Essential Rules for Investing in Precious Metal IRAs

In today’s unpredictable economy, securing your retirement goes beyond simply saving, it requires smart decisions and a clear strategy. One increasingly popular option is the Precious Metal IRA, which blends the tangible value of physical metals with the tax benefits of a retirement account.

But before you dive in, it's crucial to understand the essential rules that govern these accounts. Knowing what metals are eligible, how storage works, and what IRS regulations apply can make the difference between a smooth investment and a costly mistake.

For this reason, this article breaks down the fundamentals, so you can build a solid foundation and make informed choices. If you're thinking of adding gold or silver to your portfolio, this guide will help you do it the right way while avoiding the common mistakes. We will answer to all the most important questions about the subject so that you can take your best possible decisions.

We also advise to always seek for a qualified investment advisor before proceeding.

Key Takeaways:

- Precious Metal IRAs Combine Stability and Tax Benefits

- Investing in gold, silver, platinum, or palladium through an IRA offers the dual advantage of physical asset protection and favorable tax treatment, making them a strategic choice for long-term retirement planning.

- Strict IRS Rules Apply—Know Them Before You Invest

Not all metals or products are eligible. Investors must follow specific IRS regulations regarding purity, approved forms, storage, and custodianship to maintain compliance and avoid costly penalties. - Choosing the Right Custodian Is Critical

A qualified custodian handles storage, compliance, and transactions. Your choice directly affects security, fees, and long-term performance, so due diligence is essential. - Diversification and Tax Planning Enhance Portfolio Strength

Spreading investments across different metals and account types (Traditional vs Roth) can reduce risk and improve after-tax returns. Understanding tax implications is key to maximizing growth.

Understanding the Benefits of Investing in Precious Metals

Precious metals like gold, silver, platinum, and palladium have been trusted for centuries as a store of value. Contrarily to paper assets, they’re physical, finite, and globally recognized. During times of inflation or market volatility, these metals often hold or increase their value, making them a reliable hedge against economic uncertainty.

Including precious metals in your retirement portfolio can also provide valuable diversification. Since they tend to move independently of stocks and bonds, they help reduce overall portfolio risk. For long-term investors, this balance is especially important.

Precious metals IRAs come with tax advantages as well. Like traditional IRAs, contributions can grow tax-deferred, meaning you won’t pay taxes until you withdraw funds in retirement. If you opt for a Roth precious metals IRA, qualified withdrawals may even be tax-free.

These benefits, combined with the potential for steady growth, make precious metals a strong addition to a retirement plan.

Types of Precious Metals Eligible for IRAs

Not every precious metal can be included in a Precious Metal IRA. The IRS sets specific standards that metals must meet to qualify. These rules focus on both purity and form. In most cases, metals must be in the form of approved coins or bars and meet minimum fineness levels.

For example, gold must be at least 99.5% pure, silver must reach 99.9%, and platinum and palladium must each meet a 99.95% purity threshold.

Some of the most commonly accepted coins include American Gold Eagles and Silver Eagles, both issued by the U.S. Mint. Other eligible gold coins are the Canadian Gold Maple Leaf, Austrian Philharmonic, and Australian Kangaroo.

For silver, the Canadian Maple Leaf and Austrian Philharmonic are also approved. Always double-check that the specific coin or bar you’re considering meets IRS standards before including it in your IRA.

Bars are also allowed, provided they meet the same purity criteria. These bars must be produced by refiners or manufacturers approved by recognized commodity exchanges like NYMEX or COMEX.

This ensures the bars are authentic and investment-grade. Being informed about which metals are eligible will help you stay compliant with IRS rules and make better decisions when building your retirement portfolio.

Key Regulations and Requirements for Precious Metal IRAs

Understanding the rules that govern Precious Metal IRAs is essential if you want to avoid penalties and keep your retirement plan on track. The IRS enforces strict guidelines to protect the tax advantages these accounts provide.

One key rule is that the metals must be held by an approved custodian. You’re not allowed to store IRA metals at home or in a personal safe. Doing so could disqualify the entire account and trigger taxes or penalties.

As mentioned earlier, the metals must meet specific purity standards and be in approved forms. While Traditional and Roth IRAs are the most commonly used for precious metal investments, other account types, like SEP and SIMPLE IRAs, may also qualify.

Make sure your retirement account is eligible, and work with a custodian who understands the unique requirements of precious metal investing.

Another important aspect is the annual valuation and reporting. The IRS requires the fair market value of your holdings to be reported every year. This information helps determine whether taxes are due, especially when you start taking distributions. When you do withdraw, the metals must be valued at their current market price.

How to Choose a Custodian for Your Precious Metal IRA

Choosing a reliable custodian is one of the most important decisions you'll make when setting up a Precious Metal IRA. A custodian is responsible for securely holding your assets, managing transactions, and ensuring compliance with all IRS rules.

They also handle essential paperwork, reporting, and account administration. For this reason, it's critical to select a company with deep experience in precious metals and a strong reputation for integrity.

Look for custodians that have a proven track record, transparent fees, and positive reviews from other investors. Some specialize exclusively in alternative assets like gold and silver, while others manage a broader range of retirement investments.

Choose one that aligns with your goals and offers the services you need, such as insured storage, responsive customer service, and support in buying or selling metals.

It’s also essential to verify that the custodian is properly licensed and operates within regulatory guidelines. Reputable firms are registered with the IRS and work with approved depositories. Insurance coverage should be clearly stated, protecting your investment against loss or theft.

Taking time to evaluate custodians thoroughly can help you avoid costly mistakes and build a secure foundation for your retirement strategy.

Steps to Set Up Your Precious Metal IRA

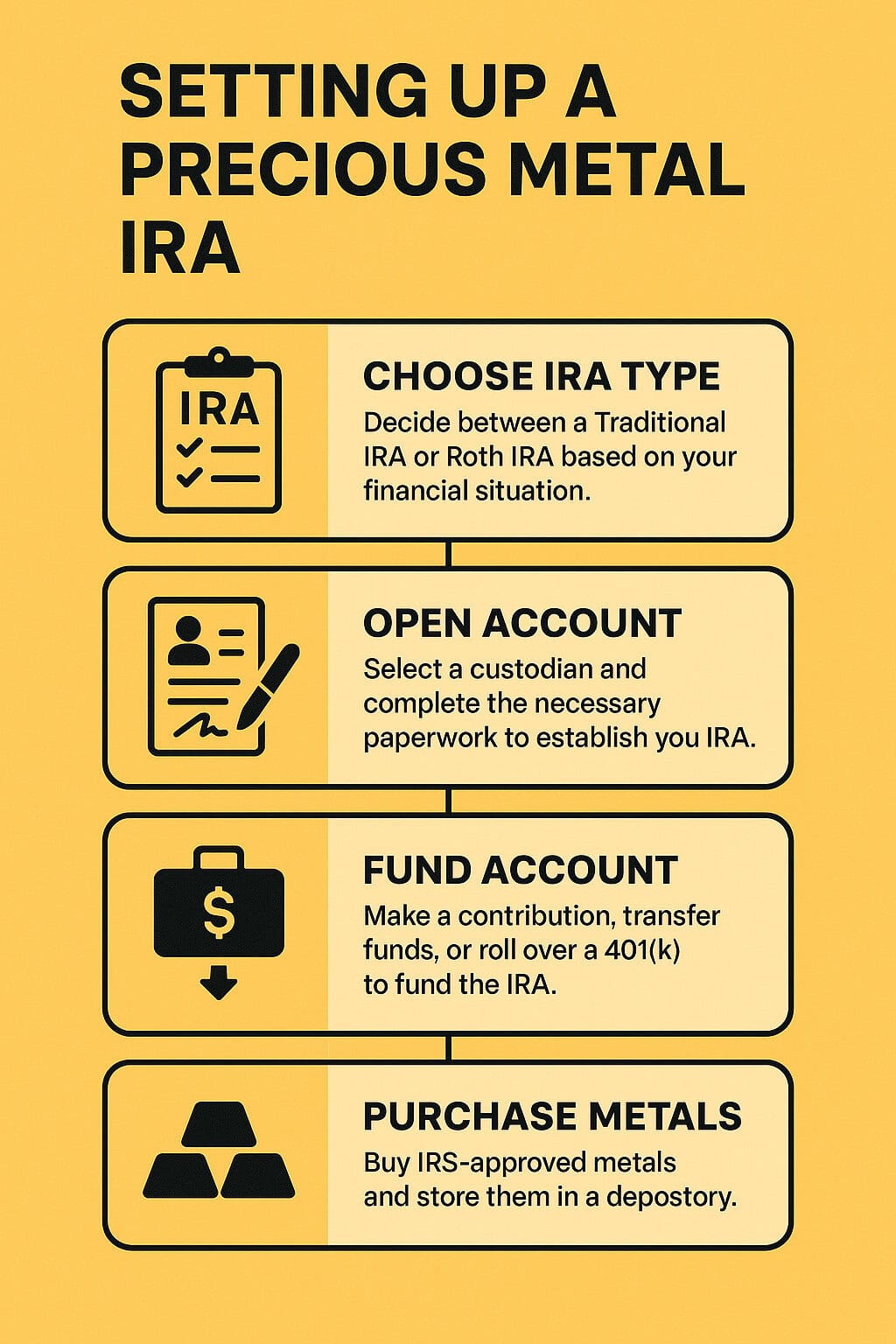

Setting up a Precious Metal IRA involves several key steps, each of which plays a role in ensuring compliance and long-term success.

The first step is to decide which type of IRA suits your financial situation: a Traditional IRA, which offers tax-deferred growth, or a Roth IRA, which provides tax-free withdrawals in retirement.

Consider your income, tax bracket, and long-term goals before making your choice.

Next, select a custodian that specializes in precious metals and meets the requirements discussed above. After choosing a provider, you'll open your IRA account by completing the necessary paperwork.

This includes personal identification, beneficiary designation, and investment instructions. Most custodians will guide you through the process to ensure everything is filed correctly.

Once the account is open, fund it by making a new contribution, transferring funds from an existing IRA, or rolling over a 401(k).

After funding is complete, you can start purchasing IRS-approved metals. Your custodian will assist you in choosing eligible products and arrange secure storage in a regulated depository.

Diversification Strategies within Precious Metal IRAs

Diversification is just as important in a Precious Metal IRA as in any other type of portfolio. Spreading your investment across multiple metals helps manage risk and allows your assets to respond differently to market forces.

While gold is the most popular choice due to its historical role as a safe haven, other metals offer distinct advantages worth considering.

Silver, for example, has broad industrial demand and can outperform gold in times of economic growth. It tends to be more volatile but offers strong upside potential.

Platinum and palladium are used primarily in the automotive sector, and their prices are influenced by emissions regulations, production levels, and global supply chains. Including these metals can add resilience and performance diversity to your IRA.

Beyond choosing multiple metals, you can diversify within each category. Consider holding a mix of coins and bars, or purchasing products from different mints and refiners. This strategy adds an extra layer of flexibility and security.

Periodic reviews and rebalancing are also key, adjust your holdings based on market trends and personal risk tolerance. By applying smart diversification strategies, you’ll enhance your IRA’s stability and long-term performance.

Tax Implications and Advantages of Precious Metal IRAs

One of the main advantages of a Precious Metal IRA is the potential for tax savings. Like traditional IRAs, contributions to a Precious Metal IRA can grow tax-deferred. This means your gains are not taxed until you take distributions during retirement, allowing your assets to compound more effectively over time.

If you open a Roth version of the account, your investments can grow tax-free, and qualified withdrawals are completely exempt from income tax, provided you meet the IRS guidelines.

However, there are important tax implications to keep in mind. When you withdraw metals from your IRA, their value is calculated at the current market rate, and the distribution is treated as taxable income. If you take a distribution before age 59½, you may also face a 10% early withdrawal penalty, on top of regular income taxes.

To avoid unnecessary costs, it's essential to plan your withdrawals strategically and consult with a qualified tax advisor.

Another factor to consider is how capital gains taxes apply. If you sell precious metals outside an IRA, any profits may be subject to capital gains tax, especially if you hold the assets for less than a year. In contrast, gains on metals held within your IRA are either deferred or tax-free, depending on the account type.

Making Informed Investment Decisions

Precious Metal IRAs offer a compelling way to protect your retirement savings with physical assets that have stood the test of time. From the stability of gold to the industrial value of silver, platinum, and palladium, these metals provide diversification and long-term potential, especially during times of economic uncertainty.

To make the most of this opportunity, it’s crucial to understand the core rules that govern Precious Metal IRAs. Know which metals are eligible, choose a qualified custodian, and follow the correct steps to set up and fund your account.

Diversifying across metals and product types can help reduce risk, while proper tax planning ensures your gains are protected from avoidable losses.

Staying informed and working with experts when needed can help you avoid common pitfalls and stay compliant with all IRS regulations. By applying the principles outlined in this guide, you can build a stronger, more resilient retirement portfolio, one that combines tax advantages with the enduring value of precious metals.

Whether you’re just starting out or fine-tuning an existing strategy, understanding the essential rules of Precious Metal IRAs puts you in control.

With careful planning, smart diversification, and attention to tax implications, you can turn physical assets into a powerful tool for long-term financial security.

Articles on all your favorite subjects

Author

Ignazio Di Salvo

Founder

I have a background in Economics and Business Administration from Bocconi University and a formation in Digital Marketing. I am passionate about investments and I founded BestGoldMoney.com to help individuals make smarter decisions when investing in gold, silver, and other precious metals.

BestGoldMoney.Com

At Best Gold Money, we simplify the complexities of investing in precious metals. Our platform offers comprehensive insights, reviews, and reliable recommendations to help you make informed decisions about investments in precious metals.

We focus on providing valuable educational resources, expert analysis, and up-to-date information on the best practices for securing your financial future.

As part of our commitment to transparency, we participate in affiliate marketing programs, ensuring that we only endorse products and services we trust.