions to fix the issue. They also provide clear explanations and never mirror the customer’s frustration or tone.

This is a strong green flag. It shows the company is client-oriented, accountable, and genuinely committed to maintaining high standards of service.

How to Set Up Your Silver IRA

Starting a Silver IRA may sound complex, but with the right provider, the process is straightforward.

- The first step is choosing a reputable company. This is critical — the right partner will walk you through the entire setup process. Once chosen, you'll open a self-directed IRA account, which allows you to hold physical silver instead of traditional assets.

- Next, you fund the account. This can be done through a rollover or transfer from an existing IRA or 401(k), or by making a new contribution. Your chosen provider will handle the paperwork and make sure everything follows IRS guidelines.

- After funding, you'll select the silver products you want to include — usually bullion bars or specific coins that meet purity requirements.

- Finally, your silver is placed in a secure depository, not stored at home. The company manages storage and keeps you updated with regular reports and support.

With a clear process and professional support, setting up a Silver IRA can be smooth, secure, and fully compliant.

Conclusion: Choose With Clarity, Not Hype

Let’s be real. Investing in a Silver IRA isn’t just about buying metal. It’s about making a smart move to protect your future. But that only works if you pick the right company to partner with.

We’ve spent time researching and comparing these providers because we know how important it is to avoid smoke and mirrors. What our readers want is clarity, fairness, and solid support, not empty promises.

Take a close look at each company’s reputation, how transparent they are with fees, and how they actually treat their clients when problems come up. That’s where the difference lies.

At the end of the day, this isn’t about chasing trends. It’s about building something solid. If you take the time to choose carefully, your Silver IRA can be a powerful piece of your long-term financial strategy. One that gives you peace of mind, not just metal in a vault.

We suggest to also take a look at this article on the IRS website to have additional insights concerning this topic.

Articles on all your favorite subjects

Subscribe to get our FREE

GOLD IRA GUIDE

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.